Crypto Giant Metaplanet Dives Deep: Massive Bitcoin Stash Acquired as Price Hovers Below $113K!

Tokyo-listed Metaplanet has made a significant stride in its Bitcoin acquisition strategy, purchasing an additional 5,419 Bitcoin for approximately $632.53 million. This substantial transaction was executed at an average price of $116,724 per coin, as disclosed to the Tokyo Stock Exchange. This latest acquisition elevates Metaplanet's total Bitcoin holdings to an impressive 25,555 BTC, which were acquired for a cumulative $2.7 billion at an average cost basis of $106,065 per Bitcoin.

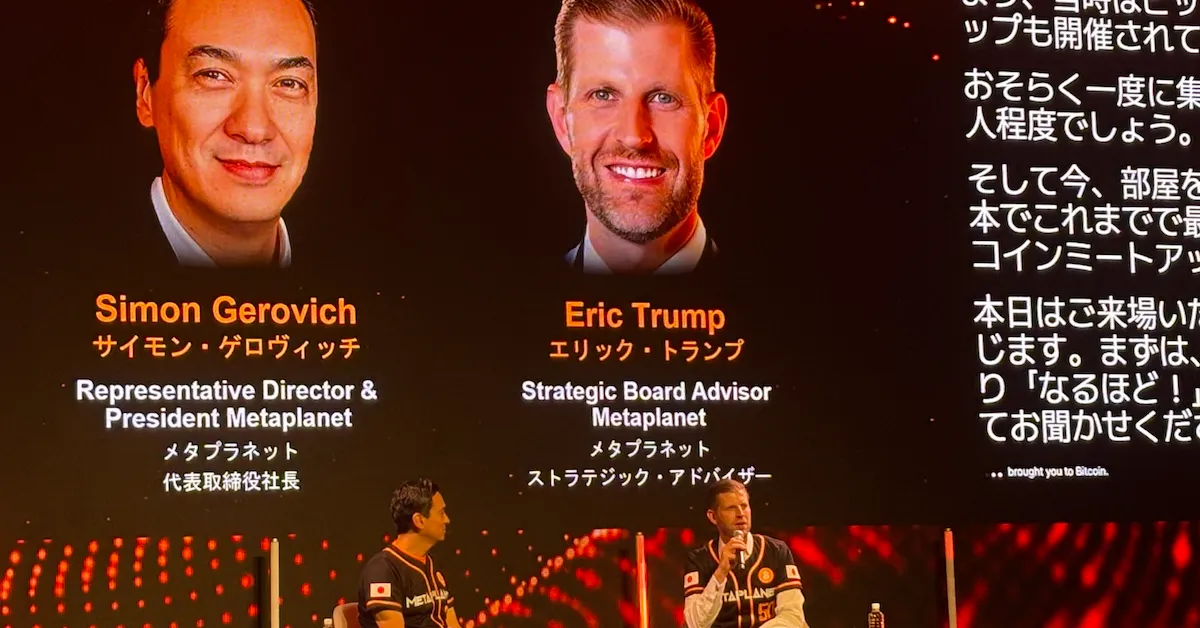

This strategic move firmly establishes Metaplanet as the world’s fifth-largest corporate Bitcoin holder, surpassing Bullish. The company now ranks behind only prominent entities such as Strategy, Marathon Digital, XXI, and Bitcoin Standard Treasury Company, underscoring its growing influence in the institutional Bitcoin space. Dylan LeClair, Metaplanet’s head of Bitcoin strategy, indicated that this purchase represents just the “first tranche” of a larger plan, referencing the $1.4 billion recently raised for further Bitcoin acquisitions.

Metaplanet is making significant progress toward its ambitious Bitcoin accumulation targets. The latest acquisition brings the company to 85.2% of its year-end 2025 goal of 30,000 BTC and positions it strongly for its 2026 target of 100,000 coins. The company has also demonstrated robust performance metrics, with its BTC Yield—a key indicator reflecting Bitcoin holdings relative to fully diluted shares—reaching 95.6% in Q1 2025 and further increasing to 129.4% in Q2 2025.

The funding for this substantial purchase primarily stemmed from the proceeds of Metaplanet’s recent international share offering, which successfully garnered approximately $1.4 billion. From the $1.25 billion specifically allocated for Bitcoin acquisitions, Metaplanet has utilized about $632.53 million in this initial, significant transaction.

