Who Really Powers Nigeria’s Fintech Boom? A Look Beneath the Apps

You've come across various fintech news and the promises thereof, I too have written so many pieces on the ever fast growing fintech space and its future that is currently being harnessed and the ones waiting to be untapped.

You and I know that for the average users of fintech based products and their knowledge about it, conversations usually start and end with apps. And it's usually flashy and aesthetically pleasing, from the ones that promise instant transfers, global cards, crypto on-ramp dreams, and a future that looks fast, borderless, and frictionless.

We celebrate founders, unicorns are applauded, funding rounds are anticipated and hoped for, and product launching are dreams come true both founders, investors, shareholders and users.

But beneath all that noise, there is actually another layer of fintech that is less glamorous, less visible, yet absolutely essential and is the backbone of most fintech based startups. This layer that doesn’t trend on social media, but without which the digital economy would stall almost immediately or maybe collapse.

Think of it as part of the foundation that holds most of all the fintech based processes and ensures that seamless plans and dreams are seamlessly executed because there is a foundation to continue from. If there is no foundation, where do you actually build from?

So when you go out and see activities that require you to either register to get a SIM card registered, have a bank card issued or maybe take part in a biometric verification that quietly decides whether you can access your money in the bank, vote, open an account, or access healthcare.

Someone, should i say a group is building or has built and is supplying that infrastructure that makes all of it possible. There is a supply chain that is building a profitable market off it and has been doing it long before “fintech” became a buzzword.

That company is Chams, yes there are other companies that also do what chams does but that is not our focus today.

Chams, SIM Cards, and the Business of Digital Identity

Chams Holding Company Plc is not new to Nigeria’s tech ecosystem. Founded in 1985, by Sir Demola Aladekomo KJW HOA, long before smartphones and APIs became everyday language, Chams has positioned itself at the intersection of identity management, payments infrastructure, and transactional technology.

And the reason for this article is that last year, the numbers finally forced people to pay attention and probably looked at the prospective of chams and its market.

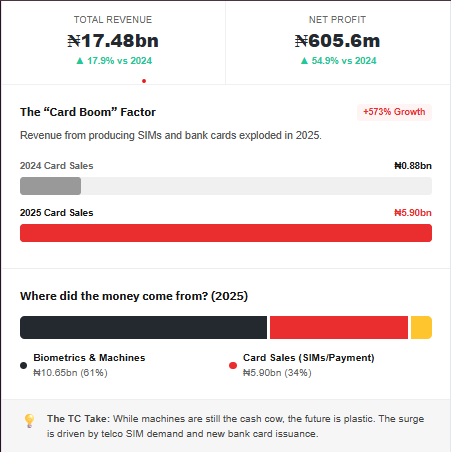

According to its unaudited full-year results, Chams grew its income by 17.89% to ₦17.48 billion, driven largely by a staggering 573.16% jump in card sales, translating to ₦5.90 billion ($4.26 million). This surge was fueled by two realities of modern Nigeria:

Telecom operators are buying more SIM cards.

Banks are issuing more payment cards.

Chams sits quietly in between these systems, supplying the physical layer, SIM cards, bank cards, biometric devices, that enables digital participation. While fintech startups grow the acquisition of users and interfaces, Chams earns by powering the backbone they all rely on.

Beyond cards, biometrics remains Chams’ strongest revenue line, generating ₦10.65 billion in 2025. Its client list reads like a map of Nigeria’s institutional infrastructure: INEC, NCC, Customs, NHIS, pension administrators, and major banks like First Bank, Sterling Bank, and Keystone Bank.

In simpler terms: if Nigeria is becoming more digital, Chams is one of the companies involved in making that transition physically possible.

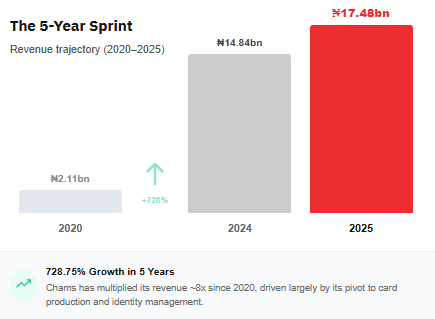

For investors and shareholders, this matters. Since 2020, the company’s turnover has jumped 728.75%, and its profit grew by 54.86% in 2025 alone, reaching ₦605.58 million. The market noticed. By January 2026, Chams’ market capitalisation stood at ₦45 billion, with a share price of ₦5.

This is not hype-driven growth or an enterprise based on trends and market volatility, It is a company that is infrastructure-driven.

