Bitcoin ATM Scams Costing Americans More Than $114 Million

Bitcoin ATM machine, dispensing the cryptocurrency Bitcoin (Photo by Smith Collection/Gado/Getty ... More Images)

Getty ImagesA report from the Federal Trade Commission (FTC) indicates a 1,000 % increase in money lost to scammers through Bitcoin ATMs in the last three years with consumers reporting losses of more than 114 million dollars in 2023.

Bitcoin and other cryptocurrency ATMs look just like traditional ATMs, but instead of distributing cash, they take cash in exchange for cryptocurrency and enable the transfer of the deposited cash turned into Bitcoin into crypto wallets. Due to the anonymity and immediacy of the Bitcoin transfers done through a Bitcoin ATM, it is a favorite method of payment for scammers. Presently there are more than 30,000 Cryptocurrency ATMs around the country and they are largely unregulated.

Most of the scams using Bitcoin ATMs involve imposter scams where the scammer poses either as a law enforcement officer, government official or someone providing tech support for a non-existent problem. What all these imposter scams have in common is that they scare the targeted victim with a story about an emergency that requires them to take cash from their bank account and use a QR code provided by the scammer to deposit the money into the account of the scammer at a Bitcoin ATM under the guise of protecting the funds.

A typical example of this type of scam earlier this year involved a 66-year-old retired health care worker in South Carolina who received a phone call from a scammer posing as an officer with the Beaufort County Sheriff’s who told her that she was in contempt of court for missing jury duty and that there was an arrest warrant out for her. She was told, however, that she could stay out of jail if she paid a $7,500 bond through a Bitcoin ATM. According to the FTC, people over 60 years old were more than three times more likely to report losing money to a Bitcoin ATM scam with an average loss of $10,000.

Arizona state representative David Marshall has filed House Bill 2387 which would provide needed regulations for these cryptocurrency ATMs to help prevent people from being scammed. If passed into law, the bill would require warnings on the ATMs before the user could do a transaction. The warnings would also provide information about cryptocurrency scams. Additionally, the bill would require the ATMs to provide printed receipts that would include information useful to law enforcement in the event of a scam. The law would also limit the amount of funds someone could deposit into a new account or send in a 72 hour period. Scammers often require their victims to send repeated deposits. Finally, the law would require greater transparency in the operation of the ATMs. The bill passed unanimously out of committee and is presently awaiting further action in the state Senate.

On the federal level, Illinois Senator Dick Durbin along with Rhode Island Senator Jack Reed, Connecticut Senator Richard Blumenthal and Vermont Senator Peter Welch is proposing a bill to respond to the problem of Bitcoin ATM scams. The bill, entitled the Crypto ATM Fraud Prevention Act would prevent new users of the cryptocurrency ATMs from spending more than $2,000 in a single day or $10,000 over a two-week period to purchase cryptocurrency at Bitcoin ATMS. The proposed law would also require Bitcoin ATM companies to speak directly with new customers attempting to perform transactions of more than $500 and require full refunds when those customers file police reports and alert companies operating Bitcoin ATMs within 30 days of their transactions. The bill also would require operators of Bitcoin ATMs to provide receipts for each transaction, including information sufficient to trace the transaction. Such receipts would also be required to include contact information for relevant law enforcement.

Protecting yourself from these imposter scams starts with recognizing that you can never be sure who is actually contacting you when you are contacted by phone, email or text message so you should never click on a link, download an attachment, make a payment or provide personal information in response to any of those communications unless you have absolutely confirmed that the communication was legitimate. Further, there is absolutely no circumstance where you will be asked by anyone legitimate to withdraw funds from your bank, deposit them into a Bitcoin ATM and transfer the funds to them. Only scammers make those requests.

You may also like...

