Data Sovereignty and Infrastructure: Why Visa’s Johannesburg Data Centre Matters for African Fintech

In July 2025, Visa made a quiet but powerful move that could redefine Africa’s digital financial landscape. The opened their first-ever African data centre, located in Johannesburg, South Africa.

At first glance, this may seem like just another milestone in the tech giant’s global expansion strategy. However, this development speaks to something far more significant which includes data sovereignty, infrastructure independence, and Africa’s growing desire to own its digital economy story.

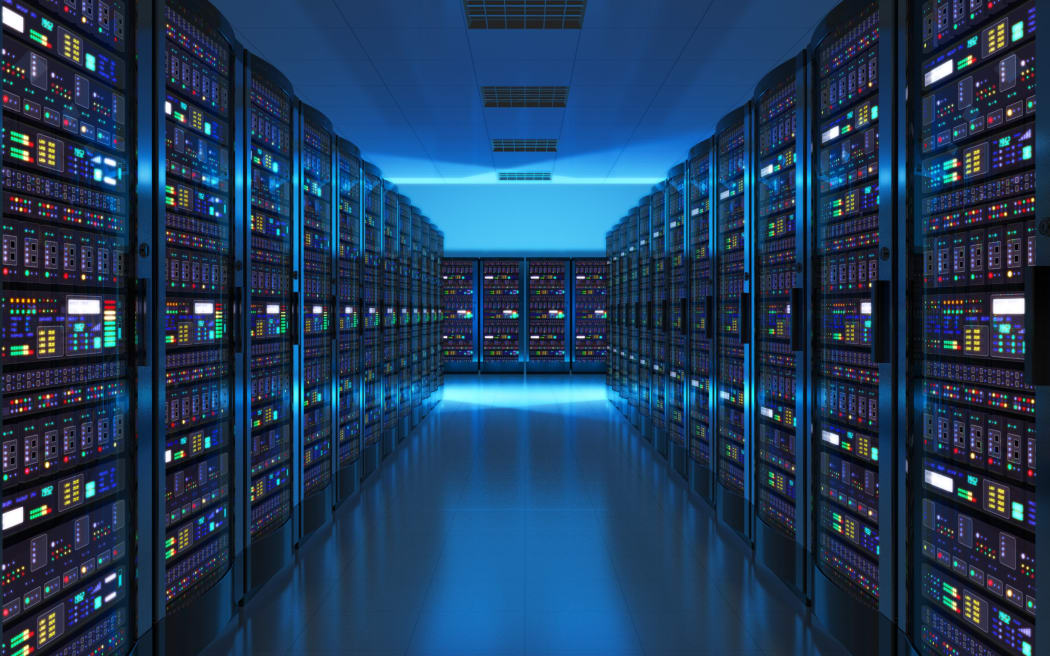

The Power Beneath the Servers

Data is the new oil. And in Africa, where fintech has exploded in the past decade, data is not just fueling innovation, it is determining who controls the future of finance.

For years, most African fintech data has been processed and stored in servers located outside the continent, mainly in Europe or North America. This meant that the bulk of Africans’ financial data including transactions, credit scores, spending patterns, was being handled under foreign jurisdictions.

Visa’s decision to build a data centre in Johannesburg shifts this dynamic. For the first time, African fintech transactions processed through Visa’s vast network will have the option to be stored and handled locally. The implications are profound.

It reduces latency and transaction times, enhances cybersecurity by minimizing cross-border vulnerabilities, and most importantly, gives African nations more control over their citizens’ financial data.

What Is Data Sovereignty and Why Does It Matter?

Data sovereignty refers to the idea that digital information is subject to the laws and governance of the nation in which it is collected. Simply put, if your citizens’ data is stored within your borders, your government has the authority to regulate it, protect it, and determine how it can be used.

In Africa’s context, this concept hits home. The continent has experienced rapid fintech growth with Nigeria, Kenya, Egypt, and South Africa leading the pack, but this growth has been tethered to external infrastructure. Most startups use cloud services from Amazon Web Services (AWS), Google Cloud, or Microsoft Azure, all headquartered in the United States.

While these services provide scalability, they also come with dependence. African governments have limited visibility into how their citizens’ financial data is stored or processed abroad.

By localizing data processing in Johannesburg, Visa is not only complying with emerging regulatory trends, it is acknowledging Africa’s demand for digital self-determination. In a world where data privacy has become political currency, this move is symbolic.

Africa’s Digital Gold Rush: The Fintech Connection

Over the past decade, Africa has become the global testbed for fintech innovation. Fintech solutions have emerged to bridge long-standing gaps in access to banking. The result is staggering: Africa’s fintech market is expected to reach $65 billion in revenue by 2030, according to the research.

