Bitcoin's Brutal Crash: $322 Million Longs Liquidated as Price Plummets 6%

The cryptocurrency market suffered a catastrophic flash crash, triggering significant liquidations and a sharp decline in Bitcoin's value. Over a 24-hour period, nearly $800 million in leveraged positions were liquidated, with a particularly brutal hour witnessing $301.15 million in long positions being wiped out. This rapid sell-off occurred as Bitcoin plunged from highs near $90,600 towards the critical $84,000 support level, catching bullish traders off guard, as long positions accounted for 96% of the immediate damage.

The total market carnage reached $797.91 million over the full day, with $690.26 million stemming from bullish traders who were betting on a breakout to new highs. Bitcoin (BTC) itself fell 5.3% to $84,635, pulling the broader digital asset market down. Hyperliquid recorded the single largest liquidation order of the day, a massive $31.64 million BTC-USD position. Data from CoinGlass shows Hyperliquid processed $137.99 million in liquidations, accounting for nearly 28% of the global total, with Binance and Bybit following in second and third place, respectively.

This swift reversal saw Bitcoin slide to lows in the $84,000 range, marking a roughly 6% drop from its 24-hour highs above $90,000. Heightened volatility around the week's Federal Reserve meeting, coupled with macro uncertainty and a fragile market structure, contributed significantly to the downturn. Federal Reserve Chairman Powell's emphasis on labor market resilience and his refrain from signaling urgency around easing policy proved unfavorable for speculative assets, turning the meeting into a

You may also like...

Tottenham's Champions League Success Contrasts With Troubled Premier League Form Under Thomas Frank

Tottenham's Premier League form poses problems for boss Thomas Frank despite their Champions League success. BBC Sport e...

The Pitt Unleashed: Exclusive Sneak Peeks, Star Secrets, and a Shocking 'Simpsons' Crossover!

The Indian SUV market sees compact SUVs leading sales in FY2025, with Tata Punch topping the charts. Maruti Brezza </div...

Neil Young Unleashes Fury: Slams Apple, Verizon, T-Mobile Over Trump Regime Support!

Neil Young has intensified his political activism, publicly condemning the Trump administration and companies like Veriz...

Grammy Gala Shakes Up 2026: Chappell Roan, Teyana Taylor, Karol G Join Presenter Ranks!

The 68th annual Grammy Awards are slated for February 1, 2026, with Trevor Noah hosting his final consecutive show. Chap...

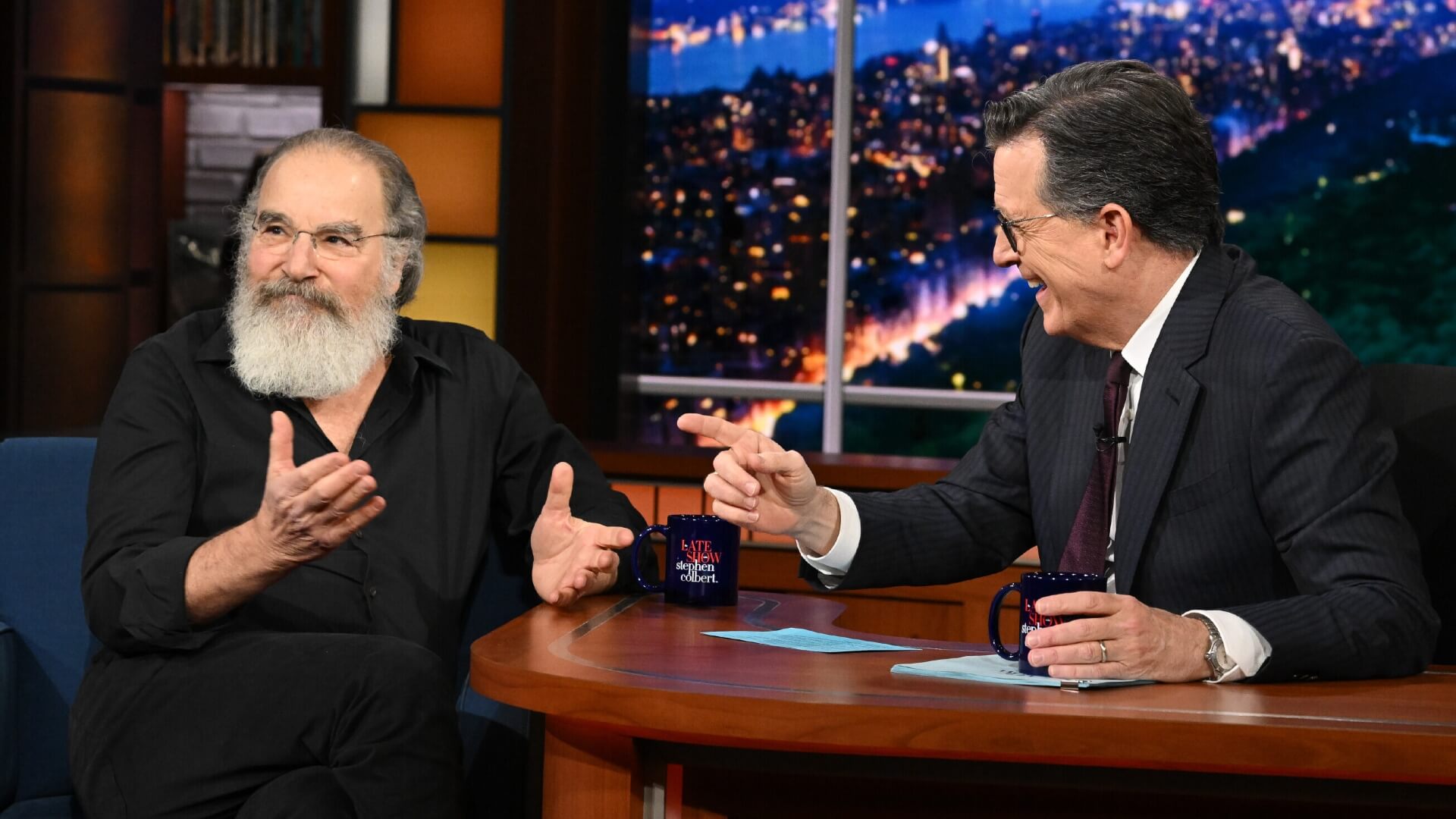

Divine Casting Revelation: Mandy Patinkin Ascends as Odin in Amazon's God Of War Series!

Mandy Patinkin has officially joined Amazon's live-action 'God of War' series, taking on the role of Odin, the Allfather...

Gaming Glory: Beth Mead, Cunha Dominate EA FC 26 Team of the Week 20!

Arsenal's Beth Mead earned a spot in the Team of the Week after a stellar performance against Chelsea, scoring and assis...

Crypto Bloodbath: Bitcoin Plummets to $84K, Triggering MicroStrategy Stock's 52-Week Low

Bitcoin's price plummeted sharply this morning, falling to the $84,000 range due to macro uncertainty and Federal Reserv...

Billion-Dollar Scandal: First Brands Founder Faces Charges for Massive Fraud

The founder and a former executive of First Brands Group, Patrick and Edward James, have been indicted in New York on ch...