What This Means for the Public, the Market, and the Future

There is a quiet lesson here to learn about how Nigeria’s fintech story is often told and how incomplete that story can be.

This is because everyone is fast driven and startups are looking at the charts to see when they finally become a unicorn, while all of this is all good, building systems and infrastructures that sustain these systems are what actually pay off in the long run.

While many startups burn cash chasing scale, Chams profits from inevitability. Whether the economy boosts by a large percent or faces some sort of recession in any scenario SIM cards will continue to be registered and banks will always continue to issue cards.

Governments will still continue to rely on biometric identity systems for better and efficient acquisition of data. Digital inclusion, for all its lofty language, still requires physical tools and someone has to manufacture and supply them.

But there is also a social question beneath the financial success.

When a company becomes deeply embedded in identity systems, SIM registration, elections, banking, its role extends beyond profit. It becomes part of the national trust architecture. Questions of data protection, regulatory oversight, and accountability are no longer abstract. They literally affect citizens directly.

Chams’ growth also exposes a broader truth about Nigeria’s economy: the most resilient companies are often those that serve systems, not trends. While fintech apps rise and fall with sentiment, infrastructure companies endure because society cannot function without them.

For the general public, this means the fintech conversation needs to mature. Digital progress is not only about speed and convenience; it is about who controls the rails, who profits from them, and how responsibly they are managed.

For investors, Chams represents a reminder that value does not always shout, sometimes it compounds quietly, anchored in boring but essential realities.

Conclusion: The Fintech Beneath the Fintech

Chams’ 2025 performance is not just a financial story. It is a mirror held up to Nigeria’s digital evolution. It shows us that while we chase innovation, there are companies already embedded in the daily mechanics of our lives, counting cards, registering identities, enabling transactions, without applause.

In a country racing toward digitisation, the loudest players are not always the most important and that is not to diminish the hard work of any fintech player. Some companies do not sell dreams, they sell structures that are sustainable and scalable and structure, in the long run, tends to outlast hype.

Chams may not be the fintech or a company everyone talks about. But it is one of the fintechs related platforms Nigeria quietly depends on.

More Articles from this Publisher

Before Vanilla Was Everywhere, There Was Edmund Albius

Before vanilla became a global staple, a 12-year-old boy named Edmund Albius changed history. This piece explores the or...

Who Really Powers Nigeria’s Fintech Boom? A Look Beneath the Apps

Chams made huge turnover in profits at the end of their 2025 auditing and this is what you should know about them. Read...

Is Our Phones Listening Or Do They Already Know Us Too Well?

AI has changed how ads work but at what cost? Read about this to explore AI, big tech, targeted advertising, and why onl...

What Travelling Teaches You That Staying Home Never Will

Travel is more than vacations and sightseeing. This reflective article explores how travelling becomes a powerful tool f...

20 African Fashion Stars That You Should Know

Discover 20 African fashion stars redefining global style, from designers and models to creatives shaping culture, susta...

So Many of Your “Professional” Problems Might Not Be About Your Career And Here Is Why

Many career problems aren’t really about work. This article explores how personal patterns, emotional history, and self-...

You may also like...

Before Vanilla Was Everywhere, There Was Edmund Albius

Before vanilla became a global staple, a 12-year-old boy named Edmund Albius changed history. This piece explores the or...

Are Movie Remakes Ruining Original Cinema

Movie remakes dominate modern cinema, from Hollywood to Nollywood. While some bring fresh perspectives, others fail to c...

We Want Respect But Won't Give It: The Hypocrisy of Food Shaming

A sharp look at the hypocrisy of food shaming as Nigerians mock other cultures’ cuisines online yet demand respect for t...

Who Really Powers Nigeria’s Fintech Boom? A Look Beneath the Apps

Chams made huge turnover in profits at the end of their 2025 auditing and this is what you should know about them. Read...

The Future of Natural Language Processing and Human-AI Collaboration

This article explains how artificial intelligence and Natural Language Processing (NLP) work together with humans in lea...

“My Style Is Not Alte”: When Fashion Labels Become Guesswork

Explore the fashion labeling debate in Nigeria as netizens mislabel unconventional styles “alte.” From archivecore to ex...

Top 10 Crypto Coins and Their Founders

Everyone talks about crypto coins, but few know the visionaries behind them. Meet the top 10 coins and the founders behi...

The Fresh Start Lie: What February Reveals About Your “New Year, New Me”

It’s February. After all the hype about the one million and one things you swore you’d do in January, you didn’t tick a ...