Crypto Triumphs in Argentina: Banks Poised to Offer Bitcoin Services

Argentina is on the verge of a financial revolution as its central bank, the Banco Central de la República Argentina (BCRA), drafts a regulatory framework that could permit commercial banks to offer Bitcoin and other cryptocurrency services. This move would reverse a 2022 ban that prohibited banks from facilitating digital asset operations, a restriction originally implemented over concerns about financial stability and money laundering.

Under the proposed system, banks could integrate crypto services directly into their existing applications, allowing customers to trade and securely hold cryptocurrencies through specially designated legal entities. These units would adhere to stricter capital, security, and liquidity requirements, while maintaining full compliance with KYC and anti-money-laundering regulations outlined by Argentina’s National Securities Commission (CNV).

The initiative aligns with President Javier Milei’s broader push for financial modernization. Since taking office in December 2023, Milei has advocated for expanded access to alternative currencies and greater financial freedoms. Analysts note that Argentina’s high inflation and stringent currency controls have driven many citizens toward cryptocurrencies as a hedge against economic uncertainty.

Statistics reflect the growing role of crypto in Argentina. Chainalysis reports the country ranks 15th globally in active crypto wallets, totaling around 10 million accounts. Between July 2023 and June 2024, on-chain transactions reached an estimated $91 billion, with over 60% involving stablecoins, underlining their importance in a volatile economy. Local banks, some of which previously tested in-app trading tools, are preparing to reintroduce regulated crypto services once official approval is granted, highlighting renewed market interest.

Globally, Argentina’s potential shift mirrors broader trends of cryptocurrency integration into traditional finance. In the U.S., the repeal of SEC’s SAB121 in January 2025 enabled major institutions like Citi and State Street to plan crypto custody services, while European banks have increasingly offered crypto products to retail clients. Argentine regulators are still reviewing the framework, evaluating risk controls, reporting standards, and the specific digital assets eligible for banking services.

If successfully implemented, Argentina could become a model for other high-inflation economies exploring ways to merge conventional banking with digital assets, providing citizens with safer tools to protect savings and hedge against currency devaluation. While the BCRA has not confirmed a final timeline, internal reports suggest a decision could be finalized by April 2026.

You may also like...

Scandal Erupts! Barcelona Outraged After Crushing Defeat, Files Official Complaint Against Atletico

)

Barcelona suffered a crushing 4-0 defeat against Atletico Madrid in the Copa del Rey, sparking outrage from head coach H...

Lookman's Blazing Performance: Atletico Madrid Obliterates Barcelona, Shattering Records!

)

Super Eagles forward Ademola Lookman has made a sensational start at Atletico Madrid since his January move, tallying fo...

