What Trump's One Big Beautiful Bill Act means for taxes on Social Security : NPR

Many Americans received an email from the Social Security Administration applauding the passage of President Trump's megabill. Saul Loeb/AFP via Getty Images hide caption

toggle caption

Saul Loeb/AFP via Getty Images

In the hours after Congress passed President Trump's megabill, an email from the Social Security Administration hit the inboxes of many Americans. It applauded the legislation's passage and said it includes a provision that "eliminates federal income taxes on Social Security benefits for most beneficiaries."

But experts say the email was misleading and that what's really in the new law is a bit more complicated.

Trump campaigned on the promise of "no tax on Social Security benefits." But the new law doesn't create a special exemption for taxes on Social Security benefits. Instead, it adds a new tax deduction for people 65 and older — and that means more of them will pay no taxes, or fewer taxes, on their Social Security benefits.

"The legislation that passed does make it so some people won't pay taxes on their benefits," says Marc Goldwein, senior vice president at the nonpartisan Committee for a Responsible Federal Budget. "The reason is that it'll make it so that some seniors won't pay any taxes, because it increases their standard deduction."

The new senior deduction is $6,000 a year for individuals 65 or older.

On July 3, the Social Security Administration blasted out an email with the subject line "Social Security ApplaudsPassage of Legislation Providing HistoricTax Relief for Seniors."

The agency is not in the practice of sending political emails, so this was notable.

But that wasn't the only issue, says Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center.

"The email was really pretty misleading. It included a number of assertions that simply are either not true or overstated or described in a way that is really going to confuse people," says Gleckman.

First, the email implies that the bill changed how Social Security benefits are taxed — and the White House put out a news release headlined "No Tax on Social Security is a Reality in the One Big Beautiful Bill."

But Social Security benefits are taxed like other income, and this law doesn't change that.

Second, the email says, "the bill ensures that nearly 90% of Social Security beneficiaries will no longer pay federal income taxes on their benefits."

Indeed, the White House Council of Economic Advisers estimates that, under the new law, 88% of older adults receiving Social Security benefits will pay no taxes on them.

But Gleckman points out that by the administration's own estimate, almost two-thirds of Social Security recipients already don't pay taxes on their benefits, because they don't make enough money for that tax to kick in.

NPR reached out to the Social Security Administration for a response to these critiques but did not hear back. In a news release with similar text to the email, the administration posted a correction that removes the language stating that the $6,000 annual deduction for older adults is in addition to another separate policy change.

It's primarily middle- or upper-middle-class folks who will see a difference with the new senior deduction, says Gleckman. He and his colleagues at the Tax Policy Center estimate that about half of older adults will benefit.

Those who'll see the biggest benefit are those with incomes between $80,000 and $130,000. They should receive an average tax cut of about $1,100.

Lower-income seniors won't notice any change from this deduction, because they already earn too little to pay taxes. And higher-income folks won't see a change, because individuals with incomes over $175,000 or couples over $250,000 won't qualify for the new deduction.

The email quotes Social Security Administration Commissioner Frank Bisignano: "This legislation reaffirms President Trump's promise to protect Social Security and helps ensure that seniors can better enjoy the retirement they've earned."

But that depends on what you mean by "protect."

Taxes paid on Social Security benefits go directly to shoring up the trust funds for Social Security and Medicare Part A. Cutting these taxes accelerates the timeline in which those trust funds will become insolvent.

According to an estimate from the Committee for a Responsible Federal Budget, that will now happen in late 2032. It estimates that Social Security benefits would be cut by an estimated 24% unless Congress makes changes before then.

In that way, cutting taxes that feed the trust fund does the opposite of protecting Social Security.

You may also like...

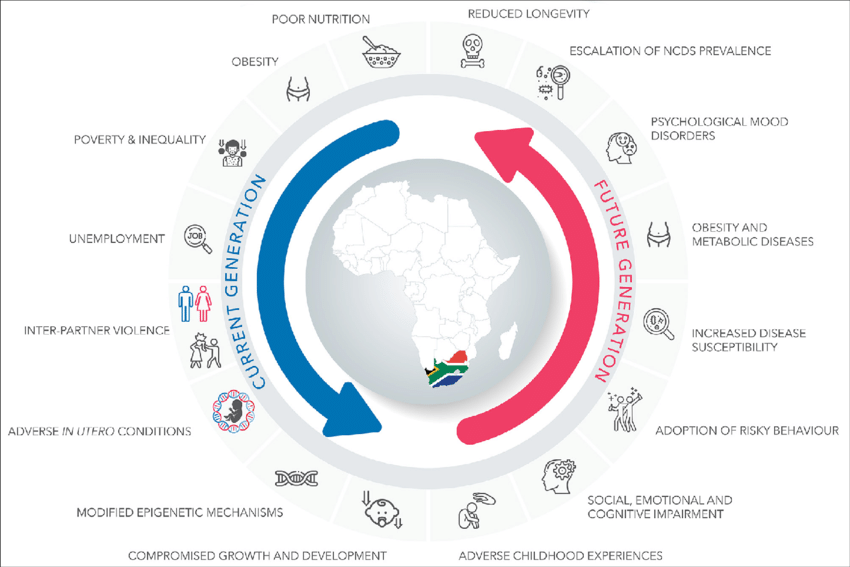

Africa's Silent Killer: Unmasking the Looming Non-Communicable Disease Crisis

Beyond infectious diseases, Africa faces a silent killer: surging rates of diabetes, hypertension & cancer. Uncover this...

OPINION: WHY KINDNESS IS NO LONGER ENOUGH IN TODAY'S WORLD

In a world overwhelmed by injustice, violence, and performative virtue, kindness has been reduced to aesthetics and slog...

From Drumbeats to Downloads: How African Storytelling Evolved Through Music and Media

From village griots to viral podcasters, discover how African storytelling has evolved through music, film, and digital ...

Textiles, Trade, and Transformation: How African Fabric Became a Global Business Icon

(1).jpeg)

Discover how African textiles, from Ghana’s Kente to Tanzania’s Khanga, evolved from ancient trade goods to global fashi...

Why A Company's Networth Doesn't Predict Success in Africa

There’s a familiar buzz every time an African startup announces a big funding round—“$80 million secured!” It feels like...

We Were Never in Leaves: An African Loom & the Civilisation We Wove

Before colonialism, African communities had thriving textile cultures, complex weaving traditions, and rich cloth econom...

Revving into the Future: Nigeria’s Formula 1 Dream Inches Closer

.jpeg)

Nigeria is accelerating toward a historic milestone with plans to host West Africa’s first Formula 1-standard racing fac...

If You’re a Gamer, Then Morocco Is Building the Ideal Country for You

.jpeg)

Discover how Morocco is transforming into a digital hub, where gaming meets cultural expression, innovation, and youth e...