Malaysian Sovereign Fund Targets Startup Boom in Power Grids, Chip Firms

Malaysia’s sovereign wealth fund, Khazanah Nasional Bhd, is ramping up investments aimed at strengthening the country’s power infrastructure and supporting domestic semiconductor firms as artificial intelligence (AI) drives a new global investment cycle. With AI rapidly redefining what constitutes an “investable” asset, reliable energy supply and grid resilience have emerged as critical factors for competitiveness.

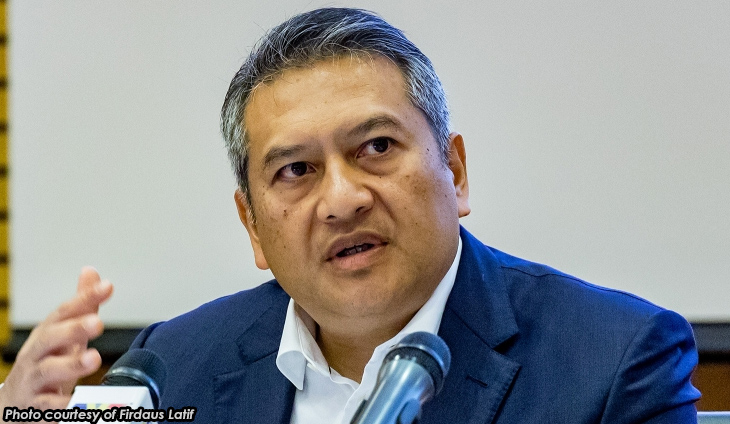

Speaking at the World Economic Forum in Davos, Khazanah Managing Director Amirul Feisal Wan Zahir emphasized that the explosive growth in AI computing demand requires robust and affordable energy systems. While many global investors are focusing on data centers, Khazanah is taking a more foundational approach by prioritizing grid resilience and access to cheap, reliable power, including renewable energy. This strategy is designed to ensure Malaysia can sustainably scale its AI and digital infrastructure.

Backing Local Semiconductor Firms to Move Up the Value Chain

In parallel, Khazanah is exploring ways to finance the capital needs of Malaysian semiconductorcompanies, with the aim of helping them move up the value chain—particularly into advanced chip packaging technologies. This focus aligns closely with national industrial priorities to deepen Malaysia’s role in the global semiconductor ecosystem.

Prime Minister Anwar Ibrahim announced in May 2024 that Malaysia aims to attract at least 500 billion ringgit ($123.40 billion) in semiconductor investments. The plan includes more than $5.3billion in fiscal incentives, as well as initiatives to build domestic capabilities in chip design and advanced packaging. Khazanah’s investment strategy supports these ambitions by strengthening local firms’ competitiveness and technological depth.

Portfolio Growth, Global Expansion, and Currency Outlook

Khazanah manages a diversified portfolio spanning multiple asset classes, sectors, and geographies, with holdings in major entities such as CIMB Group, Malaysia’s second-largest lender, and Malaysia Aviation Group. In 2024, the fund reported a 22% increase in net assetvalue, rising to 103.6 billion ringgit ($25.57 billion) from 84.8 billion ringgit the previous year.

Amirul Feisal noted that the international share of Khazanah’s portfolio is expected to expand gradually over time. On currency matters, he said there is “room” for the Malaysian ringgit to strengthen, although any appreciation will largely depend on movements in the U.S. dollar and ongoing uncertainty surrounding U.S. interest rate policy. He declined to provide a specific target for the currency.

Recommended Articles

AI Ethics Crisis: Grok Restricted in Malaysia & Indonesia Over Explicit Abuse!

Malaysia and Indonesia have become the first countries to block Grok, Elon Musk's AI chatbot, over concerns about its us...

International Crackdown: Malaysia & Indonesia Block Musk's Grok Over Sexualized AI Images

Malaysia and Indonesia have taken the lead in blocking Grok, Elon Musk's AI chatbot, due to mounting concerns over its m...

ASIA ON EDGE: China Rushes Envoy as ASEAN Steps In To Quell Thailand-Cambodia Border Tensions!

International concern grows over border clashes between Thailand and Cambodia, prompting active mediation from China and...

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...