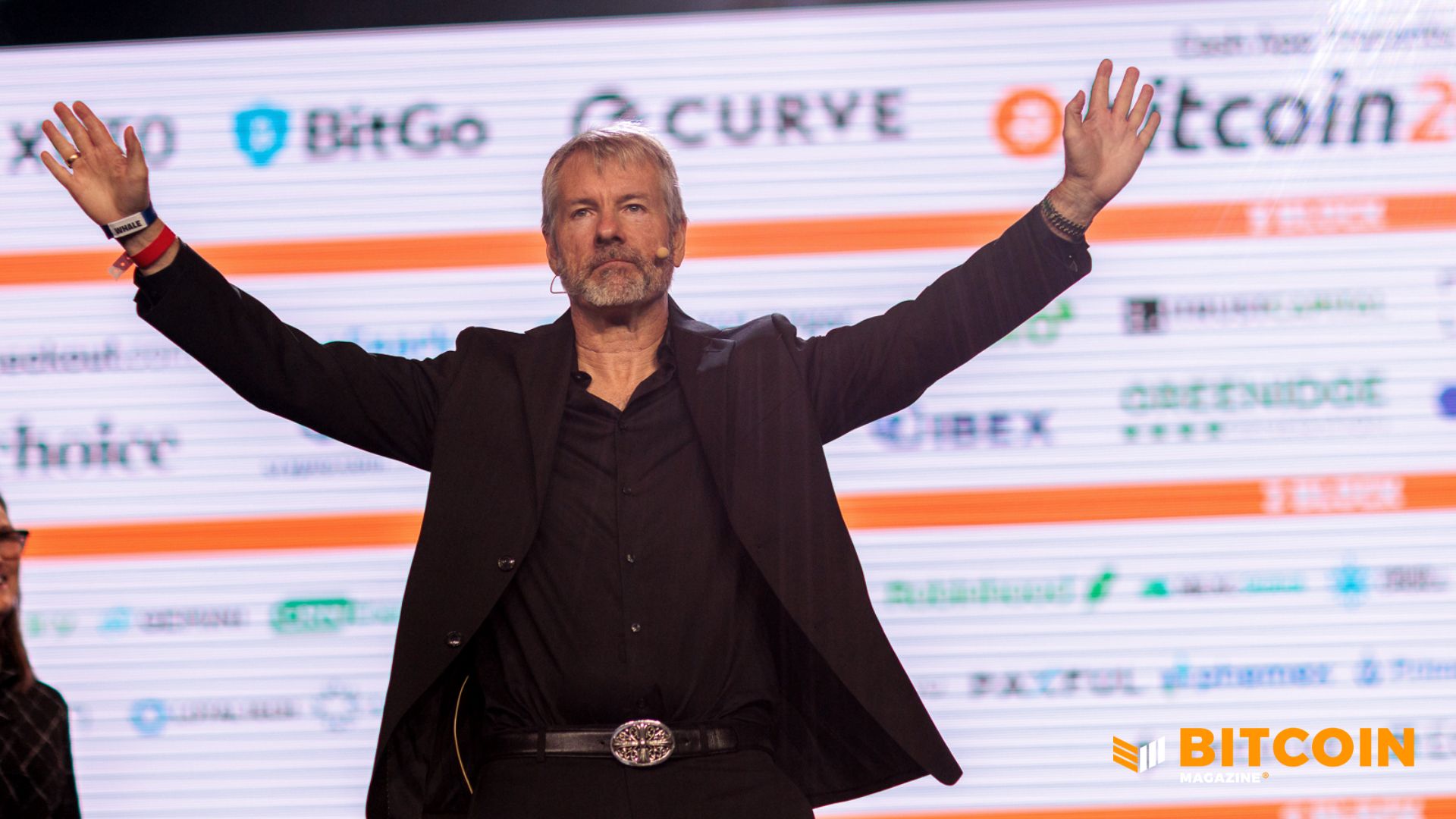

Michael Saylor's MicroStrategy Strikes Again: Second $1 Billion Bitcoin Buy Confirmed!