But while fintech has empowered millions of unbanked Africans, the infrastructure behind it often remains foreign. A digital payment in Lagos could easily travel through servers in Dublin before being approved. Every millisecond of delay costs money; every border crossed exposes the system to regulatory gray zones.

The Visa data centre in Johannesburg aims to close that loop. It promises faster payment processing, reduced costs for fintech startups, and a secure foundation for cross-border trade which is a critical enabler for initiatives like the African Continental Free Trade Area (AfCFTA).

More importantly, it establishes a precedent where global tech companies are beginning to recognize that Africa deserves to host and protect its own data.

The Race for Local Infrastructure

Visa is not alone. Other major players are also racing to establish local infrastructure hubs. Microsoft launched its first Azure data regions in South Africa back in 2019. Amazon followed suit with AWS Africa (Cape Town) in 2020.

Google Cloud’s local region went live in Johannesburg in 2022. But Visa’s move marks the first major financial network to anchor its data operations on African soil.

This matters because fintech is not like social media or entertainment, it deals directly with money, regulation, and trust. Data localization in the financial sector introduces layers of accountability that were previously absent.

It allows African regulators to monitor compliance more closely, enforce anti-money laundering (AML) and data protection laws, and set clearer frameworks for emerging sectors like digital lending and cross-border remittances.

The South African Reserve Bank (SARB) has already hailed Visa’s investment as a step toward strengthening local payment ecosystems. For startups and established fintech firms alike, this could mean fewer regulatory bottlenecks when integrating with international networks.

Sovereignty Meets Security

Beyond control, data sovereignty is a matter of security. Africa’s fintech space processes billions of dollars in transactions annually, and cyber threats have become increasingly sophisticated. The African Union estimates that the continent loses over $4 billion annually to cybercrime. Many of these vulnerabilities are tied to the cross-border flow of data and lack of local oversight.

Hosting data locally not only reduces exposure but allows quicker responses to breaches. Local data centres can ensure that financial systems remain operational even if global networks experience disruptions. For countries like Nigeria, which face frequent digital fraud and system downtimes, this could be a game-changer.

Moreover, local hosting aligns with national data protection laws such as Nigeria’s Data Protection Act (2023) and Kenya’s Data Protection Act (2019) which mandate that sensitive personal data be stored and processed within the country or in regions with adequate protection levels. Visa’s move therefore complements national efforts to assert digital independence.

What It Means for African Startups

For African fintech startups, data sovereignty brings both opportunity and challenge. On one hand, local data infrastructure means lower latency, faster integration with payment systems, and potential cost savings. It can also make it easier to comply with new regulatory frameworks without relying on offshore partners.

On the other hand, this shift introduces new expectations for compliance. Startups that once relied entirely on global cloud platforms may need to reconsider their architecture. Local storage demands can increase costs in the short term, and not every country yet has robust local infrastructure.

But in the long run, the benefits outweigh the costs. The more Africa builds its own digital backbone, the less dependent it becomes on foreign intermediaries. Visa’s data centre could even serve as a magnet encouraging other global payment firms, fintech unicorns, and data processors to follow suit.

A Continental Vision Toward Digital Independence

This development also aligns neatly with the African Union’s Digital Transformation Strategy for Africa (2020–2030), which emphasizes digital sovereignty and regional infrastructure. The plan envisions an Africa where data flows freely within the continent but is governed by African institutions, creating a unified and secure digital market.

In essence, Visa’s Johannesburg data centre is a part of Africa’s broader narrative of reclaiming digital agency. As trade, identity, and innovation increasingly migrate online, control over data becomes synonymous with control over destiny.

Imagine a continent where fintech firms in Lagos, Kigali, and Nairobi transact across borders instantly, with data regulated under African laws, stored in African servers, and powering African innovation. That is the endgame of data sovereignty, a financial ecosystem built not just for Africa, but by Africa.

The Road Ahead

Of course, one data centre cannot solve every challenge. Africa still faces issues of uneven digital infrastructure, patchy connectivity, and political fragmentation. To truly secure digital sovereignty, countries must invest in more regional data hubs, harmonized data protection laws, and cross-border cybersecurity collaboration.

Yet, this single move by Visa could be the first domino. It signals confidence in Africa’s digital economy and recognizes that the continent is not just a consumer of technology but a producer of innovation.

For the millions of Africans now using mobile banking apps, digital wallets, and instant payment systems, this development might seem distant but beneath every tap-to-pay transaction and every fintech loan approval lies the invisible machinery of data. Where that data lives, who controls it, and how it is protected will define the next decade of African fintech.

And with the hum of new servers in Johannesburg, Africa is finally beginning to own that narrative.

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...