NYC Token Meltdown: Eric Adams' Crypto Crashes 80% in Hours, Highlighting Bitcoin's Edge

Former New York City Mayor Eric Adams is currently facing intense scrutiny following the disastrous launch of his new cryptocurrency, the NYC Token. Unveiled with much fanfare on Monday at a Times Square event, the Solana-based token experienced a precipitous decline, losing 80% of its value within mere hours of its debut.

Adams had promoted the NYC Token as a groundbreaking initiative to generate funding for various social causes, including combating antisemitism and "anti-Americanism," advancing blockchain education, and providing student scholarships. He had explicitly stated to Fox Business that the proceeds would support non-profit organizations such as Combat Antisemitism and historically Black colleges and universities, all without the need for tax increases. This high-profile launch came less than two weeks after Adams concluded his term as mayor, during which he was a vocal advocate for cryptocurrency adoption, famously converting his initial mayoral paychecks into Bitcoin and other digital assets and signing an executive order to promote their use.

Despite strong initial investor interest that briefly propelled the NYC Token's market capitalization into the hundreds of millions of dollars – peaking at $580 million – its price swiftly collapsed. Market data indicates an 80% drop from its peak, resulting in the loss of nearly $500 million in market cap by January 13. This rapid devaluation sparked widespread condemnation across social media and trading forums, with on-chain analysts and traders quick to label the project a "rug pull." Many in the crypto community had anticipated such an outcome, with retail traders accusing the token's pattern of a classic pump-and-dump scheme. Further criticism was directed at the token's sparse disclosures, limited technical details, and the conspicuous absence of named partners or a clear working project roadmap.

This incident vividly underscores the inherent risks prevalent in the broader memecoin and altcoin markets, thereby reinforcing the argument for Bitcoin's comparative stability. Projects like the NYC Token are particularly vulnerable to large liquidity withdrawals, which can occur either immediately post-launch or as the token reaches new highs. The sheer popularity generated by a celebrity or political endorsement can easily attract buyers, inadvertently creating opportunities for insiders to sell off their holdings. Such actions frequently trigger sharp price drops and significant investor losses, practices widely perceived as manipulative and akin to scams.

In stark contrast, Bitcoin offers a much longer and more established track record, characterized by transparent issuance and truly decentralized governance. Its fixed supply and robust consensus mechanisms are fundamental to its resilience, fundamentally differentiating it from ephemeral tokens that often suffer from concentrated control or opaque organizational structures. Eric Adams' NYC Token serves as a prime example of the recurring pitfalls observed in speculative, celebrity- or politically branded digital assets: obscure tokenomics, centralized supply, and sudden collapses that leave retail investors financially exposed. Bitcoin's architectural design, incorporating decentralized proof-of-work security and a predictable issuance schedule, is specifically engineered to mitigate these very risks. Bitcoin's decades-long resilience has consistently withstood the speculative churn and volatility emanating from memecoins, with this recent pump-and-dump scheme from Eric Adams further highlighting why Bitcoin uniquely stands apart in the broader cryptocurrency landscape.

Recommended Articles

Bitplanet's Bitcoin Bonanza: Surges to Asia's Top 20 Corporate Holders!

South Korea's Bitplanet Inc. has acquired 300 BTC, joining Asia's top corporate Bitcoin holders with a strategy linking ...

Crypto Revolution Deepens: Citi Plunges into Bitcoin Custody, Merging with Traditional Finance

Wall Street titans Citi and Morgan Stanley are making significant strides in integrating Bitcoin and other digital asset...

Bitcoin's Elusive $150,000 Target: Why Skepticism Mounts

The digital assets market faces a volatile Friday with a major Deribit options expiry and crucial U.S. macro data influe...

Fintech Shaken: Patricia Reports Security Breach, Funds Lost Amidst Investigation

Nigerian cryptocurrency firm Patricia has announced a security breach impacting its Bitcoin and Naira assets, leading to...

Central African Republic Embraces Crypto with Launch of Meme Coin

The Central African Republic (CAR) has launched a new meme coin, $CAR, to boost its global standing and national develop...

Bitcoin Plunge: Critical $63,000 Support Shattered as Price Tumbles

Bitcoin has plummeted below $63,000, marking a 50% correction since its October 2025 highs despite increasing institutio...

You may also like...

