Gen Z Spending Habits in Africa: The Digital Consumer Revolution

Overview: Africa’s Emerging Consumer Titans

Generation Z—those born between 1997 and 2012—is no longer just a youth demographic; they are Africa's most powerful and fast-evolving consumer force. With spending power already above $10 billion and a projected leap to $801 billion by 2025, this generation is reshaping how businesses operate and engage across the continent. By 2032, Gen Z’s influence is expected to exceed $1 trillion, driven by their unique values: digital fluency, experiential preference, financial caution, and wellness consciousness.

Continental Trends: How Africa’s Gen Z Is Spending

Gen Z’s spending behavior is far from monolithic, but a few key themes define their economic footprint continent-wide.

Aggregate Spending: With each Gen Z’er spending an average of $1,277 annually, the total outlay across Africa is projected to surpass $800 billion in 2025.

Urban Anchoring: Cities like Cairo, Lagos, and Nairobi are the epicenters of this shift, hosting the most active Gen Z consumers and marking the fastest spending growth.

Digital Dominance: Mobile wallets and fintech platforms are ubiquitous—Gen Z uses digital payments 80% more than older generations, accelerating a broader move toward a projected $320 billion digital payment market in Africa by 2024.

Core Priorities: Essentials like food, housing, and transport dominate, but Gen Z is also leaning into categories such as health, experiences, and sustainability, a notable departure from previous generations.

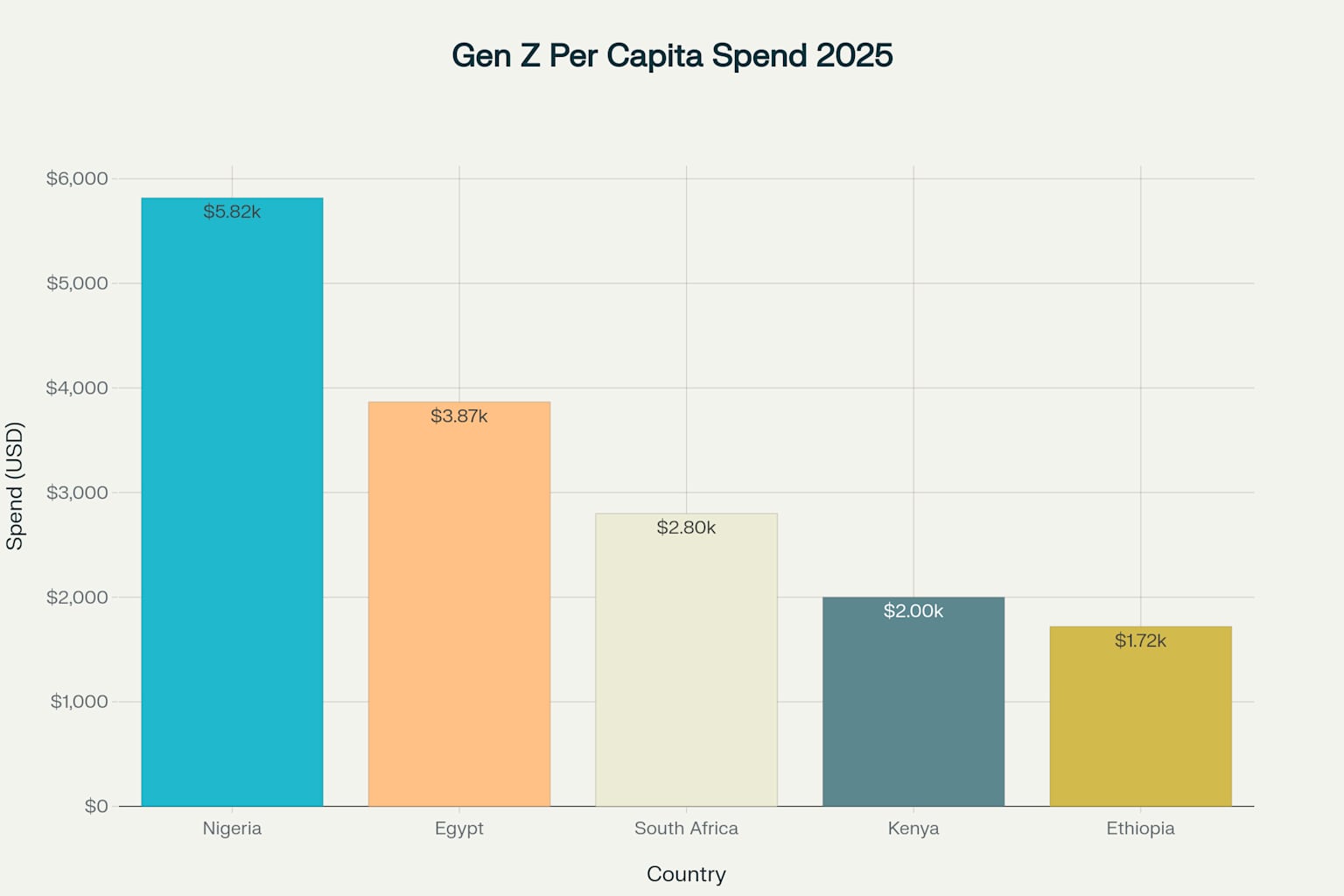

Country-Specific Insights: Diverse Markets, Unified Trends

Across Africa, Gen Z spending reflects both shared values and unique local flavors. In Nigeria, the continent’s largest Gen Z population of about 44 million drives an estimated $256 billion in spending by 2025. Their expenditures focus heavily on essentials like food and fashion, but technology and personal care are also major categories. Despite the digital surge, many Nigerian Gen Z consumers still prefer cash transactions for everyday purchases. The rise of e-commerce platforms like Jumia, combined with strong social media influence, is shaping how this generation shops.

