Microfinance 3.0: When Tech Meets the Old Village Savings Circle

The Circle That Built Communities

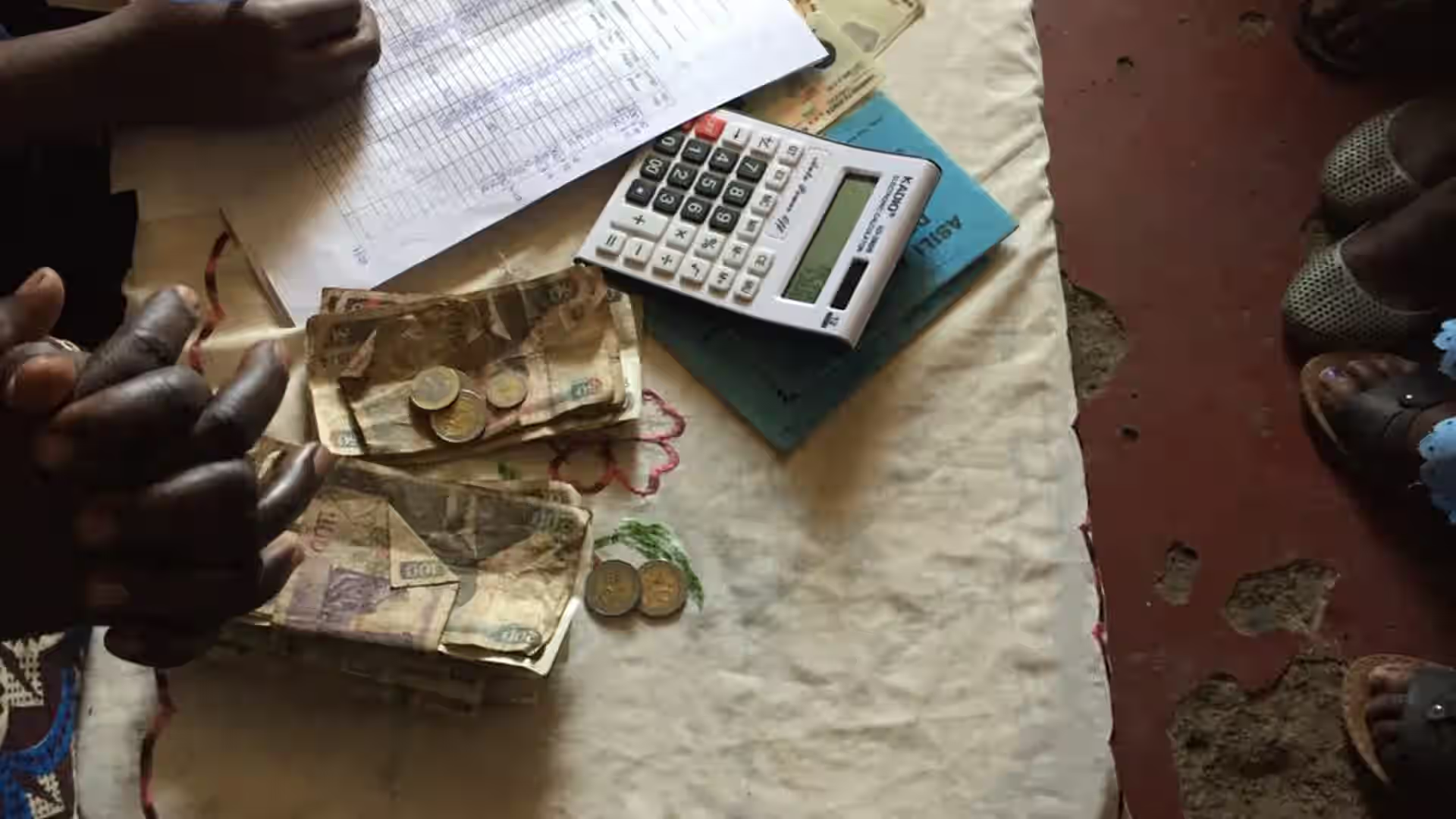

Way before venture capitalists showed up or anyone had banking apps on their phones, people across Africa already had a system for saving and lending money together. They called it different names — ajo in Nigeria, susu in Ghana, stokvel in South Africa, chama in Kenya — but the idea was the same everywhere. These were simple, local savings groups. No paperwork, no fancy tech, just trust and a shared goal. They helped folks with no bank accounts save money, lend to each other, and build something bigger than they could on their own.

Here’s how it usually worked: every week or month, everyone in the group chipped in a set amount. One person took home the whole pot that round. Next time, it went to someone else, and so on. That money sent kids to school, paid for weddings, helped start up small businesses, whatever mattered most. It wasn’t charity. It was a plan, built on trust and a sense of responsibility. In some places, your promise meant more than any document ever could.

These circles did way more than just move money around. They pulled people together. Members met up often, shared food, laughed, argued, and built a real network. The woman who ran the ajo wasn’t just counting cash. She settled disputes, kept everyone honest, and sometimes caught problems before they got big. For a lot of people shut out of banks, these groups proved finance can actually be about people, not just numbers on a screen.

Now, all these years later, technology seems to be catching up. Fintech companies are rolling out new apps and platforms, but really, they’re just dressing up an old idea. The truth is, our grandparents already figured it out: in Africa, sustainable finance isn’t just about access, it’s about trust.

When Tradition Goes Digital

Microfinance 3.0 is where old-school wisdom meets fresh tech. All over Africa, startups are popping up, turning classic savings circles into digital platforms. You’ve got apps like Esusu, launched by Nigerian immigrants in the U.S., MaTontine in Senegal, and ChamaPesa in Kenya. They’re taking those familiar group savings models and flipping them into smooth, mobile-first systems.

