Nigeria's $150K Weekly Forex Window: A Game Changer for Fintech Remittances!

Nigeria’s Central Bank (CBN) has implemented a major policy reversal, reopening official Foreign Exchange (forex) market access to licensed Bureau de Change (BDC) operators in a bid to boost liquidity and support the nation’s formal remittance ecosystem.

Under the new directive, each licensed BDC can now purchase up to $150,000 weekly from the Nigerian Foreign Exchange Market (NFEM) at prevailing official rates, ending a suspension that had previously pushed many operators toward collapse.

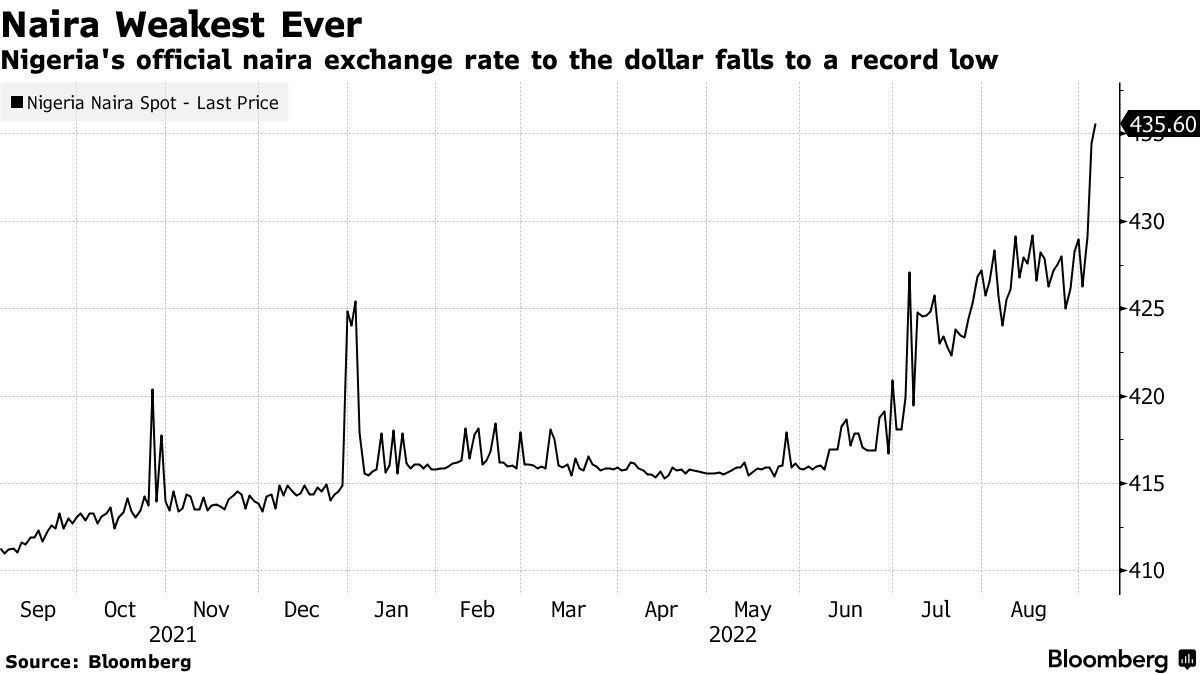

The move fundamentally alters the competitive landscape for diaspora remittance providers, including fintech companies, by narrowing the longstanding spread between official and parallel market exchange rates — a gap that historically made formal channels less competitive.

CBN Governor Olayemi Cardoso noted that Nigeria’s foreign exchange reserves have risen to about $49 billion, and the divergence between official and parallel rates has compressed to under 2%, making licensed remittance services more attractive compared with informal channels such as hawalas, cash couriers, or hand‑carried foreign currency.

For remittance companies, the policy shift offers immediate advantages.

With access to dollars at official rates, BDCs can avoid the premiums charged in the informal market, while traditional banks — buoyed by increased liquidity — are likely to offer more competitive rates on diaspora transfers.

This development provides a strategic advantage to the formal remittance sector, supporting efforts to draw inflows from unregulated operators and encouraging more money to flow via traceable, regulated channels.

The CBN’s directive comes with stringent compliance requirements to ensure oversight and transparency.

These include full Know Your Customer (KYC) checks on all forex sales, electronic reporting of all transactions, and a requirement that any unsold foreign exchange be returned to the market within 24 hours.

Additionally, cash payouts are capped at 25% of each transaction, and all activity must be processed through licensed financial institutions, effectively raising hurdles for informal operators and favoring licensed remittance platforms already operating within regulatory frameworks.

Analysts expect Nigeria’s forex inflows to strengthen through 2026 due to higher crude oil output, improved pipeline security, and sustained diaspora remittances, supporting the CBN’s policy objective of encouraging more foreign currency into formal channels.

Even as BDCs and banks recalibrate operations in response to the new environment, remittance providers will need to maintain competitive advantages in pricing transparency, speed, and user experience to capitalize fully on the improved market conditions.

The policy represents one of the most favorable operating environments for Nigeria’s formal remittance sector in years, fostering increased liquidity, narrowing the official‑parallel exchange gap, and strengthening the appeal of licensed remittance channels for diaspora Nigerians sending funds home.

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...