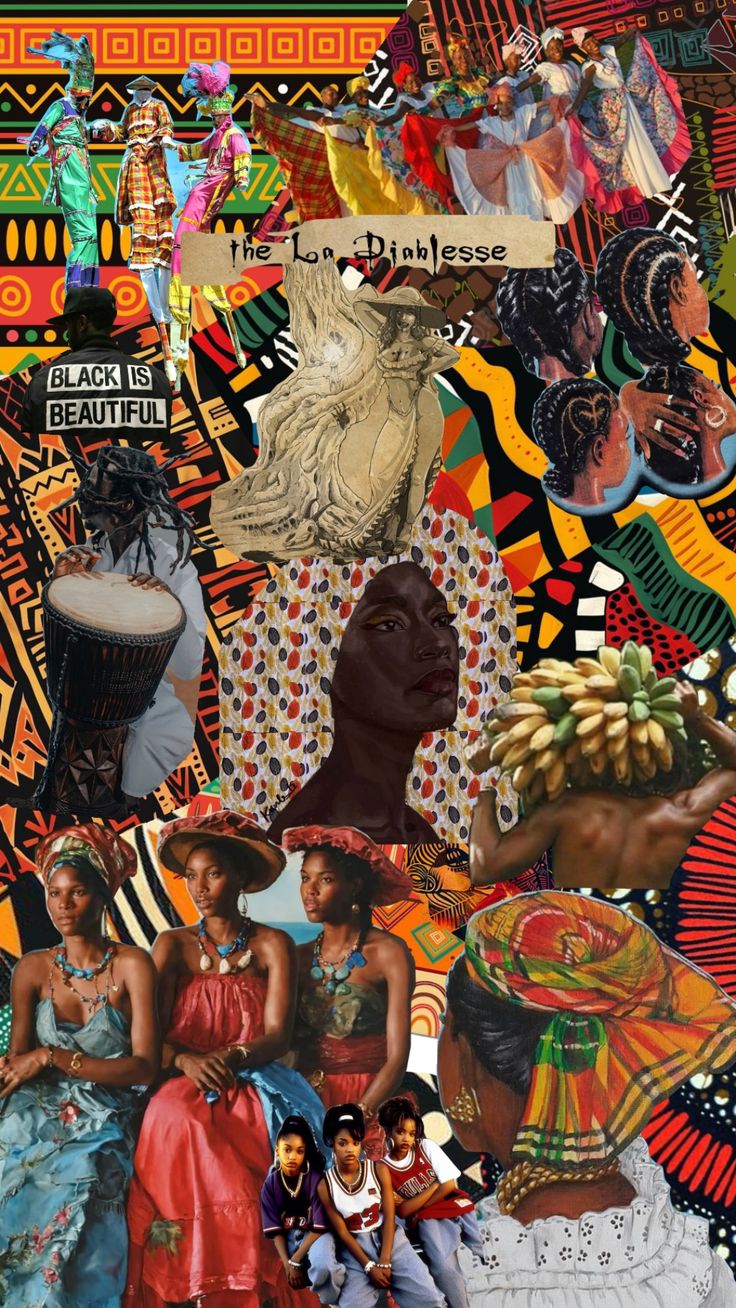

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

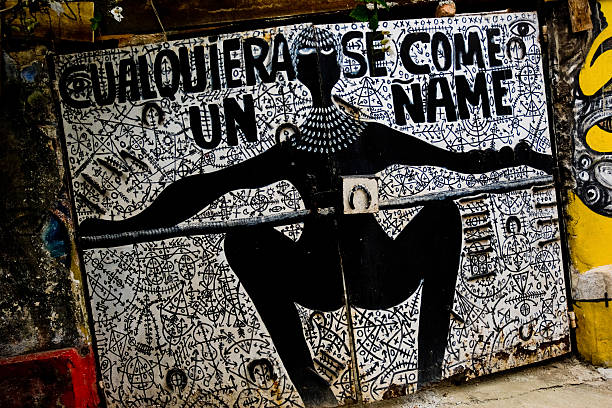

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

