AI Chip War Truce: Nvidia & AMD Agree to US Export License Levy!

In an unprecedented and potentially contentious move, major US chipmakers Nvidia Corp. and Advanced Micro Devices Inc. (AMD) have reportedly agreed to remit 15% of their revenues generated from Chinese AI chip sales to the United States government. This unusual arrangement is part of a deal to secure crucial export licenses, allowing them to continue selling advanced AI accelerators in the lucrative Chinese market.

Sources familiar with the internal deliberations, who requested anonymity, indicated that Nvidia plans to pay 15% of the revenue derived from its H20 AI accelerator sales in China. Similarly, AMD is set to deliver the same share from its MI308 chip revenues. This agreement reflects a consistent approach by the former US President Donald Trump's administration, which sought to engineer financial payouts for America in exchange for trade concessions. A notable precedent cited is Apple Inc.'s pledge of $600 billion for domestic manufacturing in return for relaxed trade conditions, such as tariffs.

However, the concept of a narrow, select export tax of this nature has very little precedent in modern corporate history, making this deal particularly noteworthy and potentially controversial. The arrangement has already drawn criticism and concern from various quarters.

Beijing, which has expressed increasing apprehension regarding Chinese firms' deployment of chips like the H20, is unlikely to embrace the idea of such a "chip tax." Yuyuantantian, a social media account linked to state-run China Central Television, which often communicates Beijing's stance on trade, publicly criticized the H20 chip on Sunday, citing supposed security vulnerabilities and inefficiencies. This suggests that China may view the arrangement unfavorably, potentially as a form of economic coercion or a negotiation tactic to highlight their independence from US chips.

From an export control perspective, experts like Jacob Feldgoise, a researcher at the DC-based Center for Security and Emerging Technology, describe this as a "seeming quid pro quo" that is unprecedented. Feldgoise warns that such an arrangement risks invalidating the national security rationale typically cited for U.S. export controls. Furthermore, he believes it could undermine the US's position when negotiating with allies to implement complementary controls, as allies might question the sincerity of US policymakers if they appear willing to trade away national security concerns for economic concessions from either US companies or foreign governments.

Nvidia has publicly stated its adherence to US export rules and, despite not having shipped H20 chips to China for months, expresses hope that the rules will eventually enable US companies to compete in the Chinese market. AMD has not yet provided an immediate public response to the development. The Financial Times was the first to report this development, following an earlier report from the same outlet that the Commerce Department had begun issuing H20 licenses last week, shortly after Nvidia Chief Executive Officer Jensen Huang's meeting with Donald Trump. Huang has consistently advocated for lifting restrictions, arguing that isolating China could impede the global spread of American technology and inadvertently bolster local competitors like Huawei Technologies Co.

Analysts predict significant strategic implications. Hebe Chen, an analyst with Vantage Markets in Melbourne, views this as a "strategic bargaining chip" that strengthens Washington's influence over a critical technology sector during trade discussions with China. Over the long term, this export hurdle is expected to deter both Nvidia and AMD from deeper expansion in China, which is the world's largest chip-importing market. This, in turn, could provide a clear advantage to local Chinese producers, accelerating domestic semiconductor innovation and allowing them to capture a larger market share.

Financially, while the tax is expected to funnel capital to the US government, the total amount may not be enormous in relative terms. Both Nvidia and AMD have indicated that it will take time to ramp up production of their China-specific products, and there's uncertainty regarding whether order levels will return to previous highs. Nvidia's H20 sales in the fiscal quarter ending April 27 amounted to $4.6 billion, with an additional $2.5 billion in H20 China revenue being unschippable due to new restrictions. If sales can rebound to over $7 billion per quarter, the US government could potentially receive around a billion dollars quarterly from this deal. Morgan Stanley estimates that AMD could generate between $3 billion and $5 billion in 2025 revenue if restrictions were lifted.

The rise of Chinese alternatives further complicates the picture; Huawei’s Ascend chips, for instance, now account for an estimated 20% to 30% of domestic demand. Vey-Sern Ling, managing director at Union Bancaire Privee in Singapore, suggests that the US government's motivation likely stems from its deficits and eagerness to collect tariffs. However, he also notes that China's accusations about H20 chips containing "backdoors" could be a negotiation tactic, signaling that the country is not desperate for US chips and has viable domestic alternatives.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

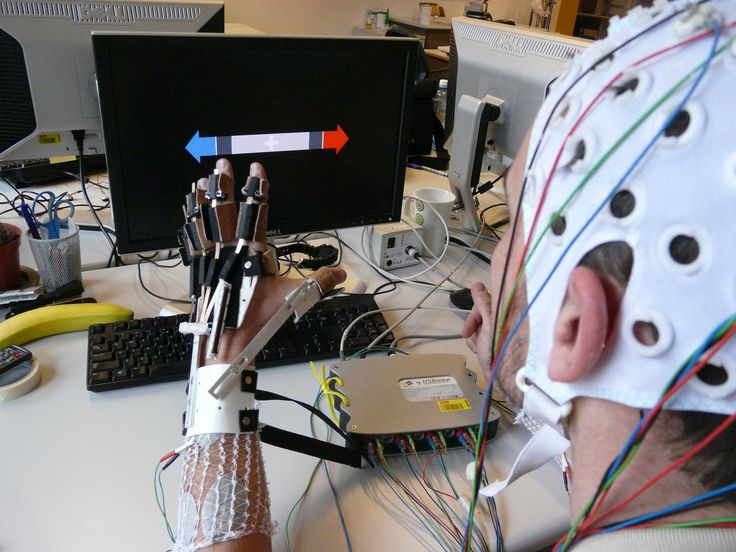

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...