MicroStrategy's Bitcoin Frenzy: $168M Haul Boosts Holdings to Staggering 717,131 BTC!

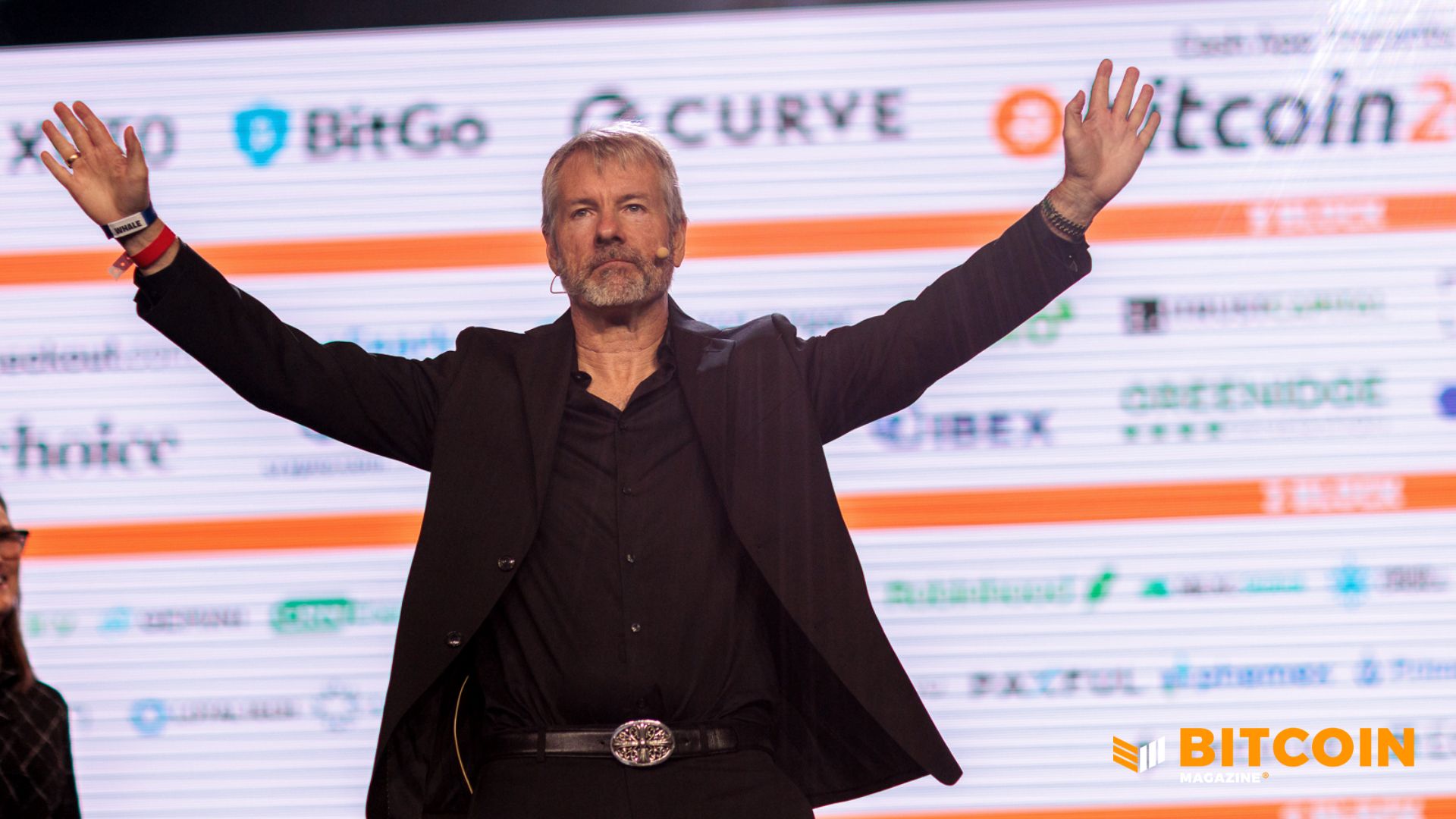

Strategy, the prominent bitcoin treasury company helmed by Executive Chairman Michael Saylor, recently bolstered its substantial bitcoin holdings with a significant acquisition of $168.4 million worth of the cryptocurrency. This latest purchase, comprising 2,486 BTC, demonstrates the company's unwavering commitment to its long-running accumulation strategy, even amidst the persistent volatility characterizing the broader crypto market.

