Wall Street Giant Bank of America Endorses Crypto for Wealth Clients, Signaling Bitcoin's Mainstream Ascent!

Bank of America has announced a pivotal shift in its wealth management strategy, now recommending that its clients consider allocating a small, yet deliberate, portion of their portfolios to digital assets. This significant move, suggesting a 1% to 4% crypto allocation, marks a notable evolution in how one of the United States' largest financial institutions approaches exposure to Bitcoin and the broader cryptocurrency market.

The new guidance is comprehensive, extending its reach across Bank of America's diverse wealth management platforms, including Merrill, Bank of America Private Bank, and Merrill Edge. This policy change will have a substantial impact on the bank's advisory force, as it liberates over 15,000 financial advisers who were previously constrained from initiating discussions about digital assets unless explicitly prompted by a client. This removes a significant barrier, allowing proactive engagement on crypto investments.

The official implementation of this new recommendation is slated for January 5. On this date, the bank’s chief investment office will commence formal research coverage of four prominent spot Bitcoin exchange-traded funds (ETFs). These selected funds include Bitwise’s BITB, Fidelity’s FBTC, Grayscale’s Bitcoin Mini Trust, and BlackRock’s IBIT, providing regulated and accessible avenues for clients to gain digital asset exposure.

Chris Hyzy, the chief investment officer for Bank of America Private Bank, articulated the bank's "measured approach" to this new frontier. He highlighted that a modest allocation could be well-suited for investors keen on gaining exposure to thematic innovation, with an explicit caveat that this exposure should strictly be through regulated financial products. Hyzy also underscored the critical importance of setting clear expectations regarding the inherent volatility of digital assets. The bank further specified that the lower end of the 1% to 4% range would likely appeal more to conservative clients, while the higher end would be suitable for those with a greater tolerance for risk.

This policy adjustment is a direct response to a burgeoning interest in Bitcoin among affluent investors. Nancy Fahmy, head of Bank of America’s investment solutions group, confirmed a noticeable surge in demand for digital asset exposure over the past year. Previously, many clients had to venture outside the bank's ecosystem to access Bitcoin ETFs, indicating a clear market need that Bank of America is now addressing internally.

By making this move, Bank of America is aligning itself with several of its industry peers who have already integrated Bitcoin exposure into their wealth management strategies. Morgan Stanley, for instance, recommended a 2% to 4% allocation for appropriate clients in October, famously likening Bitcoin to "digital gold" and describing cryptocurrency as a speculative yet maturing asset class. They too emphasized ETF-based exposure with rigorous rebalancing. BlackRock, the world’s largest asset manager, has posited that even a modest 1% to 2% allocation can significantly enhance long-term portfolio efficiency. Fidelity has long maintained a broader suggested range of 2% to 5%, with a tendency to recommend higher allocations for younger investors.

Furthermore, the broader institutional landscape continues to open up, expanding access to crypto investments. Bloomberg recently reported that Vanguard, historically resistant to offering Bitcoin-linked products, has begun allowing select crypto ETFs and mutual funds on its platform. This follows similar approvals and integrations by other major financial players such as Morgan Stanley, Charles Schwab, Fidelity, and JPMorgan Chase, collectively signaling a mainstream acceptance of digital assets within traditional finance.

This institutional shift unfolds amidst a period of significant volatility for Bitcoin. The digital asset has experienced a decline of approximately 10% over the past year, retracing from record highs that exceeded $126,000 in October. Despite these fluctuations, major banks continue to express bullish long-term outlooks. JPMorgan has recently set an ambitious price target of $170,000 for Bitcoin, while Standard Chartered has reiterated its forecast for the cryptocurrency to approach $200,000. At the time of this writing, Bitcoin is trading at $89,046, reflecting its dynamic market nature.

You may also like...

Premier League Giants Battle for USMNT Star Adams: Man Utd, Chelsea, Liverpool in Transfer Frenzy!

The latest football transfer market updates reveal intense activity among top clubs. Manchester United, Chelsea, and Liv...

Wemby's Relief: NBA Star Victor Wembanyama Speaks Out After Friend's Safe Return

San Antonio Spurs star Victor Wembanyama's longtime friend, Elijah Hoard, was safely located after going missing at Chic...

