Falling Oil Prices Stall Nigeria's $5 Billion Oil-Backed Loan from Aramco

A proposed $5 billion oil-backed loan agreement between Nigeria and Saudi energy giant Aramco is experiencing significant delays. The slowdown is primarily attributed to a recent sharp decline in global crude oil prices, which has unsettled potential lenders and complicated the terms of what would be Nigeria's largest oil-collateralised loan to date and Aramco's most significant financial involvement in Africa's largest oil producer.

The loan proposal was reportedly initiated by Nigerian President Bola Tinubu during a meeting with Saudi Crown Prince Mohammed bin Salman in Riyadh in November, on the sidelines of the Saudi-Africa Summit. This facility is intended to be part of a larger $21.5 billion external borrowing plan submitted by President Tinubu to the National Assembly, aimed at shoring up the national budget and boosting foreign currency reserves.

The recent slump in Brent crude, falling approximately 20 per cent from over $82 per barrel in January to around $65 per barrel, has directly impacted negotiations. This price drop was caused largely by a shift in policy by the Organisation of Petroleum Exporting Countries (OPEC) and its allies, OPEC+, to regain market share rather than curtail supply. Lower oil prices mean Nigeria would need to commit a significantly larger volume of crude oil to secure the loan, potentially at least 100,000 additional barrels per day for the $5 billion facility. This complicates discussions as Nigeria already faces challenges in meeting its oil production targets.

Nigeria's crude oil production has been hampered by years of underinvestment. In April, the country produced just under 1.5 million barrels per day (bpd), well below its 2 million bpd target and far from enough to support a loan of this size. Furthermore, about 300,000 bpd are already committed to servicing existing oil-backed debts, limiting the amount of crude available for new financing arrangements. The Nigerian National Petroleum Company (NNPC) also allocates crude to its joint-venture partners, including international majors like Shell and local producers like Seplat and Oando, to cover its portion of operating costs, further constraining available oil.

Banks expected to co-finance the loan alongside Aramco, including Gulf lenders and at least one African bank, have expressed caution. Concerns primarily revolve around Nigeria's capacity to consistently deliver the required oil cargoes under the current market conditions and production shortfalls. This hesitancy has slowed the progress of the deal, with reports indicating difficulty in finding underwriters. Official comments on the deal have been limited, with Saudi Aramco declining to comment, and Nigerian entities such as NNPC, the finance ministry, and the petroleum ministry reportedly not providing comments or redirecting inquiries.

Crude-backed financing is not new to Nigeria. Over the past five years, the country has secured about $7 billion through similar loans, typically used for budget support, shoring up foreign reserves, or to fund refinery upgrades. Since 2019, the NNPC has entered into crude prepayment deals, often referred to as “forward sales,” worth approximately $21.6 billion, including major deals like Project Gazelle and Project Gazelle II. While these offer short-term liquidity, they raise long-term concerns about future oil revenues, domestic energy needs, and financial transparency, with some repayment agreements stretching for nearly a decade. For instance, between January and February 2024, existing crude-backed loans cost Nigeria about $1.4 billion from over 17.1 million barrels of oil lifted by various organisations.

Such financing becomes riskier when oil prices fall, as it extends repayment timelines and reduces government oil earnings. NNPC's commitment to these forward sales has also constrained its ability to meet its Domestic Crude Supply Obligation (DCSO). This directly affects local refiners, including the Dangote Refinery, which has a 650,000 barrels per day capacity. While the Dangote Refinery has helped reduce reliance on fuel imports and improved local refining, it has not fully resolved Nigeria’s supply issues and has sometimes had to import crude oil despite Nigeria being a major oil producer.

To address these challenges, President Tinubu recently signed an executive order aimed at cutting oil production costs, which could free up more revenue per barrel. However, Nigeria's 2024 budget is based on a benchmark oil price of $75 per barrel, significantly above current market levels, raising concerns that the government may need to borrow even more to fund its budget. The Nigerian trading firm Oando is reportedly expected to manage the offtake of physical cargoes for the proposed Aramco loan. Due to the prevailing market conditions and production challenges, the final size of the Aramco deal may now be reduced.

You may also like...

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

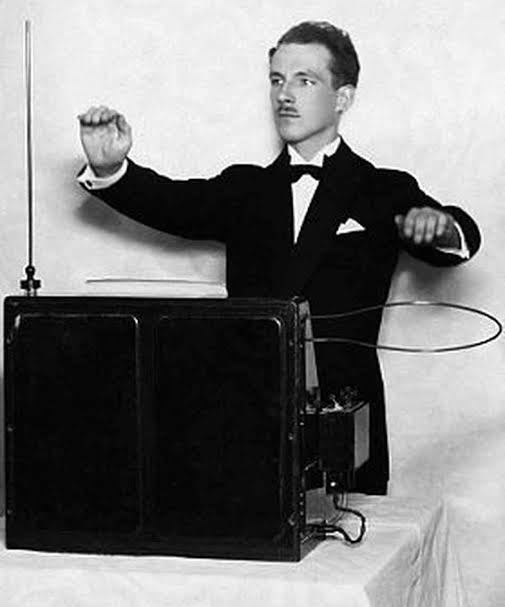

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...