Kenya’s Crypto Turning Point: What the New Law Means for Digital Finance

Kenya just hit this wild milestone with crypto. October 2025, Parliament finally did the thing—they passed the VASP Bill. So now, for the first time, all that crypto hype in Nairobi isn’t just floating in legal limbo. Before this, everyone from college kids to hustling freelancers were trading coins, launching projects, and basically winging it because, honestly, no one was watching. Now, with the bill chilling on President Ruto’s desk, the vibe’s totally changed. It’s gone from “let’s see what happens” to “okay, here’s the playbook.”

Here’s the skinny: the law basically tells crypto companies—exchanges, wallets, stablecoin folks—“y’all gotta register, play by our rules, and let us keep an eye on you.” The Central Bank’s got dibs on stablecoins and digital payments. The Capital Markets Authority? They’ll keep an eye on trading and make sure investors don’t get hosed. There was this whole idea floating around about making a separate crypto authority, but nah, the government just decided to beef up the squad they already had.

Now, operators have to actually have an office in Kenya. No more hiding out in Telegram groups or running things from a laptop in Mombasa. They’ve gotta keep customer money separate from their own, track every transaction, and—get this—actually follow anti-money laundering rules. The FATF stuff. Basically, Kenya’s trying to prove it can roll with the big boys and isn’t just running a crypto flea market.

Regulators are all about “protect the people, stop the scams.” But for the crypto nerds and builders? This is their shot to go legit and finally get some of that international cash that’s been sitting on the sidelines. Still, not everyone’s stoked. All these new rules? There’s a cost—the homegrown startups that made Kenya’s crypto scene so lively—they might get affected. So yeah, it’s a turning point.

Balancing Innovation and Control

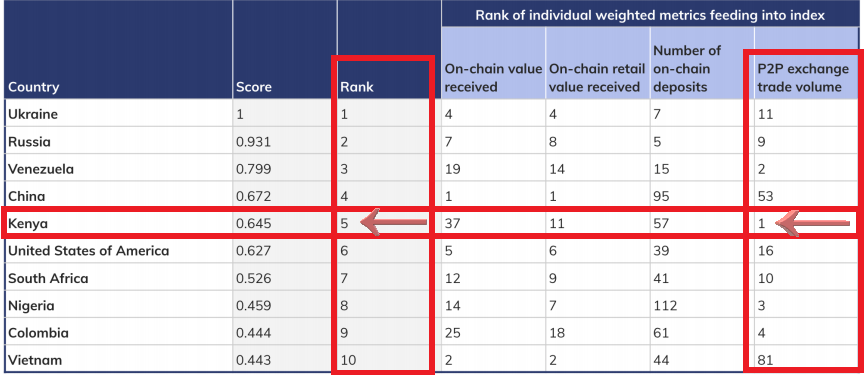

Honestly, this whole crypto regulation thing in Kenya? It’s not just about keeping up with the tech bros and their shiny new coins. There’s money on the line, trust issues, and yeah, Kenya’s trying to flex a bit on the world stage. I mean, just look at the numbers—Chainalysis had Kenya right up there in 2023 and 2024 for peer-to-peer trading. Young folks are all over Bitcoin and stablecoins, using them for remittances, stashing savings, and hustling on the side. But let’s be real, no rules meant scams blew up and regulators were running around like headless chickens trying to catch up.

Now the government’s like, “Fine, you can have your crypto, but you gotta play nice.” They want to grab that fintech crown in Africa, pull in big global companies, and still make sure people don’t get burned. Fits perfectly with Ruto’s whole “Digital Superhighway” thing—he’s all about flashy tech, getting everyone online, and acting like they’ve got it all under control.

But, yeah, here’s where it gets messy. Actually making this stuff work? Not easy. Regulators have to get serious tech skills—watching blockchains, doing audits, cracking down on bad actors. Go too hard with the rules, and you kill the scrappy startups that made Kenyan fintech cool in the first place (hey, remember when M-Pesa was the rebel?). Go too soft, and you’ve basically rolled out the red carpet for money launderers and scammers. There’s no magical sweet spot.

And you know who’s gonna catch the heat first? The little guys. All that paperwork, fees, compliance nonsense—it’s enough to make a small operator throw in the towel or just go underground. Plus, nobody’s really teaching people what’s up. Most Kenyans jumping into crypto are just following what they see on WhatsApp or Telegram. Even with new laws, if you don’t spell it out in plain language, the same old confusion and misinformation will stick around. Or as a blockchain dev in Nairobi put it, “Yeah, regulation’s cool, but only if people get what they’re being protected from.” I couldn't have said it better myself.

Everyday Impact and the Road Ahead

How’s this all gonna play out for regular folks in Kenya? Well, don’t expect overnight fireworks. Changes will creep in bit by bit. You’ll probably start seeing more ads from “official” exchanges—now all proud about their licenses, promising safety and transparency, waving the whole “we’re not scammers” flag. After all the recent horror stories with crypto cons and those get-rich-quick schemes that left people broke, can you blame them?

These new, shiny platforms? They’ll want you to help cover the cost of all that paperwork and regulation. So, yeah, expect fees to go up. Nobody ever said progress was cheap. But look, with rules finally clear, maybe Kenyan banks and fintechs will quit hiding from crypto and actually start offering proper services. Imagine sending money via stablecoins to your cousin in the UK—no crazy charges, and the money gets there for real this time.

There’s something kinda poetic about the whole thing too. Kenya’s got this rep for shaking up money with M-Pesa, right? Now it’s eyeing the blockchain crown. It’s like saying, “Hey world, Africa can make its own rules here. We’re not just copying Silicon Valley, thanks.” Of course, that all sounds great until you realize someone’s gotta actually enforce the law, and, oh yeah, people need to understand what the heck blockchain even is. And let’s not forget—if the government and techies aren’t talking, the whole thing could go sideways.

And honestly, there’s this elephant in the room: can you really mesh strict regulations with crypto’s wild, decentralized roots? That’s the million-shilling question. Are Kenyans suddenly gonna trust officials to run a system that’s supposed to run on, well, zero trust? Feels a bit ironic, doesn’t it? For now, most people seem more hopeful than worried. But let’s be real, regulation isn’t a “set it and forget it” deal. It’s more like an endless tug-of-war—freedom vs. control, wild ideas vs. government rules.

At the end of the day, Kenya’s new crypto law isn’t some magic bullet. But it’s a pretty gutsy first step. If the country pulls this off, who knows? Maybe it will become the blueprint for the whole continent. Or maybe it’s just another chapter in the ongoing saga of “what do we even do with crypto?” Only time (and probably a bunch of angry Twitter threads) will tell.

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...