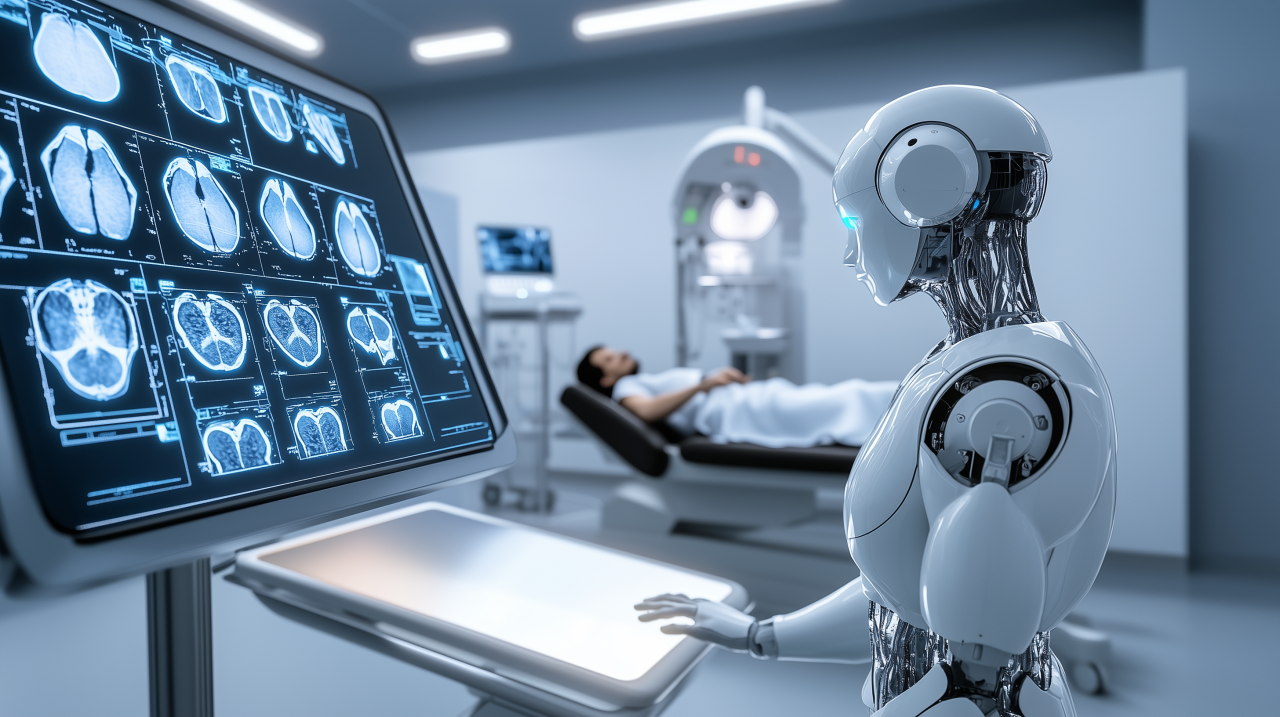

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

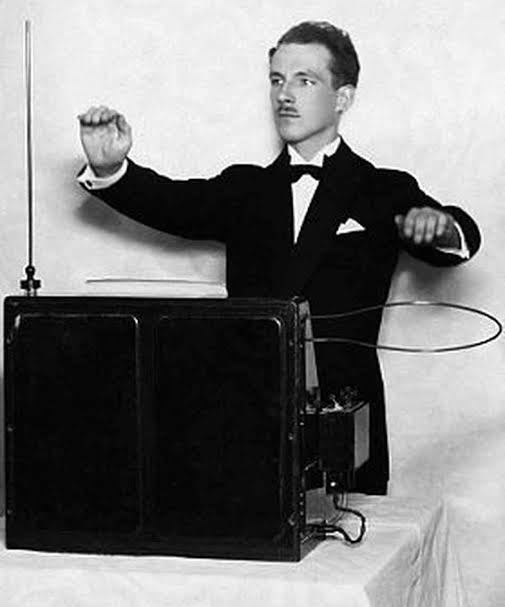

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...