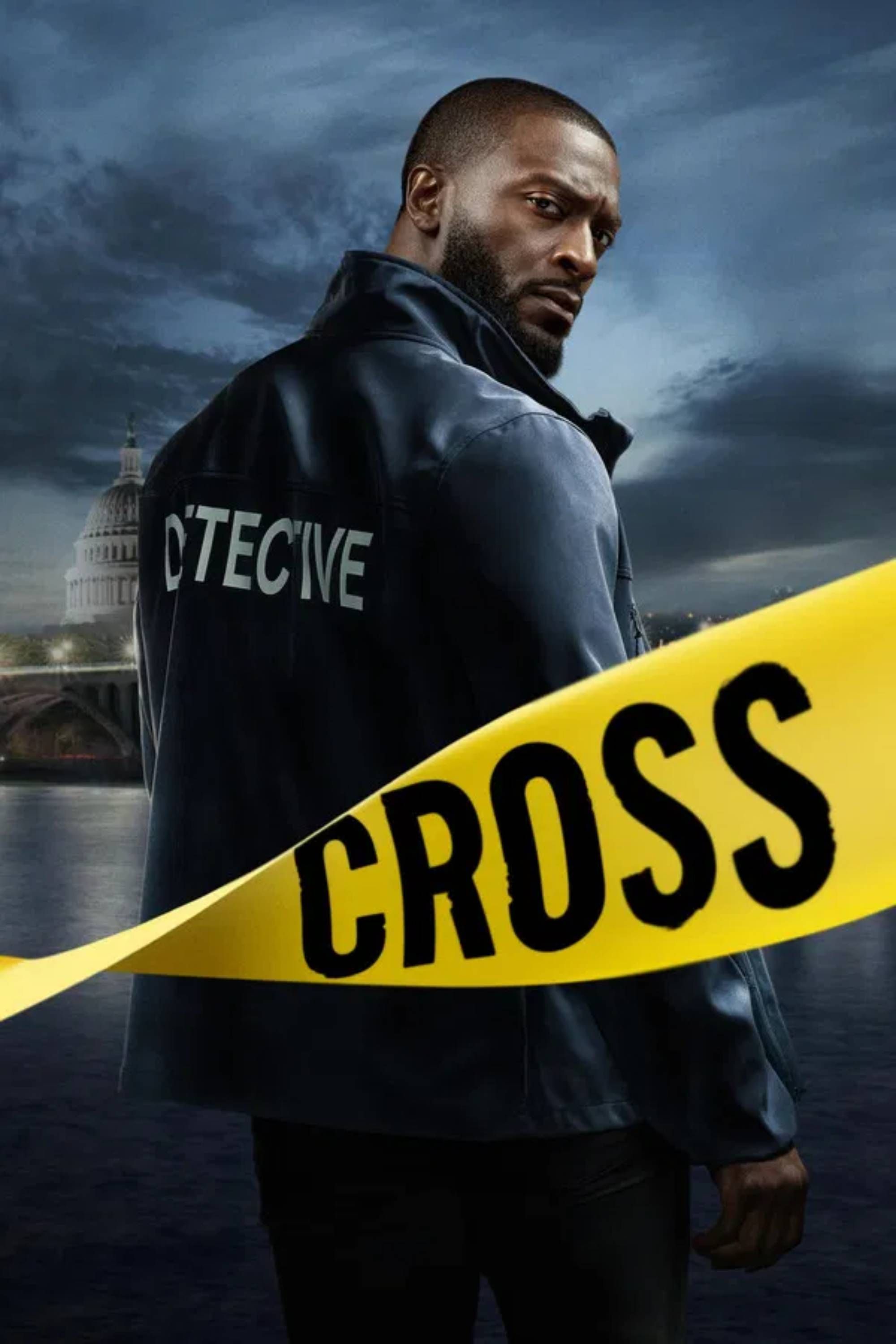

Prime Video's Epic Thriller Dethrones 'True Detective' on Rotten Tomatoes!

Cross Season 2 has swiftly risen to dominate Prime Video's streaming charts, following the conclusion of Fallout. Starri...

Vampire Lestat Teaser Drops, Unleashing Series' Most Explosive Chapter!

The third season of AMC's "Interview with the Vampire" is rebranded as "The Vampire Lestat," shifting focus to Sam Reid'...

BTS's Future Unveiled: Members Vow to Stay Together 'Into Our 60s' Despite RM's Disbandment Doubts

Ahead of their new album "Arirang," BTS members shared their hopes for continued performance into their older years, emp...

Shocking Allegations and Mental Health Battle: Evan Dando Hospitalized Amidst Fan Accusations

Evan Dando of The Lemonheads has been hospitalized for mental health issues, following recent allegations of sending unw...

S.H.E. Project 2026: The 'HERfluence' Initiative Revolutionizing Narratives!

The S.H.E Project, an initiative by SOSSA at the University of Lagos, successfully empowered young women through its ina...

Funmilayo & Dami: 12 Years of Matrimony, Still Unraveling Each Other's Secrets!

Discover the inspiring love story of Dr. Funmilayo and Dr. Dami, who transitioned from medical college classmates to a m...