AI Power Play: SoftBank Eyes Staggering $30 Billion Investment in OpenAI

SoftBank Group Corp. is reportedly in talks to make an additional investment of up to $30 billion in OpenAI, according to The Wall Street Journal and Reuters.

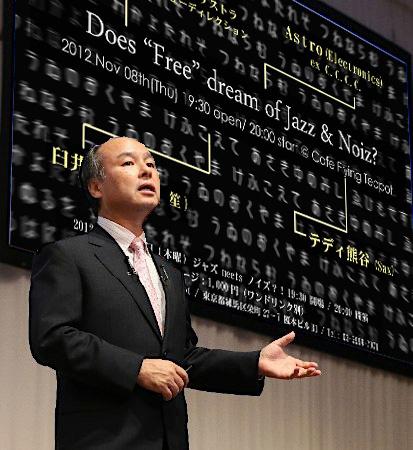

The potential deal would further deepen SoftBank’s financial backing of the ChatGPT developer and reflects CEO Masayoshi Son’s ambition to position the conglomerate at the center of the global artificial intelligence boom.

OpenAI is currently seeking fresh capital as part of a major fundraising effort, with ambitions to raise as much as $100 billion.

If successful, the round could value the company at a staggering $830 billion, underscoring investor confidence in OpenAI’s expanding influence across AI applications and infrastructure.

Masayoshi Son’s AI-Centric Strategy

The prospective investment aligns with Son’s broader vision to embed artificial intelligence across all devices and technologies. To support this strategy, SoftBank has been actively reshaping its portfolio, divesting from several high-profile assets to free up capital.

These moves include selling its stake in Nvidia Corp. and pausing acquisition talks with U.S. data center operator Switch Inc.

SoftBank is already a significant OpenAI stakeholder, having reportedly injected $22.5 billion last month to build an 11% stake in the company.

The group has also accelerated AI-focused acquisitions over the past year, including the $6.5 billion purchase of U.S. chip designer Ampere Computing and a $5.4 billion deal for ABB Ltd.’s robotics unit.

Financial Risks and Market Concerns

Despite being an early proponent of artificial intelligence, SoftBank has largely missed out on the global race to develop core AI hardware such as semiconductors and server infrastructure.

Its recent investment surge, combined with a decline in the value of Arm shares late last year, has raised concerns about the group’s financial resilience.

To fund its aggressive expansion, SoftBank has sold down shares in T-Mobile US, exited its Nvidia position entirely, and increased margin loans secured against its Arm holdings.

These developments prompted S&P Global Ratings earlier this month to flag potential risks to the company’s credit profile, highlighting the delicate balance between Son’s bold AI ambitions and SoftBank’s financial stability.

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...