Following this most recent transaction, Strategy's total bitcoin reserves have surged to an impressive 717,131 BTC, solidifying its position as one of the largest corporate holders of bitcoin globally. The company has disclosed that its entire bitcoin position has been accumulated for an aggregate sum of $54.52 billion, translating to an average purchase price of $76,027 per bitcoin. However, with bitcoin currently trading around $68,000, Strategy's substantial holdings presently sit below its aggregate cost basis. This discrepancy implies an unrealized loss of approximately $8,000 per coin, amounting to an estimated $5.7 billion across the company’s total stack.

Michael Saylor officially confirmed the latest purchase, reiterating that Strategy continues to actively build its bitcoin position as an integral component of its overarching corporate treasury strategy. The company has a well-established track record of consistently adding bitcoin through various market cycles, steadfastly framing the digital asset as a crucial long-term reserve holding. Strategy's influence in the corporate bitcoin landscape is notable, as it accounted for more than 90% of net new public-company bitcoin purchases in January. Furthermore, the company now controls nearly two-thirds of the total approximately 1.13 million BTC held by public companies, while also extending its market reach through hybrid digital credit instruments such as STRC and STRF.

The financing details for these most recent acquisitions were also outlined in a company filing. Strategy funded the bitcoin purchases through a combination of $90.5 million in proceeds generated from common stock sales and an additional $78.4 million raised from sales of its STRC preferred series. This approach highlights the company's reliance on a diversified mix of equity issuance and other financing tools in recent years to sustain its ambitious bitcoin accumulation program.

Strategy’s distinctive approach has elicited a spectrum of reactions from market participants. Proponents laud the company as a trailblazer in institutional bitcoin adoption, pioneering a path for other corporations. Conversely, skeptics express concerns regarding the inherent risks associated with leveraging corporate capital markets activity to amplify exposure to such a volatile asset. These significant purchases coincide with a period where bitcoin has traded considerably below its record highs, thereby exerting pressure on companies that maintain substantial treasury allocations in the cryptocurrency. The fact that Strategy's average acquisition cost now surpasses the current market price underscores the potential for drawdowns, even for firms that have meticulously built their positions over several years.

In the equity markets, Strategy’s shares (MSTR) have mirrored investor caution. MSTR stock experienced a 3.2% decline in premarket trading on Tuesday and has recorded a decrease of over 60% year-over-year, according to available market data. Despite these fluctuations, with a notable surge of over 10% last Friday, the company has consistently maintained its resolute commitment to both holding and acquiring more BTC. Strategy has repeatedly articulated its perspective that bitcoin is a long-duration asset and constitutes a central pillar of its balance sheet philosophy.

You may also like...

Ndidi's Besiktas Revelation: Why He Chose Turkey Over Man Utd Dreams

Super Eagles midfielder Wilfred Ndidi explained his decision to join Besiktas, citing the club's appealing project, stro...

Tom Hardy Returns! Venom Roars Back to the Big Screen in New Movie!

Two years after its last cinematic outing, Venom is set to return in an animated feature film from Sony Pictures Animati...

Marvel Shakes Up Spider-Verse with Nicolas Cage's Groundbreaking New Series!

Nicolas Cage is set to star as Ben Reilly in the upcoming live-action 'Spider-Noir' series on Prime Video, moving beyond...

Bad Bunny's 'DtMF' Dominates Hot 100 with Chart-Topping Power!

A recent 'Ask Billboard' mailbag delves into Hot 100 chart specifics, featuring Bad Bunny's "DtMF" and Ella Langley's "C...

Shakira Stuns Mexico City with Massive Free Concert Announcement!

Shakira is set to conclude her historic Mexican tour trek with a free concert at Mexico City's iconic Zócalo on March 1,...

Glen Powell Reveals His Unexpected Favorite Christopher Nolan Film

A24's dark comedy "How to Make a Killing" is hitting theaters, starring Glen Powell, Topher Grace, and Jessica Henwick. ...

Wizkid & Pharrell Set New Male Style Standard in Leather and Satin Showdown

Wizkid and Pharrell Williams have sparked widespread speculation with a new, cryptic Instagram post. While the possibili...

Victor Osimhen Unveils 'A Prayer From the Gutter', Inspiring Millions with His Journey

Nigerian football star Victor Osimhen shares his deeply personal journey from the poverty-stricken Olusosun landfill in ...