Fintech Giant Paymenow Unlocks $22M War Chest for Massive African Expansion

South African fintech Paymenow has secured a significant credit facility of 400 million rand, approximately $22 million, from Standard Bank. This funding, announced on July 8, 2025, is earmarked for the substantial scaling and regional expansion of Paymenow's early wage access platform across Southern Africa and beyond. The strategic investment aims to bolster the company's efforts in providing flexible financial tools to a broader segment of the African workforce.

Paymenow's innovative platform allows workers to access a portion of their earned wages ahead of their scheduled payday. Crucially, this service is offered without any fees or interest, making it a viable solution for employees facing urgent financial needs. The core objective of the platform is to reduce reliance on informal lenders and costly credit options, thereby promoting financial well-being among its users.

The necessity for such services is underscored by a severe household savings crisis in South Africa, as highlighted by data from Paymenow. The country's household savings rate stands at a concerning negative 1%, indicating that for every 100 rand of disposable income, households are spending 101 rand, frequently resorting to borrowing to bridge this gap. Furthermore, national savings account for only 15% of South Africa's GDP, significantly below the global average of 28%. This weak savings culture leaves millions of workers vulnerable, often compelling them to seek unregulated and high-interest credit to cover basic living expenses.

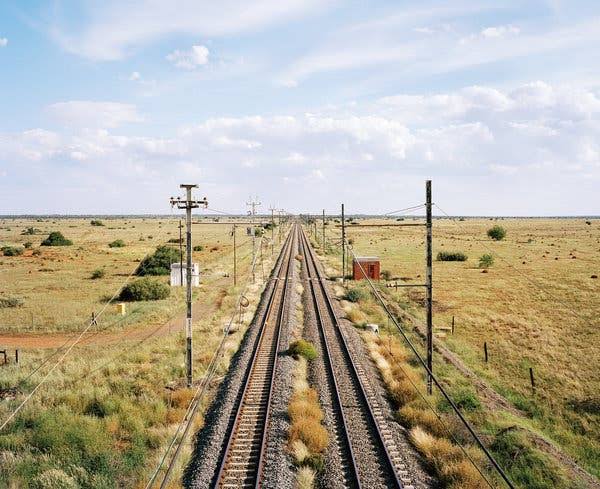

Launched in 2019 by co-founders Bryan Habana and Deon Nobrega, Paymenow currently operates in South Africa, Namibia, and Zambia. With the fresh capital infusion, the company plans to broaden its geographical footprint into additional African regions where conventional financial services struggle to meet the daily financial demands of workers. Deon Nobrega, CEO of Paymenow, emphasized that this loan represents a pivotal step towards expanding financial inclusion for millions of workers and disrupting the pervasive cycle of recurring debt through a model built on consistent earnings and long-term financial resilience.

Standard Bank views this partnership as an integral component of its broader mission to empower African fintechs. The bank believes that robust collaboration between traditional financial institutions and innovative fintech firms has the potential to redefine the financial interactions between employers and employees, fostering a more inclusive financial ecosystem. The early wage access sector is experiencing rapid global expansion, with Research Nester projecting the market to grow from $30.83 billion in 2025 to over $242.46 billion by 2034, reflecting an impressive annual growth rate of 25.75%.

Paymenow is actively capitalizing on this surge in demand for flexible financial solutions. In 2025, the company is handling more than one million transactions each month and supports close to 500,000 active users, a substantial increase from just a few hundred at its inception. This growth positions Paymenow as a key player in addressing the financial liquidity challenges faced by workers across Africa.

You may also like...

Atalanta Coach Slams Lookman: 'I Won't Beg Him to Play!'

Ademola Lookman is set to miss Atalanta's Serie A clash against Lecce, as Head Coach Ivan Juric publicly questioned the ...

Ruben Amorim Lays Down the Law for Man Utd's Kobbie Mainoo: 'Talent Not Enough!'

Manchester United midfielder Kobbie Mainoo's request for a loan move was blocked, leading manager Ruben Amorim to clarif...

Star-Studded Deauville Festival Bash: Kristen Stewart, Zoey Deutch & More Dazzle

The Deauville American Film Festival hosted a star-studded dinner by Canal+ Group and Chanel, celebrating French and Ame...

Ice Cube's 'War of the Worlds' Shocker: Filmed Solo in 15 Days Without Director

Ice Cube sheds light on the turbulent production of the 2020 film “War of the Worlds,” revealing his scenes were shot in...

Sharon Osbourne's Heartbreaking Silence Broken After Ozzy's Tragic Passing

Sharon Osbourne has broken her silence following the death of her husband, Ozzy Osbourne, expressing deep gratitude for ...

Mystery 00s Pop Superstar Ditches BBC Podcast for Explosive New Music Return

A flurry of celebrity news unfolds, with Lily Allen exiting her BBC podcast to focus on new music and Olivia Attwood sta...

Music Icon Elton John Hospitalized, Shares Alarming Photos From Bedside

Sir Elton John sparked concern among fans with hospital bed photos featuring elaborate casts, only to reveal it was for ...

Mum's 'Sick Day' Holiday Lie Exposed by Five-Year-Old Son's Jet2 Tenerife Confession

A mum's attempt to take her son on a term-time holiday humorously backfired when her five-year-old 'grassed' on her fabr...