The concept isn’t complicated, but it changes everything. Tech now formalizes what used to be informal, without losing the heart of the community. Instead of handing cash to an ajo leader, people just tap their phones and send money through mobile wallets or apps. Forget paper logs—now it’s all digital ledgers. Trust isn’t just a handshake; it’s blockchain contracts and automatic reminders.

But honestly, there’s more going on here than just some new tools. It’s a cultural comeback, disguised as a tech upgrade. These fintech companies aren’t just fixing a financial gap. They’re shining a light on local systems that people used to call “backward.” By moving ajo and susu into the digital world, they’re showing that traditional African finance was always smart, just overlooked.

Take Esusu in the U.S.—named after the Yoruba word ẹ̀sùsù—it helps immigrants build credit with digital savings circles. In Kenya, ChamaPesa keeps those trusted investment groups going, but now everything’s tracked by smart contracts. MaTontine in Senegal? It’s helping women who’ve never had a bank account save money and build a financial identity, all through their phones.

Sure, these platforms borrow ideas from Silicon Valley, data crunching, mobile access, slick user experiences. But they keep their African spirit. The real drivers? Trust, reciprocity, accountability. The same stuff that made village savings circles work for generations.

Switching to digital isn’t all smooth sailing, though. Trust is still the big question. Back in the day, everyone watched each other in person. Now, it’s all about trusting lines of code. Can an app really take the place of a community elder’s watchful eye? Fintech founders think so. They’re adding live contribution trackers, instant receipts, withdrawal alerts, trying to make everything clear as day. But that deep sense of connection, the feeling that everyone’s in it together, is a lot harder to squeeze into an app.

Redefining the Future of African Finance

Fintech in Africa is coming into its own, and honestly, the future doesn’t look like a carbon copy of Western banks. Instead, it’s about giving old practices a digital twist. Microfinance 3.0 isn’t just about fancier apps or faster transactions—it’s a whole new way of thinking. The focus isn’t on wiping out tradition; it’s on building tech that respects it.

Take digital ajo platforms, for example. They’re not just a nostalgic throwback. People across Africa are picking up systems that actually make sense to them, not just what’s imported. Traditional banks still shut out a lot of folks, informal traders, market women, and rural business owners. So, digital savings circles step in. They give people real power over their money, without making them jump through hoops or lose that feeling of community. Picture a trader who’s never set foot in a bank. Now, she can join an ajo with a few taps on her phone—same trust, way less hassle.

But scaling up brings headaches. Regulation, for one. Governments are still figuring out what to do with these hybrid platforms—are they banks, or not? Without clear rules, startups end up stuck in the same gray zones that held back microfinance before. And then there’s the risk of losing what made these systems special in the first place. When venture-backed fintechs start chasing numbers over values, trust turns into just another KPI. That’s how the community spirit fades.

Even so, there’s a lot to feel good about. Cooperative fintechs are trying new things, like letting users earn a piece of the pie as they save. Some startups are actually using blockchain for meaningful stuff, like helping groups verify members or make decisions together. It proves that digital doesn’t have to mean distant or cold, it can be local, open, and built on trust.

Funny enough, the future of African fintech might just be your grandmother’s savings circle, dressed up in 21st-century tech. The real difference? Now, what used to work for a handful of women at the market can reach millions, even across borders. There’s something poetic about that. Africa, the birthplace of community banking, could end up showing the rest of the world how to put the “human” back in digital finance.

Microfinance 3.0 doesn’t try to replace the village savings circle. It proves it never went out of style. As technology moves forward, Africa’s oldest financial wisdom might just turn out to be its strongest new advantage.

Recommended Articles

There are no posts under this category.You may also like...

Explosive Racism Claims Rock Football: Ex-Napoli Chief Slams Osimhen's Allegations

Former Napoli sporting director Mauro Meluso has vehemently denied racism accusations made by Victor Osimhen, who claime...

Chelsea Forges Groundbreaking AI Partnership: IFS Becomes Shirt Sponsor!

Chelsea Football Club has secured Artificial Intelligence firm IFS as its new front-of-shirt sponsor for the remainder o...

Oscar Shockwave: Underseen Documentary Stuns With 'Baffling' Nomination!

This year's Academy Awards saw an unexpected turn with the documentary <i>Viva Verdi!</i> receiving a nomination for Bes...

The Batman Sequel Awakens: Robert Pattinson's Long-Awaited Return is On!

Robert Pattinson's take on Batman continues to captivate audiences, building on a rich history of portrayals. After the ...

From Asphalt to Anthems: Atlus's Unlikely Journey to Music Stardom, Inspiring Millions

Singer-songwriter Atlus has swiftly risen from driving semi-trucks to becoming a signed artist with a Platinum single. H...

Heartbreak & Healing: Lil Jon's Emotional Farewell to Son Nathan Shakes the Music World

Crunk music icon Lil Jon is grieving the profound loss of his 27-year-old son, Nathan Smith, known professionally as DJ ...

Directors Vow Bolder, Bigger 'KPop Demon Hunters' Netflix Sequel

Directors Maggie Kang and Chris Appelhans discuss the phenomenal success of Netflix's "KPop Demon Hunters," including it...

From Addiction to Astonishing Health: Couple Sheds 40 Stone After Extreme Diet Change!

South African couple Dawid and Rose-Mari Lombard have achieved a remarkable combined weight loss of 40 stone, transformi...