Strategy, the world's largest publicly traded bitcoin holder, has significantly expanded its digital asset reserves with another substantial acquisition. The company recently added 10,645 bitcoin (BTC) for approximately $980.3 million, marking its second consecutive mega-purchase. This acquisition occurred as bitcoin prices experienced a pullback, nearing the $90,000 level. The average price paid for this latest batch of BTC was $92,098 per coin, according to a filing released on Monday.

Following this purchase, Strategy's total bitcoin holdings now stand at an impressive 671,268 BTC, acquired for a cumulative sum of $50.33 billion. This gives the company an average acquisition cost of $74,972 per coin. The latest acquisition, consistent with recent purchasing trends, was primarily funded through equity issuance. Specifically, Strategy raised $888.2 million through sales of its common stock, with the remaining capital sourced from sales of its STRD preferred shares. Despite persistent concerns regarding shareholder dilution, the company has consistently leveraged equity markets to bolster its bitcoin exposure.

The timing of this significant purchase is notable, occurring amidst a broader market correction for bitcoin, which briefly dipped below $90,000 over the weekend before stabilizing around $89,600. While Strategy has maintained a steady purchasing pattern throughout 2025, most weekly acquisitions in recent months had been relatively modest due to fundraising constraints. However, over the past two weeks, Executive Chairman Michael Saylor has ramped up purchases, signaling a renewed conviction in bitcoin despite ongoing volatility in both the cryptocurrency and Strategy’s own stock.

In other corporate developments, Strategy ($MSTR) has confirmed its continued inclusion as a constituent of the Nasdaq 100 index, maintaining its classification within the technology category. Furthermore, the company has actively challenged proposals from the index provider MSCI, which is currently reviewing whether to exclude companies with significant bitcoin treasury holdings from its benchmarks. In a formal letter, Strategy argued that MSCI’s proposed digital asset threshold is 'misguided' and would result in 'profoundly harmful consequences.' MSCI is anticipated to announce its final decision on this matter in January.

Strategy, formerly known as MicroStrategy, made a strategic pivot from enterprise software to a bitcoin-focused treasury strategy in 2020. This innovative model has since been emulated by numerous other firms, though some critics contend that these companies are increasingly functioning more as bitcoin investment vehicles than as traditional operating businesses. Despite these criticisms, Michael Saylor has remained resolute and unapologetic in his bold purchasing decisions. As of December 14, 2025, Strategy reported a year-to-date BTC yield of 24.9%, underscoring its unwavering commitment to accumulating bitcoin irrespective of short-term market fluctuations or equity price pressures. At the time of writing, bitcoin was trading near $89,650.

You may also like...

Bundesliga's New Nigerian Star Shines: Ogundu's Explosive Augsburg Debut!

Nigerian players experienced a weekend of mixed results in the German Bundesliga's 23rd match day. Uchenna Ogundu enjoye...

Capello Unleashes Juventus' Secret Weapon Against Osimhen in UCL Showdown!

Juventus faces an uphill battle against Galatasaray in the UEFA Champions League Round of 16 second leg, needing to over...

Berlinale Shocker: 'Yellow Letters' Takes Golden Bear, 'AnyMart' Director Debuts!

The Berlin Film Festival honored

Shocking Trend: Sudan's 'Lion Cubs' – Child Soldiers Going Viral on TikTok

A joint investigation reveals that child soldiers, dubbed 'lion cubs,' have become viral sensations on TikTok and other ...

Gregory Maqoma's 'Genesis': A Powerful Artistic Call for Healing in South Africa

Gregory Maqoma's new dance-opera, "Genesis: The Beginning and End of Time," has premiered in Cape Town, offering a capti...

Massive Rivian 2026.03 Update Boosts R1 Performance and Utility!

Rivian's latest software update, 2026.03, brings substantial enhancements to its R1S SUV and R1T pickup, broadening perf...

Bitcoin's Dire 29% Drop: VanEck Signals Seller Exhaustion Amid Market Carnage!

Bitcoin has suffered a sharp 29% price drop, but a VanEck report suggests seller exhaustion and a potential market botto...

Crypto Titans Shake-Up: Ripple & Deutsche Bank Partner, XRP Dips, CZ's UAE Bitcoin Mining Role Revealed!

Deutsche Bank is set to adopt Ripple's technology for faster, cheaper cross-border payments, marking a significant insti...