Adani Group Roars Back: Tycoon Unveils Ambitious Future After Hindenburg Dismissal!

Billionaire Gautam Adani has announced a renewed strategic focus for his ports-to-energy conglomerate, emphasizing accelerated innovation, enhanced transparency, and the creation of lasting, meaningful impact. This declaration follows the Securities and Exchange Board of India (SEBI)'s recent dismissal of Hindenburg's allegations, which had included claims of accounting irregularities, stock manipulation, and the involvement of opaque offshore entities.

In an internal message to his staff, as reported by news agency PTI, Adani conveyed, “Today, a cloud that had hung over us for more than two years has been lifted. SEBI's comprehensive investigation has concluded by rejecting all allegations contained in the Hindenburg report from January 2023.” He further stressed the importance of building for a legacy that endures for decades, remarking, “Headlines fade, but what we create must leave its mark on history. Either we shape the future into what we dream or be shaped by the future into what we fear.”

Following the initial report by Hindenburg, SEBI initiated various investigations, including probes into related-party transactions and arrangements involving offshore funds. In its subsequent orders, SEBI explicitly stated that there was no evidence to suggest the conglomerate utilized related-party transactions to funnel funds into its publicly listed companies. Furthermore, the transactions highlighted by Hindenburg were deemed not to qualify as related-party transactions under regulatory definitions.

However, it is important to note that while SEBI's orders addressed specific allegations, they did not dismiss all claims made by Hindenburg. The Adani group continues to face regulatory scrutiny, notably due to an indictment by the US Department of Justice in an alleged USD 265 million bribery case.

The initial allegations from Hindenburg led to a significant selloff in Adani Group's publicly listed companies, resulting in a loss of over USD 150 billion in market value at one point. The Adani Group consistently refuted these claims, and Hindenburg has since ceased its operations. Adani himself characterized these claims as part of a “targeted, multidimensional assault,” asserting that “This attack was never just a market event.” He lauded his employees for sustaining operational progress despite intense worldwide scrutiny.

Adani acknowledged the group's workforce for successfully advancing key infrastructure projects amidst the challenges. He highlighted the steady development of ports, power plants, airports, and renewable energy initiatives, even as the group navigated reputational and legal hurdles. According to PTI, Adani remarked, “While the world debated about us, our ports expanded, transmission lines stretched farther, power plants ran reliably, renewable projects continued to green the world, airports advanced, cement furnaces fired away, and logistics teams delivered flawlessly. You proved that execution under pressure is the truest test of character, and that the Adani character is simply unbreakable.”

Looking ahead, Adani stated that the company has emerged more resilient and outlined future objectives that prioritize integrity, transparency, innovation, the creation of long-term value, and proactive transformation. “Integrity and transparency must remain the foundation of everything we do, inseparable, uncompromising, and safeguarded relentlessly,” he added. The report detailed additional priorities, including accelerating innovation across energy, logistics, and infrastructure sectors, establishing a lasting legacy beyond fleeting attention, and actively leading transformation to shape the future rather than being passively shaped by it. Meanwhile, Adani Enterprises Ltd shares have shown robust performance, surging over 80% year-to-date as of Monday, outperforming the Nifty 50 Index.

You may also like...

Ex-Premier League Referee Faces Prison After Guilty Plea in Child Image Case

Former Premier League referee David Coote has pleaded guilty to the serious charge of making an indecent image of a chil...

Osimhen's Hat-Trick Fuels Super Eagles' World Cup Hopes in Thrilling Benin Clash

Nigeria's Super Eagles secured a playoff spot for the 2026 FIFA World Cup with a dominant 4-0 victory over Benin, highli...

