How Lesaka Turned a Profit Despite a Slowdown in Its Merchant Business

In Africa’s fintech space, profit is still the exception and not just an outright rule, pattern or expectation. We all see and growth stories dominate headlines, but sustainable profitability remains elusive for many digital payments companies navigating thin margins, rising competition, and shifting consumer behavior.

That is why Lesaka Technologies’—a South African fintech company'slatest financial results stand out.

Despite a noticeable slowdown in its merchant business, the South African digital payments fintech has recorded its first profit since launching in 2022.

In the second quarter of its 2026 financial year, Lesaka posted a net profit of R61 million ($3.6 million), a dramatic turnaround from the R589 million ($34.7 million) loss recorded in the same period a year earlier.

At first glance, the numbers raise an obvious question: how does a fintech company achieve profitability while one of its core revenue engines is under pressure?

The answer lies in how Lesaka is reshaping its business, moving away from volume-heavy, low-margin products and toward deeper, more diversified digital financial services.

From Airtime to Ecosystems: What Changed at Lesaka

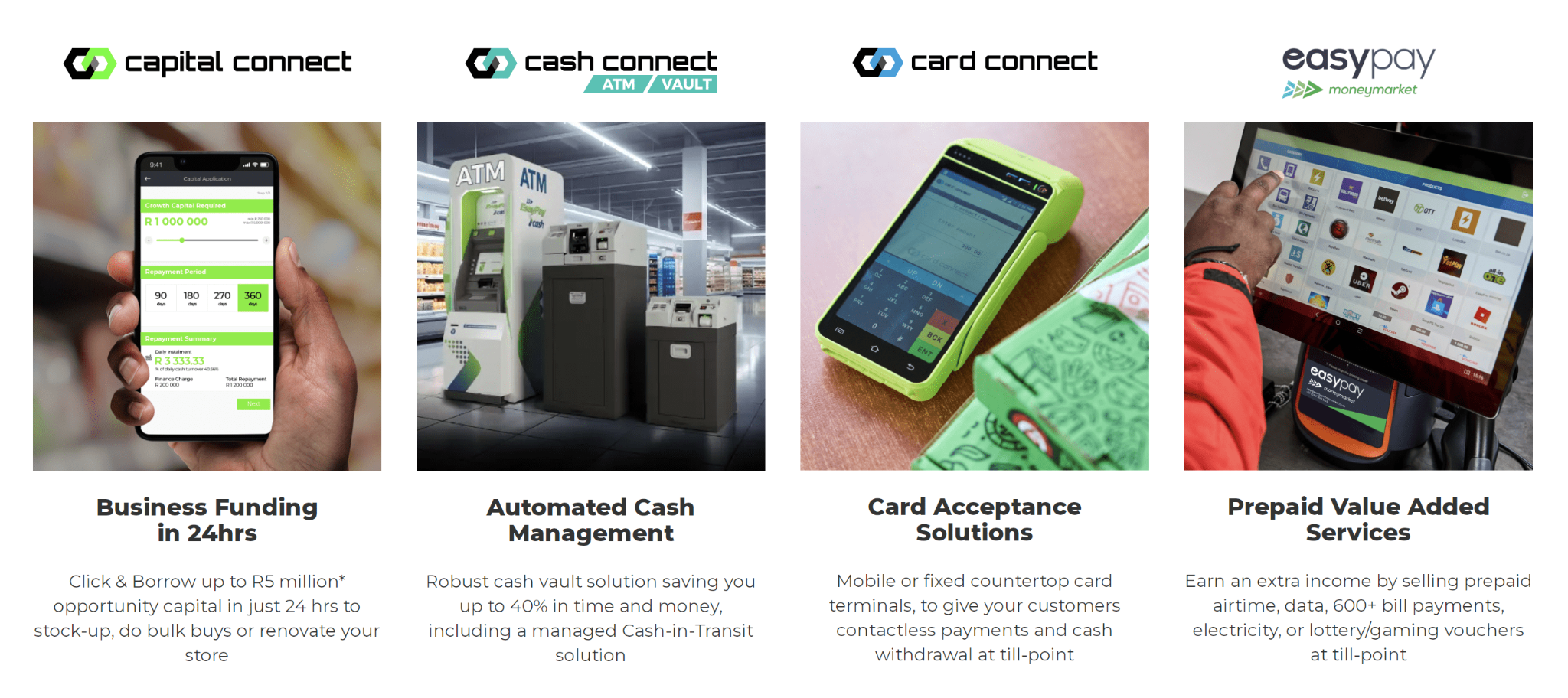

For years, Lesaka’s merchant business, operating under the Kazang and Connect brands, thrived on airtime sales and basic transaction services for small and mid-sized businesses, but that model experienced some sort of strain.

Merchant revenue fell 13% year-on-year to R2.26 billion($131.9 million), even as the number of merchants grew by 8%. The problem was not scale, but value and the average revenue per merchant declined by 10%.

According to CEO Lincoln Mali, the pressure was structural. Airtime margins were shrinking as consumers increasingly relied on free Wi-Fi, bundled data offers, and public hotspots. What was once a reliable cash cow is now an ignored, crowded, competitive space with limited upside.

And in all of this, beneath the surface, Lesaka’s transaction volumes told a different story. Card transaction volumes rose to R12.1 billion ($654 million), cash volumes climbed 5% to R31.9 billion ($1.72 billion), and 73,500 merchants now accept card payments through its platform. The issue, then as it's been seen even by the average South African, is not usage, but profitability per transaction.

Rather than chasing scale alone, Lesaka is shifting its strategy “from scale to depth.” The company has consolidated merchant operations under a single leadership structure and now measures success by active merchants, product penetration, and aggregated output, rather than sheer footprint.

