Asia's New Bitcoin Whale: Sora Ventures Launches $1 Billion BTC Treasury Fund

Sora Ventures has announced the groundbreaking launch of Asia’s first dedicated Bitcoin treasury fund, a significant development unveiled during the prestigious Taipei Blockchain Week. This pioneering initiative is backed by a substantial $200 million commitment from a consortium of partners and investors spanning across the Asian region. The fund's ambitious objective is to acquire an impressive $1 billion worth of Bitcoin within an aggressive six-month timeframe, as detailed in an official press release to Bitcoin Magazine.

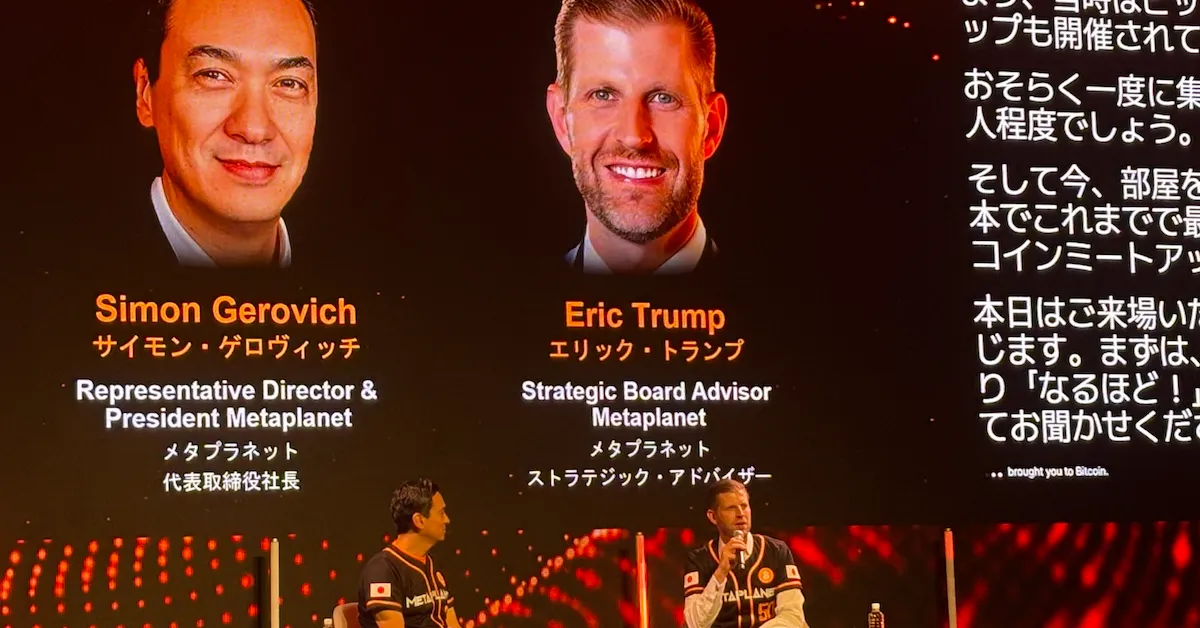

This new institutional fund emerges in the wake of a growing trend of individual Bitcoin treasury firms that have independently established themselves across Asia in recent years. Notable examples include Japan’s Metaplanet (TYO:3350), Hong Kong’s Moon Inc. (HKG:1723), Thailand’s DV8 (SET:DV8), and South Korea’s BitPlanet (KOSDAQ:049470). While these existing entities hold Bitcoin directly on their respective balance sheets, the Sora Ventures treasury fund is designed to operate as a centralized pool of institutional capital. Its dual purpose is to provide crucial support to these pioneering Asian firms and to catalyze the establishment of similar Bitcoin treasuries on a global scale.

By strategically reinforcing Asia’s early adopters of the Bitcoin treasury model and simultaneously expanding its reach internationally, the fund aims to cultivate powerful synergies between regional and international treasury operations. This integrated approach is intended to bolster Bitcoin’s fundamental role as a robust reserve asset across diverse markets. The initiative will be spearheaded by Sora Ventures’ experienced management team and is poised to attract new institutional partners, thereby broadening the resource base and expanding the network of Bitcoin treasury companies actively operating throughout Asia.

Luke Liu, a Partner at Sora Ventures, underscored the unprecedented nature of this venture, emphasizing, “This is the first time that Asia has seen a commitment of this magnitude toward building a network of Bitcoin treasury firms, with capital commitment towards Asia’s first $1 billion treasury fund.” Historically, the most substantial Bitcoin treasury funds and the broadest corporate adoption of Bitcoin as a reserve asset have been predominantly concentrated within the U.S. market. However, Asia is now unequivocally positioning itself as a formidable contender for significant institutional Bitcoin investment.

Jason Fang, founder and Managing Partner at Sora Ventures, highlighted this pivotal shift, stating, “Asia has been one of the most important markets for the development of blockchain technology and Bitcoin. We have seen a rise in interest from institutions investing in Bitcoin treasuries in the U.S. and EU, while in Asia efforts have been relatively fragmented. This is the first time in history that institutional money has come together, from local to regional, and now to a global stage.” Sora Ventures has already demonstrated its commitment to this vision through strategic investments.

In 2024, Sora Ventures invested in Metaplanet, recognized as Japan’s first Bitcoin treasury, facilitating its allocation of ¥1 billion (approximately $6.56 million) to Bitcoin. Continuing its strategic expansion in 2025, the firm acquired Moon Inc. in Hong Kong and DV8 in Thailand, and forged a partnership in the acquisition of BitPlanet in South Korea. Each of these calculated deals was meticulously designed to replicate and scale Bitcoin-first treasury models across the entire Asian continent. With Asia’s institutional landscape increasingly converging on Bitcoin adoption, this newly launched $1 billion fund represents a monumental stride towards achieving mainstream recognition of Bitcoin as a critical treasury reserve asset within global financial markets.

You may also like...

Postecoglou Sacked: Forest's Managerial Crisis Deepens Amidst Replacement Speculation

)

Nottingham Forest has sacked manager Ange Postecoglou after just 39 days and an eight-game winless streak, following a 3...

Must-See Netflix Thriller Achieves Rare 100% Rotten Tomatoes Score, Dominates Global Streaming!

"The Perfect Neighbor" is a critically acclaimed documentary praised for its gripping narrative and original technique, ...

Selena Gomez Ignites Beauty Brand Battle With Hailey Bieber

Selena Gomez recently posted a social media message interpreted as a response to Hailey Bieber's remarks about beauty br...

Prince Andrew Faces Stark Choice: UK Exile on the Horizon?

Amid the continuing fallout from the Jeffrey Epstein scandal, royal biographer Nigel Cawthorne claims Prince Andrew is c...

Katherine Ryan's Family Grows: Comedian Welcomes Fourth Child with Unique Name

Katherine Ryan and Bobby Kootstra have welcomed their fourth child, a daughter named Holland Juliette, expanding their f...

Kombucha's Secret Impact: Unveiling Its Effect on Your Blood Sugar Levels

:max_bytes(150000):strip_icc()/Health-GettyImages-1396531488-b07aa0e4b22f42b3acd1ec41c97a8ab6.jpg)

This article delves into how kombucha, a fermented tea, affects blood sugar levels. While containing some sugar, ferment...

Political Shift: Commissioners Champion 'Value Reorientation' in APC States

Progressive Commissioners of Information from APC-governed states have pledged to implement the National Value Reorienta...

Royal Ruckus: MP Demands Answers on 12M Virginia Giuffre Payment Source

Rachael Maskell MP is urging the royal family for transparency regarding Prince Andrew's £12 million settlement with Vir...