Heading northeast to Egypt, approximately 30 million Gen Z’ers will spend an estimated $116 billion in 2025. Egyptian youth prioritize health and wellness, with a distinct interest in eco-conscious and green products. Digital payments and education are also prominent, highlighting a pragmatic approach toward personal development and financial responsibility.

In South Africa, home to roughly 20 million Gen Z individuals, spending is projected at $56 billion. This group focuses on personal care, education, and is characterized by significant digital payment adoption. Despite urban lifestyle spending, South African Gen Z consumers exhibit financial caution, carefully balancing their budgets.

In Ethiopia, with around 25 million Gen Z’ers, spending amounts to approximately $43 billion, largely centered in urban areas. There is increasing digital adoption alongside a focus on essential goods, reflecting the emergence of a middle class in cities like Addis Ababa.

Kenya’s Gen Z population of 17 million is expected to spend about $34 billion, heavily leveraging mobile payment systems like M-Pesa. Key spending categories include transport and education, while urban centers such as Nairobi, Mombasa, and Kisumu fuel rapid growth in consumer activity.

In Ghana, an estimated 10 million Gen Z’ers prioritize education savings—with nearly 46% focused on this goal. Personal care, mobile payments, and tech adoption are also strong trends, indicating a digitally engaged and financially conscious youth segment.

The Moroccan Gen Z population of around 9 million concentrates on upskilling, personal development, and health. Social media plays an outsized role in consumer behavior here, with 43% spending between 3 to 5 hours daily on platforms that influence purchasing decisions.

In Tanzania, roughly 12 million Gen Z consumers balance their spending between fashion, beauty, technology, dining out, and entertainment, while maintaining a practical approach to saving.

Similarly, Uganda’s approximately 9 million Gen Zers are rapidly adopting mobile payments, with spending focused on personal care and education, signaling growing digital integration.

Finally, Senegal’s Gen Z population of around 5 million aligns with broader continental trends, showing a preference for digital and urban-centric spending, although detailed data remains limited.

Spending Breakdown: Where the Money Goes

The average African Gen Z consumer in 2025 will distribute their spending as follows:

Food: 39.3% (~$502 annually)

Housing: 14.9% (~$190)

Transport: 9.6% (~$123)

Clothing: 6.3% (~$81)

Furnishings: 5% (~$63)

Miscellaneous: 4.6% (~$58)

Education: 4% (~$50)

Restaurants: 3.9% (~$50)

Communications: 3.4% (~$44)

Alcohol: 3.3% (~$43)

Health: 3.3% (~$42)

Recreation: 2.4% (~$30)

This breakdown highlights not only their spending power but also Gen Z’s shift from survival needs toward comfort, expression, and long-term investment.

Behavioral and Financial Trends: Pragmatism Meets Purpose

Digital-First Lifestyles: Mobile payments, e-commerce, and fintech apps are central to Gen Z's spending behavior. Platforms like M-Pesa in Kenya and Jumia in Nigeria are not just convenient—they are culturally embedded.

Experience Over Excess: Rather than acquiring goods for status, Gen Z leans toward experiences—be it travel, entertainment, or social causes. This is an expressive, values-driven generation.

Financial Foresight: Unlike the "YOLO" stereotype often associated with youth, African Gen Z is cautious and calculated. Many use fintech tools to save, budget, and invest, especially in Ghana (where 46% prioritize education savings).

Eco and Health Consciousness: In countries like Egypt and Morocco, there's a visible tilt toward sustainable and healthy living, including green products and fitness spending.

Social Media Power: Platforms like Instagram and TikTok shape preferences, with influencer culture playing an especially strong role in Nigeria, Kenya, and Morocco, where 43% of Gen Z spend 3–5 hours daily on social media.

Urban Epicenters: Where the Future Is Being Spent

Cairo, Egypt: Africa’s top Gen Z spending city.

Lagos, Nigeria: Fashion, tech, and e-commerce dominate.

Nairobi, Kenya: Leading in spending growth, with $10.1 billion expected by 2025.

Johannesburg, South Africa: Digital payments and retail innovation converge.

Mombasa & Kisumu, Kenya: Rapidly growing markets with increasing Gen Z spending.

Conclusion: The Shape of Africa’s Consumer Future

Generation Z in Africa is not just adapting to modern markets—they are defining them. Their digital nativity, urban influence, and value-oriented mindset are pushing the continent into new economic territory. By 2030, Gen Z will not only be the dominant consumer class but also the defining voice in how Africa shops, saves, and lives.

Businesses that wish to thrive in this new landscape must understand the continent’s Gen Z not just as consumers, but as creators of economic culture—influential, informed, and increasingly impossible to ignore.

Sources

Bello-Aruoc, O. (2024, January 11). Why GenZ buying power and spending behavior matter to the African retail industry. LinkedIn.

Mojatu. (2025, April 22). Gen Z to drive Kenya’s consumer spending to Ksh.4.4 trillion in 2025.

Pierrine Consulting. (2024, September 10). The African Gen-Z: Understanding sophistication on a budget.

Pierrine Consulting. (n.d.). The African Gen Z consumer and their relationship with money.

Standard Media. (2025, April 1). Gen Zs to dominate consumer spending in the next 10 years.

Statista. (2024, October 22). Younger generations to become biggest spenders in Africa, Asia.

Techish Kenya. (2025, April 14). The new kings of African commerce: Why Gen Z now dominates spending.

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...