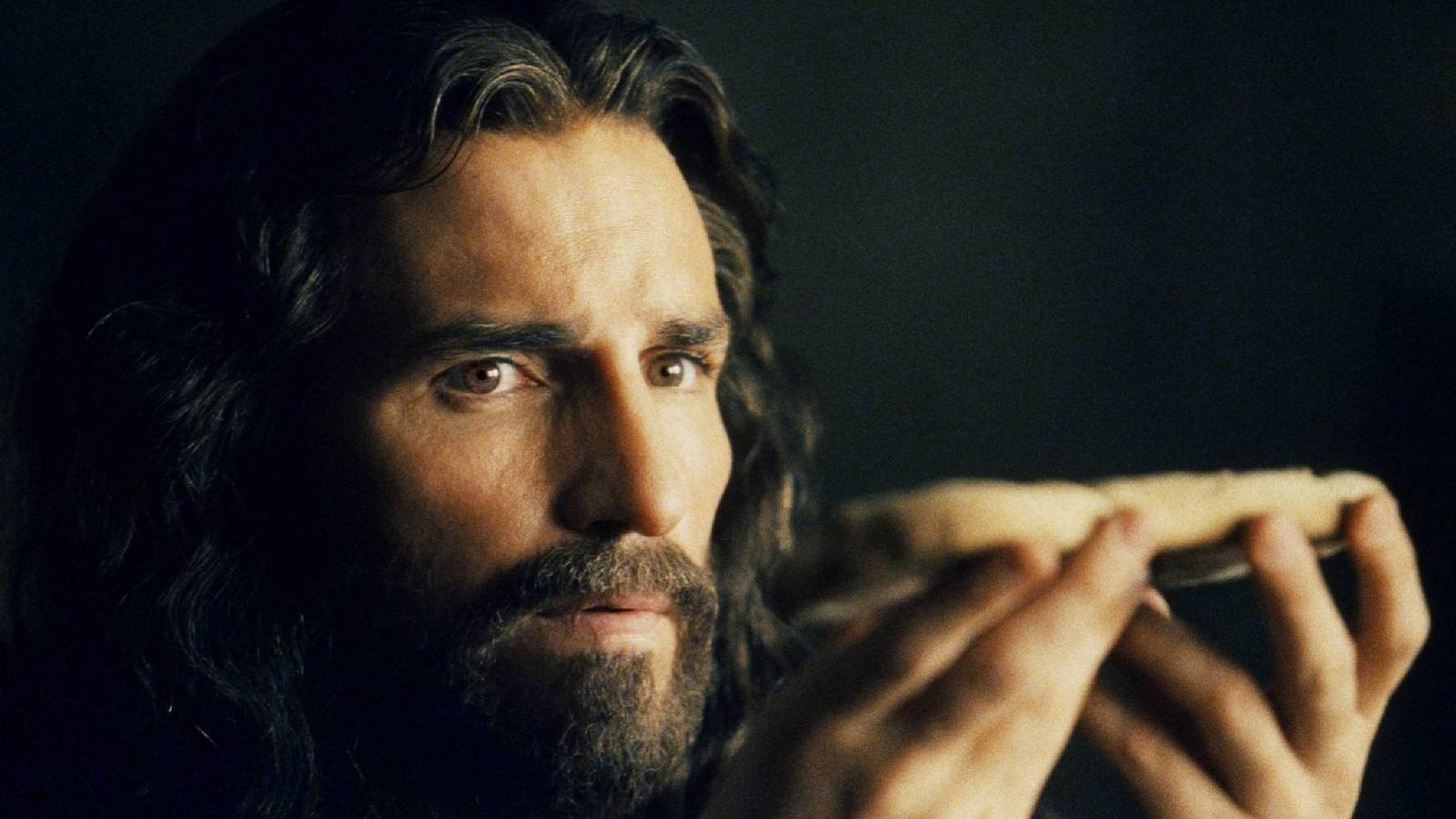

Mel Gibson Casts New Jesus for Highly Anticipated ‘Passion of the Christ’ Sequel

"The Resurrection of the Christ," Mel Gibson's highly anticipated sequel to "The Passion of the Christ," has begun filmi...

Legendary ‘Star Wars’ & ‘Blade Runner’ Poster Artist Drew Struzan Passes Away at 78

Renowned artist Drew Struzan, known for his iconic film posters for movies like “Star Wars” and “Blade Runner,” has pass...

Cosmic Sounds: Brian Eno & Beatie Wolfe Launch New Album Into Space

Brian Eno and Beatie Wolfe have unveiled a trio of ambient albums born from a strikingly normal creative process, now cu...

King Kylie Storms Music Scene: Kylie Jenner Drops Debut Track ‘Fourth Strike’

Kylie Jenner has released her debut song, "Fourth Strike," collaborating with pop duo Terror Jr and reviving her King Ky...

Secret Affair Unveiled: Katy Perry Confirms Justin Trudeau Romance at London Gig

Katy Perry has seemingly confirmed her new relationship with former Canadian Prime Minister Justin Trudeau during a Lond...

Jennifer Hudson Electrifies in Neon, Sets New Style Trend!

Jennifer Hudson made a dazzling entrance in a neon yellow gown and hot pink heels, electrifying the crowd in the spirit ...