XRP Crypto Price Action & Bullish Forecasts

XRP, the digital asset associated with Ripple, has demonstrated remarkable resilience and strength throughout 2024, consistently trading above the $0.50 mark and currently holding steady near $2.20. This sustained uptrend, second only to Bitcoin in market stability and structure since breaking past the crucial $0.50 level in early 2024, has fueled growing optimism among investors and analysts alike. The token's tight consolidation above $1.90–$2.00, a level once considered a historical resistance, is now seen as a precursor to a significant sentiment shift and a potential major breakout, with technical charts indicating a distinct 'coiling' pattern.

Technical analysts are closely watching XRP's eight-month chart, noting that the price is 'coiling' within a very tight range, a pattern often preceding a strong rally. According to Elliott Wave tenets, XRP is on the verge of a new bullish phase, projected to unfold in five distinct waves. This could propel the token's price beyond $30 by mid-2026. The current price action strikingly mirrors a symmetrical triangle pattern observed in 2017, where six monthly candles formed a tightening range between $1.70 and $2.50. This consolidation is pivotal, as narrowing trendlines suggest a significant buildup of buying pressure. The $2.25 support level is critical; maintaining this level could validate the pattern and signal a breakout above the $2.50 resistance, aligning with historical precedents of substantial gains following similar formations. The convergence of the 0.382 Fibonacci retracement level with the $2.25 support further strengthens the bullish outlook.

Beyond technical indicators, several fundamental and utility-based factors are contributing to XRP's bullish predictions. Analysts like Vincent Code anticipate a spectacular rise to $30–$50, citing RippleNet's potential to capture 20–30% of the $1 trillion global cross-border payment market, positioning XRP as a central asset in global remittance infrastructure. Furthermore, over 50 central banks worldwide are reportedly considering XRP as a bridge currency for CBDC interoperability, driving future demand. Ripple's 2024 strategic agreement with Saudi Arabia’s central bank could pave the way for oil-backed trade settlements using XRP, significantly enhancing real-world applications and widening its geopolitical utility. Ripple is also actively pursuing a US banking license, aiming for further integration with the traditional financial industry and regulatory legitimacy.

The speculation surrounding a potential XRP spot ETF is another significant catalyst, with analysts estimating it could attract $20–$50 billion in institutional inflows, thereby legitimizing XRP alongside other popular digital assets and generating immense buying demand. Market observer MelarinX characterized XRP's current configuration as a 'coiled spring' poised to unleash accumulated momentum. Even Davinci Jeremie, an early Bitcoin proponent, has turned bullish on XRP, foreseeing a climb to $24 by December 2025, hinting at discreet U.S. government backing that could lead to positive regulatory outcomes. The community sentiment reflects this optimism, with many expecting a return to its 2021 range ($2-$3) and aggressive targets like $5 by November and $10 by year-end, with some even anticipating a push past its all-time high. While some express caution or skepticism, the overarching tone emphasizes XRP's long-term potential driven by utility and regulatory clarity.

Despite its current consolidation within a tight $2.00–$2.40 range for three months, XRP's healthy fundamentals, increasing institutional demand, and strong long-term technical setup point towards a substantial future move. Increased trading volumes and a climbing Relative Strength Index (RSI) at 57 underscore sustained buying interest. Traders and analysts are closely monitoring the $2.50 and $3 resistance levels, expecting a breakout that could unleash the token’s subsequent major rally, potentially reaching targets as high as $37.5 based on historical market cycles and Fibonacci extensions. The repeated six-month strength buildup indicates XRP is poised for a final wave rally that could surpass previous all-time highs. As the broader crypto market anticipates the next bull cycle, XRP is gaining wider acceptance as a top altcoin to watch, supported by its practical utility, increasing adoption, and an evolving regulatory landscape.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

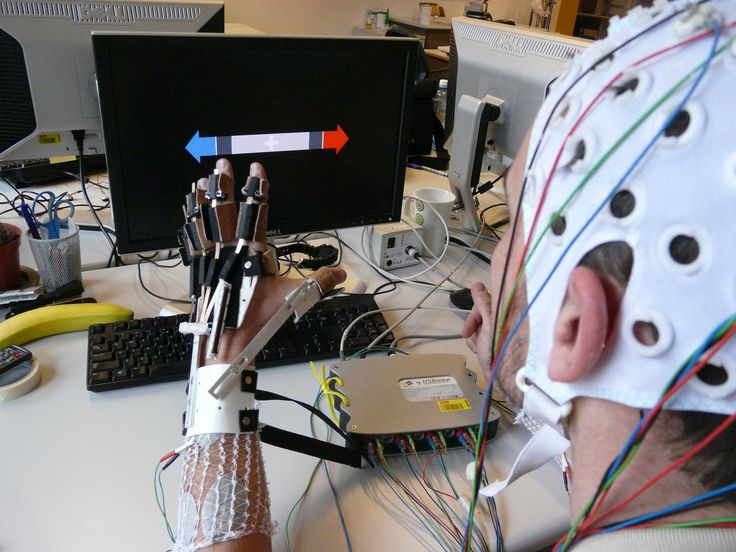

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...