Warner Bros. Discovery on the Auction Block: Empire For Sale After Banner Year

Warner Bros. Discovery has officially confirmed it is reviewing "strategic alternatives" after receiving unsolicited interest from multiple parties for both the entire company and its standalone Warner Bros. streaming and studios entity. This announcement, made via a press release, follows weeks of speculation and signals a significant shift for the media conglomerate.

The board of directors has initiated a comprehensive review process aimed at maximizing shareholder value. This review encompasses a broad range of strategic options, including the outright sale of the entire company, separate transactions for its Warner Bros. and/or Discovery Global businesses, or an alternative separation structure that could facilitate a merger of Warner Bros. with a third-party acquirer alongside a spin-off of Discovery Global to shareholders. The company had previously announced a plan to separate into two distinct entities, Warner Bros. and Discovery Global, with completion targeted by April 2026.

While Warner Bros. Discovery did not explicitly name the interested parties, rumors have heavily suggested Paramount Global, and specifically Paramount Skydance headed by David Ellison, is one of the bidders. Paramount Skydance reportedly made a $20-per-share offer for Warner Bros. Discovery earlier this month, which was subsequently rejected by WBD as too low. Following the official announcement, the company's stock saw a notable jump of more than 8% in early trading, nearing $20 per share.

David Zaslav, President and CEO of Warner Bros. Discovery, released a statement emphasizing the company's efforts to position its business for success in the evolving media landscape. He highlighted advancements in strategic initiatives, the return of studios to industry leadership, and the global scaling of HBO Max. Zaslav noted that the significant value of their portfolios is receiving increased recognition in the market, leading to this comprehensive review to unlock the full value of their assets. Samuel A. Di Piazza Jr., Chairman of the Warner Bros. Discovery board, reiterated the board's commitment to considering all opportunities for shareholders, affirming that while the planned separation into two leading media companies is still believed to create compelling value, broadening their scope with this review is in the best interest of shareholders.

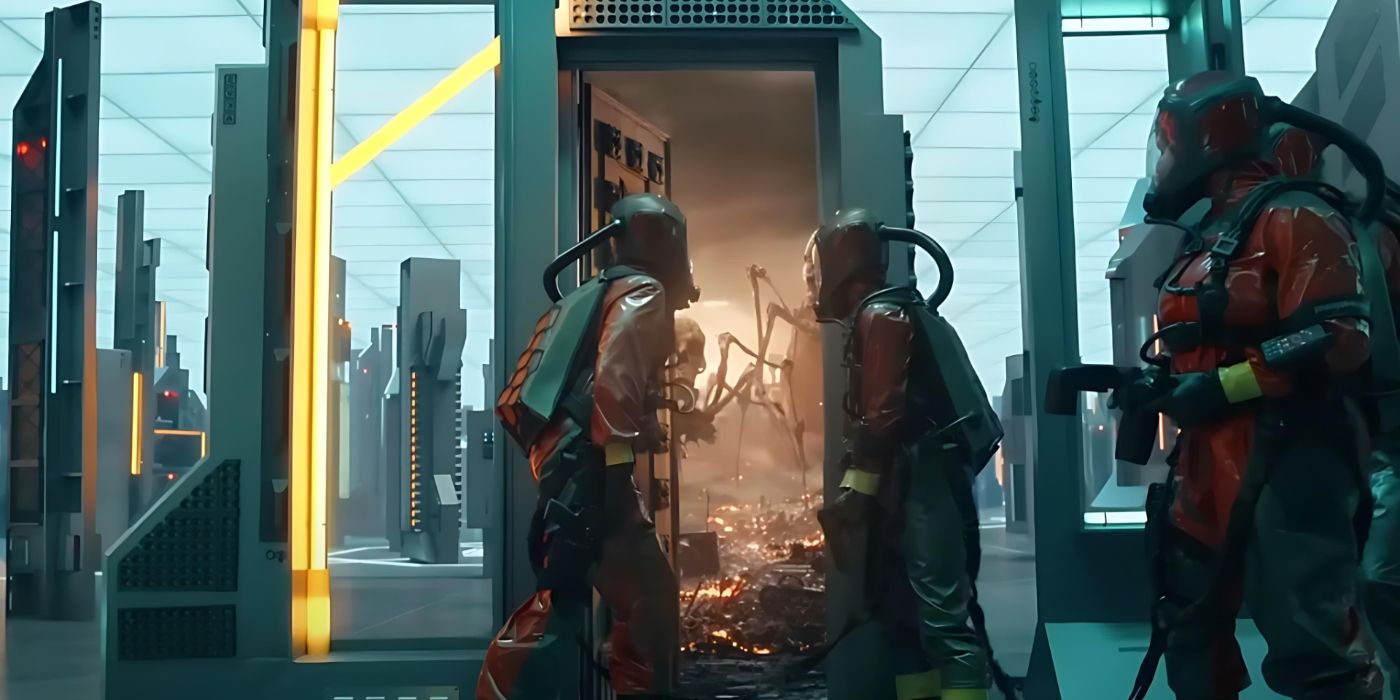

Interestingly, this review comes after a remarkably profitable year for Warner Bros. in 2025 at the movies. "A Minecraft Movie" emerged as its highest-grossing outing, exceeding $950 million globally and already securing a sequel for 2027. The film "Superman" also achieved significant success, grossing over $600 million at the global box office and performing strongly on streaming platforms. Other notable successes included the horror films "Sinners" and "Weapons," which were hailed as two of the greatest horror movies of the decade and also found box office success, with "Sinners" released on April 18, 2025.

Warner Bros. Discovery has stated there is no definitive timetable for the completion of this strategic alternatives review process. The company does not intend to make further announcements unless and until the board approves a specific transaction or deems further disclosure appropriate or necessary. Allen & Company, J.P. Morgan, and Evercore are serving as financial advisers, with Wachtell Lipton, Rosen & Katz and Debevoise & Plimpton LLP acting as legal counsel.

You may also like...

LeBron's Injury Rocks Lakers: Betting Markets in Turmoil!

The sports betting world is highly reactive to real-time sports news, with major events like LeBron James' injury, unexp...

Super Eagles Stunned: PSG Star Out of WAFCON Qualifier!

Nigeria's Super Falcons will face Benin Republic in their 2026 WAFCON qualifiers without star midfielder Jennifer Echegi...

Netflix Secures Rights to Iconic 'Catan,' Plans Movies and TV Series!

Netflix has acquired the global rights to the popular board game "Catan," planning a comprehensive slate of projects inc...

Prime Video's 'Harlan Coben's Lazarus' Unveils Sneak Peek and Thrilling Review!

Sam Claflin and Bill Nighy star in <em>Lazarus</em>, a new original horror thriller from Harlan Coben and Danny Brockleh...

Africa's Pulse: Essential Music News & Trends for October 21st

previewed for public order into question.

Chrisley Family Turmoil: Lindsie Chrisley Finally Addresses Bitter Family Feud

Lindsie Landsman, Todd Chrisley’s eldest daughter, is breaking her silence regarding her family and the Lifetime documen...

Shocking Exposé: Prince Andrew's Private Life Reveals Disturbing Staff Treatment and Pranks

Prince Andrew has relinquished royal titles amid renewed scrutiny over sexual assault allegations from Virginia Giuffre,...

Tragedy Strikes: Zimbabwe Bus Accident Claims 44 Lives, Nations Unite on Repatriation

A tragic bus accident near Louis Trichardt, Limpopo, has resulted in 44 fatalities. The governments of Zimbabwe and Mala...