Ghana's Medical Debt Crisis: Nearly 70% of Doctors Default, Banks Demand Action

The banking sector in Ghana is grappling with an alarming trend of loan defaults, predominantly by medical doctors who migrate abroad after securing personal loans. John Awuah, President of the Ghana Association of Banks, revealed that nearly 70% of medical doctors who obtain loans from local banks ultimately default on their repayment obligations. This development has become a significant concern for financial institutions, especially given the high societal regard for medical professionals.

Speaking on Joy News’ PM Business Edition, Mr. Awuah detailed how these professionals leverage their financial standing. Doctors, often perceived as highly credible and trustworthy, secure personal loans – sometimes substantial amounts like GH¢120,000 or GH¢150,000 – using their bank statements. These funds are then reportedly used to facilitate their travel abroad, where they subsequently take up employment in other jurisdictions. Once settled and gainfully employed overseas, a significant majority of these doctors fail to settle their debts in Ghana, leaving their loans hanging.

Mr. Awuah expressed profound disappointment at this practice, noting that it undermines confidence in a demographic traditionally considered to possess high moral integrity. He questioned the lack of effort from these practitioners to honor their financial obligations, especially when they are earning income abroad. The high default rate contributes to an increase in non-performing loans (NPLs) within the Ghanaian banking system, posing a threat to financial stability.

The Ghana Association of Banks has highlighted the severity of the issue, which has prompted them to explore various corrective measures. At one point, there was a consideration to engage embassies, requesting that visa applicants obtain clearance from banks before their visa processes could proceed. However, this approach would require formal diplomatic engagement.

Currently, the Association has initiated formal processes with the Ministry of Foreign Affairs to address the problem through diplomatic channels. Mr. Awuah confirmed that a letter has been logged at the Ministry of Foreign Affairs, aiming to establish mechanisms to ensure that Ghanaian borrowers who relocate abroad continue to fulfill their financial responsibilities. While this engagement with the diplomatic corps is seen as a reactive mechanism, banks are hopeful that it will lead to sustainable solutions to mitigate the impact of these loan defaults on the nation's banking sector.

Recommended Articles

African Fury Erupts: Russian 'Yaytseslav' Viral Videos Spark Scandal, Victims Speak Out in Kenya and Ghana

A viral scandal involving Russian man Vladislav Lyulkov, who filmed and leaked private encounters with African women, ha...

Ghana's Cocoa Crisis Deepens: GH₵30bn Bailout Battle Sparks Political Firestorm

Ghana's Parliament's Majority Caucus has raised alarm over the Ghana Cocoa Board's (COCOBOD) severe financial distress, ...

Ghana-Russia Diplomatic Storm: Envoy Summoned Over 'Atrocious Conduct' Allegations!

Ghana has summoned the Russian Ambassador over allegations that a Russian national sexually exploited women and circulat...

Ghana Faces Water Crisis as Debt, Ageing Pipes and 130 Million Gallon Daily Deficit Deepen

Ghana's urban water system is facing severe financial and operational challenges, with over half of treated water lost a...

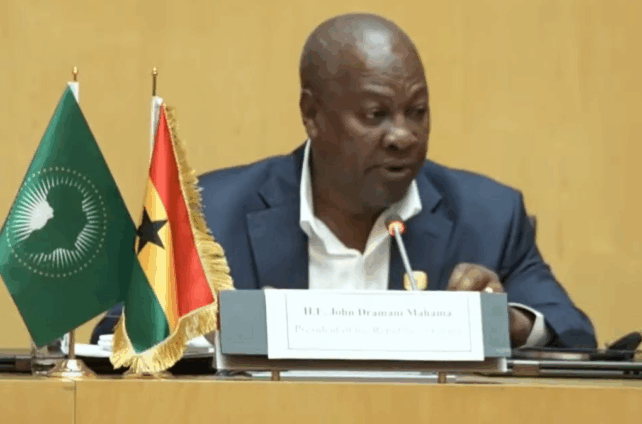

Africa United: Mahama's Fierce Demand for Reparatory Justice Rocks AU Summit with Historic UN Resolution

Ghana, led by President John Dramani Mahama, has secured unanimous African Union endorsement for a landmark resolution r...

African Union Sounds Alarm: Burundi Leads Charge Against Looming Water Crisis

Burundi's President Évariste Ndayishimiye has been elected the new AU Chairperson for 2026, succeeding Angola's Presiden...

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...