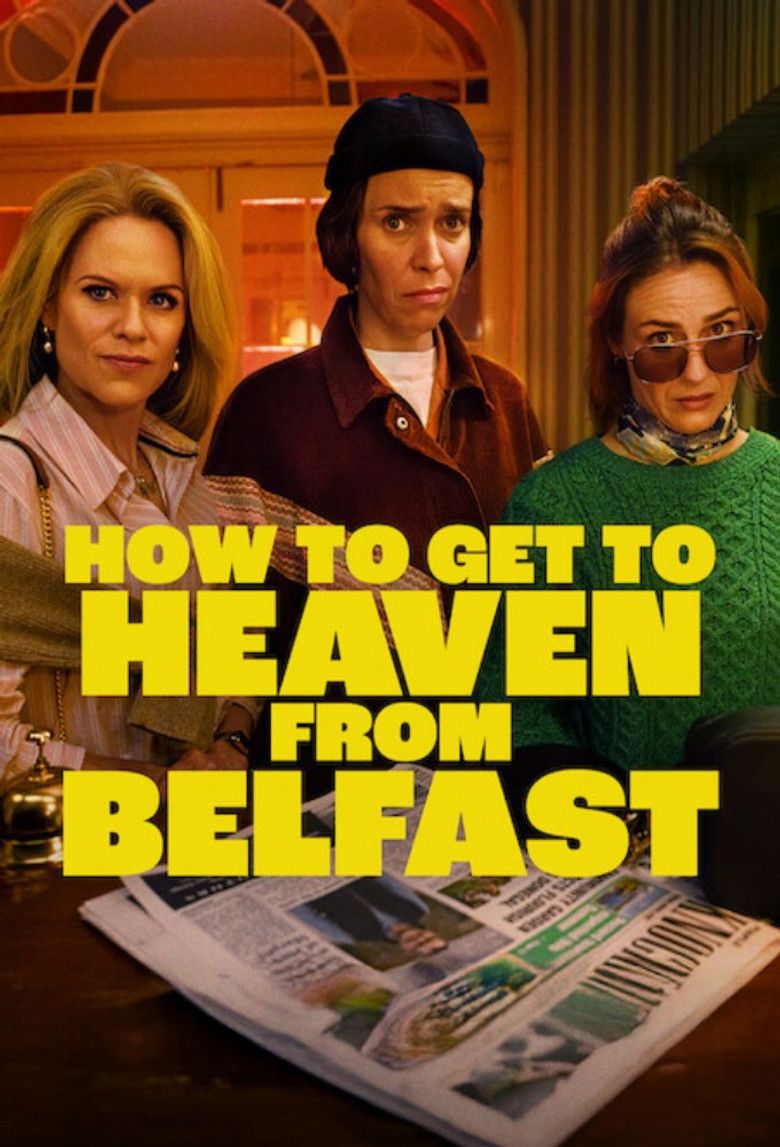

Binge-Worthy 8-Episode Thriller Masterpiece Lands on Netflix!

Lisa McGee, creator of "Derry Girls," brings "How To Get To Heaven From Belfast" to Netflix, a gripping comedy thriller....

Blockbuster Oscar Nominee Hits Netflix After Raking In Millions!

<i>Jurassic World Rebirth</i> redefines the beloved franchise by exploring scientific overreach and humanity's evolving ...

Little Mix's Leigh-Anne Reveals Dream Collaboration with Manon and Normani!

Leigh-Anne Pinnock expressed her desire to collaborate with Manon Bannerman and Normani, a wish that carries significant...

Music Star Thomas Rhett & Lauren Akins Announce Arrival of First Son!

Country music star Thomas Rhett and his wife, Lauren Akins, have welcomed their fifth child and first son, Brave Elijah ...

Bridgerton Stars Unveil Game-Changing Season 4 Death

An interview with the stars of Bridgerton Season 4 Part 2 delves into the tragic death of John Stirling and its aftermat...

Shocking Recruitment Scandal: Kenyan Faces Charges for Sending Youths to Ukraine War

A Kenyan man has been arraigned in court over alleged human trafficking, accused of recruiting 22 youths for the Russia-...

Angola Under Fire: Billion-Dollar Contracts Awarded Without Public Tender

A comprehensive review of Angolan presidential decrees has uncovered that at least US$61.5 billion in public spending wa...

Pentagon Declares AI Heavyweight Anthropic a Supply Chain Risk

The Trump administration has ordered federal agencies to cease using Anthropic products following a dispute over the com...