Ghana Revenue Authority Unveils Bold VAT Reforms to Combat Non-Compliance and Stabilize Economy

Ghana is currently losing approximately 60 percent of its potential Value Added Tax (VAT) revenue, primarily due to systemic inefficiencies and widespread non-compliance.

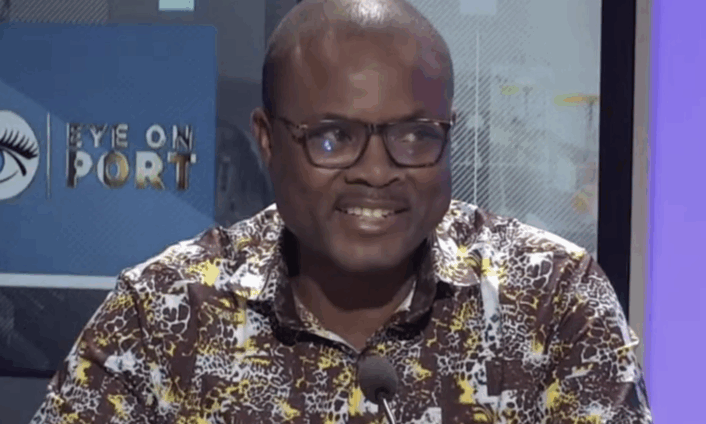

Thomas T. K. Agorsor, Head of the Domestic Tax Revenue Division (DTRD) Free Zones Office of the Ghana Revenue Authority (GRA), highlighted these challenges during a media engagement organized by the Ghana PortsandHarbours Authority (GPHA).

He noted that decades of amendments to VAT, particularly the decoupling of various levies, have created a “tax-on-tax” effect, raising operational costs for businesses and ultimately driving higher prices for consumers. This complexity has discouraged compliance and widened the tax gap.

Comprehensive VAT Reforms Introduced

In response, the Ministry of Finance has launched a major VAT reform aimed at consolidating previous amendments into a single, clear legal framework.

The new VAT Act 1151 of 2025 harmonizes VAT, the GETFund levy, and the National Health Insurance Levy into a standard 20 percent rate.

Key reforms include abolishing the COVID-19 levy, recoupling past levies, and raising the VAT registration threshold.

These measures are expected to reduce business costs, stabilize consumer prices, and simplify compliance procedures for medium and large enterprises, while small businesses will transition to the Modified Tax Scheme.

Expected Outcomes and Implementation

Officials, including Agorsor and Chief Revenue Officer David Lartey Quarcoopome, project that the reforms will narrow the VAT compliance gap from 60 percent to approximately 20 percent, boost Ghana’s tax-to-GDP ratio from 13 to 16 percent, and contribute to the government’s GH¢225 billion revenue target for 2026.

The GRA plans to support compliance through taxpayer education, digital payment platforms, electronic invoicing, and targeted market outreach, aiming to create a fair, predictable, and efficient VAT system that benefits both businesses and consumers.

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...