Metaplanet's aggressive expansion aligns with a broader trend of accelerating corporate Bitcoin adoption. Corporate Bitcoin treasury holdings have now collectively exceeded 1 million BTC, accounting for roughly 5% of Bitcoin’s circulating supply. This surge in institutional interest has been particularly evident since early 2025, with other companies like BitMine and Forward Industries also embracing Bitcoin for their corporate treasuries.

To further support its expanding operations and strategic initiatives, Metaplanet has established two key subsidiaries. Metaplanet Income Corp., a Miami-based entity with $15 million in initial capital, is tasked with managing derivatives operations separately from treasury activities, thereby enhancing governance and risk management. Additionally, Bitcoin Japan Inc., a new subsidiary in Japan, focuses on managing media, events, and services related to Bitcoin, complemented by the strategic acquisition of the Bitcoin.jp domain name.

Despite this significant corporate acquisition, the Bitcoin price has remained under some pressure, trading below $113,000 after recently touching highs above $117,000. Nevertheless, the continuous acceleration of institutional adoption, spearheaded by companies like Metaplanet, signifies a pivotal evolution in corporate treasury operations. The integration of Bitcoin into corporate balance sheets represents a profound shift in traditional financial management practices and is poised to establish new benchmarks for institutional engagement with digital assets.

Recommended Articles

Michael Saylor's Bitcoin Crusade: Unpacking His Latest Market Moves and Predictions

Strategy (formerly MicroStrategy), led by Michael Saylor, continues its aggressive Bitcoin accumulation strategy, recent...

Crypto Giant Emerges: KindlyMD and Nakamoto Merge, Target Massive 1 Million BTC Acquisition

KindlyMD and Nakamoto Holdings have merged, forming a publicly traded Bitcoin treasury vehicle with the ambitious goal o...

KindlyMD and Nakamoto Merge, Splash $679 Million on Bitcoin Bonanza!

KindlyMD, Inc. and Nakamoto Holdings Inc. have successfully completed their merger, creating a publicly traded Bitcoin t...

Mega Merger Shakeup! KindlyMD & Nakamoto Join Forces, Unleashing Bitcoin Treasury Expansion With Million BTC Target!

KindlyMD, Inc. and Nakamoto Holdings Inc. have completed their merger, creating a publicly traded Bitcoin treasury vehic...

Crypto Power Play: KindlyMD and Nakamoto Merge, Eyeing Million BTC Purchase After Massive $679M Haul!

KindlyMD and Nakamoto Holdings have completed their merger, creating a publicly traded Bitcoin treasury vehicle aiming t...

You may also like...

Liverpool Crisis? Reds Face Scrutiny After Consecutive Defeats

Liverpool faces scrutiny after two straight losses, with BBC Sport expert Chris Sutton highlighting their defensive vuln...

Man Utd Managerial Shake-Up Looms: Amorim Speculation Ignites Southgate Concerns

Manchester United faces a managerial dilemma as Ruben Amorim's position comes under scrutiny amidst a dire start to the ...

Bone Lake: Twisted Thriller Sparks Critical Debate on Erotic Horror

Mercedes Bryce Morgan's <em>Bone Lake</em> explores the 'sexy horror' genre, blending psychological manipulation and bla...

Country Power Couple Kane & Katelyn Brown Land Lifetime Christmas Film Deal Based on Hit Song!

Country music stars Kane and Katelyn Brown are making their debut as television executive producers for Lifetime's holid...

Mariah Carey Breaks Silence On Eminem Feud & ‘8 Mile’ Rumors!

Mariah Carey recently discussed her long-standing feud with Eminem, confirming rumors that he once asked her to play his...

Coronation Street Shocker: Beloved Star Sally Ann Matthews Bids Farewell to Soap

Coronation Street bids farewell to two prominent stars as Sally Ann Matthews makes an emotional exit as Jenny Connor aft...

Tems Shatters Records: First Nigerian Female Artist to Hit 10 Million US Units!

Tems has made history as the first female Nigerian artist to sell over 10 million units of a single in the U.S. with her...

Autumn's Hottest High Street Bags Revealed: Top Trends Starting from Just £20!

For Autumn/Winter 2025, bags transcend their functional role to become the main event in fashion, with a diverse array o...