XRP ETF Sparks Frenzy: Price Predictions & 762% Surge Rock Third-Largest Crypto

XRP has entered the spotlight this week following the significant announcement of its first-ever Exchange-Traded Fund (ETF) launch. Data from CryptoQuant on Thursday, September 18, 2025, revealed an explosive surge in exchange activities, with total inflows across all supported exchanges soaring by a massive 762%. On the day the first U.S. XRP ETF went live, total exchange inflows reached 11.57 million XRP, a substantial increase from the 1.34 million XRP recorded the previous day. This surge in activity is widely attributed to the buzz surrounding the ETF launch, sparking speculative trading and encouraging holders to reposition their assets ahead of potential market volatility.

The debut of the Osprey REX XRP ETF (XRPR) on the CBOE exchange marked a crucial step toward institutional adoption for XRP. XRPR launched at $25.80 per share, closely tracking its $25 net asset value. Despite its relatively modest scale, initial demand was robust, with the ETF generating $24 million in volume within the first 90 minutes. By the close of trading, volume had reached $37.7 million. This performance significantly surpassed the debut of any XRP futures-based ETF and even outperformed initial trading volumes of other spot crypto basket ETFs like $GDLC ($22m) and $DOJE ($12m), although it remained a considerable distance from Bitcoin ETF launches.

Interestingly, the notable surge in XRP exchange inflows, which often signal mounting selling pressure, coincided with a substantial price increase for XRP, which surged over 5% on the same day. This suggests that the ETF launch generated strong demand for XRP, capable of absorbing the heightened selling pressure. However, with XRP’s price subsequently returning to the red zone, analysts have expressed uncertainty regarding its immediate price trajectory. Nonetheless, there is strong optimism that the XRP ETF launch will ignite fresh institutional participation, potentially pushing XRP’s price beyond previous record highs in the long term.

The XRPR launch is part of a broader wave of increasing institutional momentum for both XRP and the wider crypto market. XRPR’s underlying holdings primarily consist of CME’s CF XRP-Dollar Reference Rate and CoinShares’ Physical XRP product, along with a small cash balance. This composition ensures XRPR trades within the $25 to $26 range, rather than directly reflecting XRP’s spot price of approximately $3.11 on cryptocurrency exchanges. For U.S. investors, options have historically been limited to leveraged or futures-based XRP ETFs. However, the SEC is widely anticipated to approve several spot XRP ETFs from major issuers such as Franklin Templeton, Bitwise, 21Shares, and Grayscale later this year, further expanding institutional access.

Additional institutional developments reinforce the long-term narrative for XRP. The Grayscale Digital Large Cap Fund recently secured SEC approval under Generic Listing Standards, bringing a multi-asset exchange-traded product that includes Bitcoin, Ethereum, XRP, Solana, and Cardano to market. Furthermore, Ripple, the company behind XRP, has announced a partnership with Franklin Templeton and DBS to develop repo markets utilizing stablecoins and tokenized collateral. Bitwise, a leading crypto index fund manager, had already filed for an XRP ETF in October of the previous year, underscoring growing institutional interest.

From a technical analysis perspective, XRP exhibits moderate strength on the daily chart, trading in the upper half of its Bollinger Bands, indicative of consistent but controlled growth. However, on the monthly chart, the Bollinger Bands are widening at their fastest rate in the asset’s history, a pattern that can sometimes signal exhaustion rather than sustained expansion. The technical picture presents a degree of asymmetry, with the upper band slightly above $3.50 and the lower band well below $2.00, suggesting that downside risk remains more accessible than significant short-term upward movement. Low trading volume also indicates that neither bulls nor bears are currently poised for a decisive breakout. Consequently, XRP is expected to consolidate within the $3.10 to $3.30 range in the near term, with traders advised to monitor for any volume increase that could signal a new trend.

In conclusion, the launch of XRPR marks a significant milestone for XRP and clearly signals expanding institutional interest. While the ETF itself may not serve as an immediate explosive catalyst for price, sustained strong ETF inflows and the potential approval of additional spot products could enable XRP to retest the $3.50 resistance level in the coming months. Until such developments materialize, range-bound trading appears to be the most likely scenario.

Recommended Articles

XRP Ignites: Open Interest Skyrockets Amid Parabolic Price Surge

XRP is showing renewed strength as the broader crypto market rallies, with its open interest surging and price climbing ...

Bollinger Drops Dire Bitcoin 'Head Fake' Alert!

Prominent crypto analyst John Bollinger warns of a "head fake" setup in Bitcoin, while Fundstrat's Tom Lee touts Ethereu...

Ethereum's Stunning Revival: New All-Time High Electrifies Crypto Markets

Ethereum has hit a new all-time high of $4,885, surging over 15% in a single day for the first time in nearly four years...