This shift is evident in its Alternative Digital Payments (ADP) segment, which surged 27% year-on-year to R14 billion ($870 million). More than 102,000 merchants now use supplier-enabled payments, creating stronger platform lock-in. Lending is also becoming central as merchant loan originations rose from 35% to R205 million, while the loan book grew 28% to R389 million. Merchants who borrow are more likely to route supplier payments through Lesaka, creating a compounding revenue loop.

Why Diversification and Banking, Now Matter More Than Ever

While the merchant segment slowed, Lesaka’s consumer and enterprise divisions surged, cushioning the group’s overall performance. The consumer business, focused on underserved individuals and micro-merchants, recorded 38% revenue growth, driven by expansion in accounts, lending, payments, and insurance.

Lesaka now serves over 2 million active consumers, with market share rising from 11.9% to 14.3%, making it the second-largest player in that segment after Capitec.

The enterprise unit also emerged as a quiet growth engine, revenue jumped 58% to R253.2 million, swinging into profitability with R24.3 million in adjusted earnings.

New corporate clients such as Shoprite and Investec signal Lesaka’s expanding relevance beyond informal retail into large-scale commercial infrastructure.

Perhaps the most transformative move ahead is Lesaka’s planned R1.09 billion ($56.3 million) acquisition of Bank Zero. The deal would give the fintech a full banking licence and digital banking infrastructure, allowing it to fund merchant loans using deposits rather than expensive wholesale capital.

As Mali explains, this could unlock a “billion rand swing” in lending economics, making credit cheaper, more flexible, and more sustainable.

Profit, But With a New Playbook

Lesaka’s return to profitability is not a victory of scale, it is a lesson in adaptation and they've survived through the years. As margins compress across Africa’s fintech ecosystem, companies that survive will be those that move beyond single-product dependency and build interconnected financial ecosystems.

The slowdown in airtime sales may continue, but Lesaka’s growing focus on payments depth, lending, enterprise services, and banking infrastructure suggests a fintech company that understands the next phase of digital finance.

Profit, in this case, is not the destination or the end goal—it is proof that the strategy is working.

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...