Yellow Card teams up with Visa for stablecoin payments

One of Africa’s premier exchanges, Yellow Card, has partnered with Visa (NASDAQ: V) to expand stablecoin payments across the region.

The partnership will center around cross-border transfers, which continue to be slow, inefficient, and expensive. According to the World Bank, Africans pay 8.5% in costs, with the global average at 6.6%.

“When you look at stablecoins, there’s a lot of excitement in the market and all the major payment companies are exploring ways to get into the space,” Yellow Card CEO Chris Maurice told Bloomberg.

Yellow Card has been shifting its business model to focus on stablecoins for years. In January 2024, the exchange told CoinGeek that its African users were now turning to stablecoins to make payments abroad and receive remittances.

Under the new partnership, the exchange plans to launch its new stablecoin service in at least one African country this year, Maurice said. It intends to expand its services to more than 20 countries in which it operates next year.

While the company didn’t reveal which country it would launch in first, Kenya is the most likely. According to the exchange’s senior legal counsel, Edline Murungi, the East African nation’s recent regulatory efforts have made it among the most appealing on the continent. The proposed Virtual Asset Service Providers Bill draws a distinction between speculative ‘crypto’ tokens and stable assets, laying out separate policies for each category. If it passes, the bill will be the most progressive in Africa, Murungi told Bloomberg in a separate interview.

“Those use cases are going to really change the industry. And if other countries follow suit, then Kenya is going to be a hub for a lot of digital-asset activities,” she stated.

In addition to the upcoming friendly laws, stablecoin adoption in Kenya is also among the highest in Africa. A report by the International Monetary Fund (IMF) in January revealed that a large number of Kenyan firms now pay their foreign suppliers in stablecoins owing to a dollar shortage and high costs on mainstream channels.

While most African countries still lack comprehensive ‘crypto’ regulations, CEO Maurice believes the region is still the best place to launch digital asset products due to its fintech-friendly frameworks.

“There’s no better place to be [launching] a company in stablecoins than the African continent where you have more regulators that have licensing available, there’s more engagement with regulators…[Africa’s] had more friendly trends over the past two and a half years than you did in any other single continent in the world,” Maurice stated while speaking at a recent event in New York.

For Visa, the Yellow Card partnership is the latest in its quest to position itself as a stablecoin mainstay. It first settled a stablecoin transaction on its rails in 2023, and since then, it claims to have settled $225 million in similar transactions, a small fraction of the $28 trillion that flowed through stablecoins last year.

Visa’s stablecoin ventures are as much about innovation as they are about protecting its position. Industry experts have expressed concerns that stablecoins could eat into the market share that the company and Mastercard (NASDAQ: MA) have enjoyed for decades.

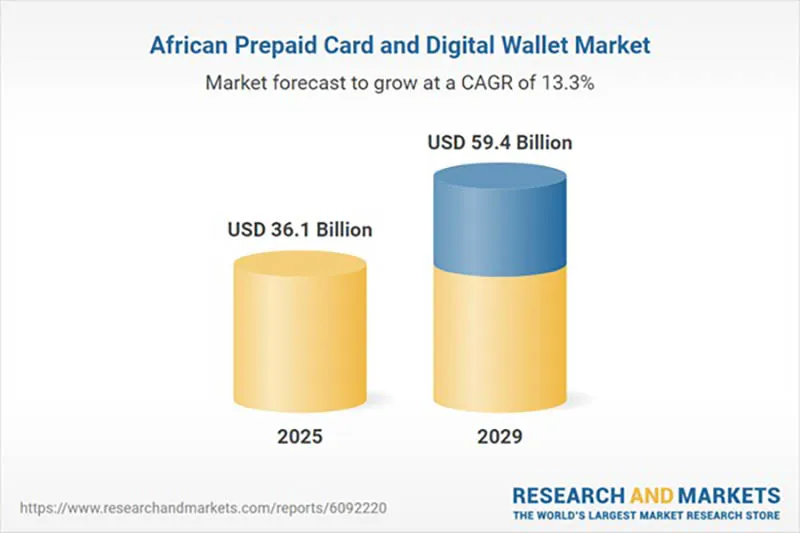

Away from stablecoins, a new report has revealed that Africa’s prepaid card and digital wallet market will continue growing aggressively over the next four years to hit $59 billion by 2029.

The report revealed that over the past four years, the sector has recorded an 18.8% compound annual growth rate (CAGR), and is expected to end this year at $36.1 billion.

Digital wallets and prepaid cards have benefited from a rise in the adoption of digital solutions and concerted efforts to promote financial inclusion. This has rapidly lowered the number of unbanked and underbanked people, with some countries like Kenya and Egypt achieving a financial inclusion rate exceeding 75%.

African countries continue to lead in mobile money banking. To capitalize on it, digital wallet providers have integrated their solutions into mobile money platforms, further fueling adoption.

“As the market evolves, companies that adapt to regulatory requirements, invest in security enhancements, and offer innovative solutions will be best positioned for long-term success,” the report noted.

Watch: Boosting financial inclusion in Africa with BSV blockchain