US Stablecoin Law: Global Finance Braces for Major Regulatory Shifts

The U.S. has enacted its first major federal cryptocurrency law, the GENIUS Act, which aims to regulate stablecoins and ...

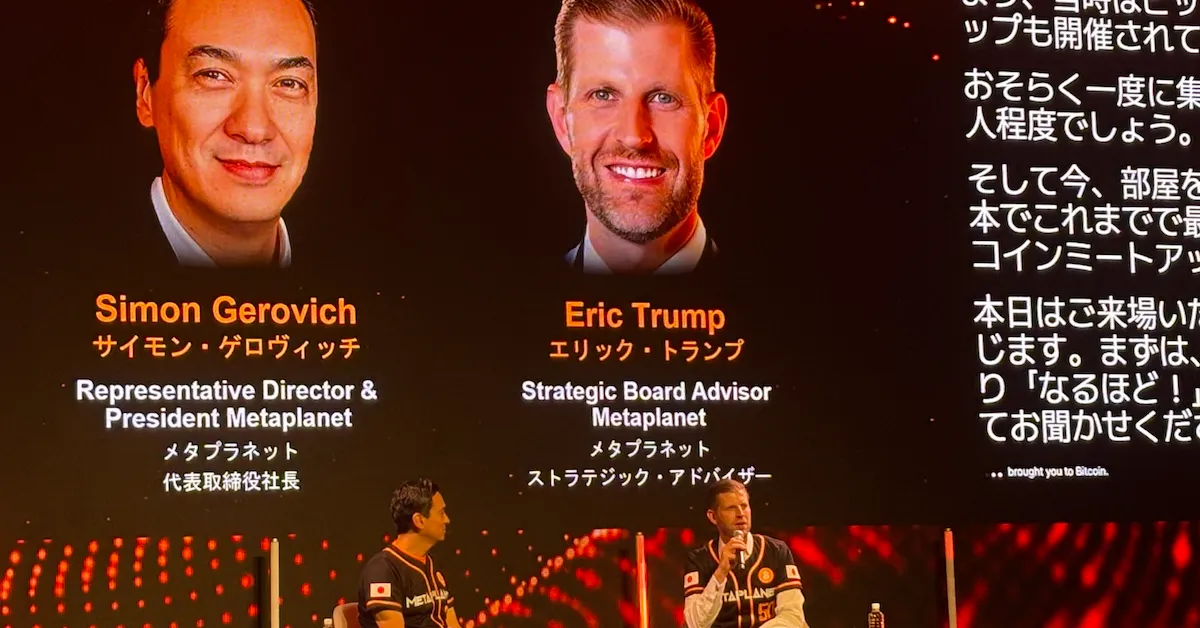

Crypto Giant Metaplanet Dives Deep: Massive Bitcoin Stash Acquired as Price Hovers Below $113K!

Tokyo-listed Metaplanet has significantly bolstered its Bitcoin holdings with a $632.53 million acquisition, raising its...

You may also like...

Liverpool Crisis? Reds Face Scrutiny After Consecutive Defeats

Liverpool faces scrutiny after two straight losses, with BBC Sport expert Chris Sutton highlighting their defensive vuln...

Man Utd Managerial Shake-Up Looms: Amorim Speculation Ignites Southgate Concerns

Manchester United faces a managerial dilemma as Ruben Amorim's position comes under scrutiny amidst a dire start to the ...

Bone Lake: Twisted Thriller Sparks Critical Debate on Erotic Horror

Mercedes Bryce Morgan's <em>Bone Lake</em> explores the 'sexy horror' genre, blending psychological manipulation and bla...

Country Power Couple Kane & Katelyn Brown Land Lifetime Christmas Film Deal Based on Hit Song!

Country music stars Kane and Katelyn Brown are making their debut as television executive producers for Lifetime's holid...

Mariah Carey Breaks Silence On Eminem Feud & ‘8 Mile’ Rumors!

Mariah Carey recently discussed her long-standing feud with Eminem, confirming rumors that he once asked her to play his...

Coronation Street Shocker: Beloved Star Sally Ann Matthews Bids Farewell to Soap

Coronation Street bids farewell to two prominent stars as Sally Ann Matthews makes an emotional exit as Jenny Connor aft...

Tems Shatters Records: First Nigerian Female Artist to Hit 10 Million US Units!

Tems has made history as the first female Nigerian artist to sell over 10 million units of a single in the U.S. with her...

Autumn's Hottest High Street Bags Revealed: Top Trends Starting from Just £20!

For Autumn/Winter 2025, bags transcend their functional role to become the main event in fashion, with a diverse array o...