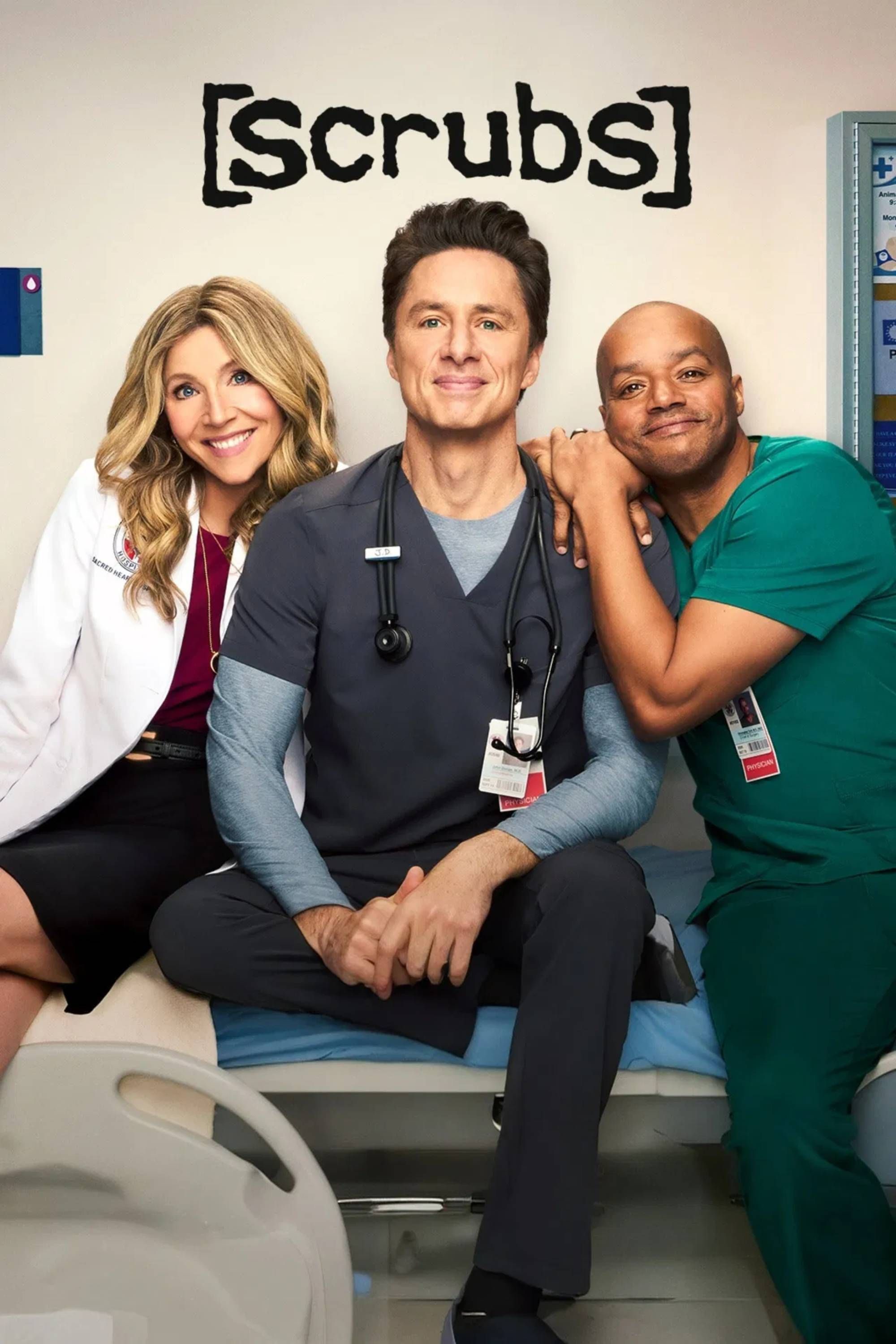

Iconic Comedy 'Scrubs' Makes Triumphant Comeback After 16 Years With Record-Shattering Ratings

The iconic medical sitcom "Scrubs" has made a triumphant return to ABC, drawing over 11 million viewers and achieving AB...

Streaming Shake-Up: HBO Max Merges With Divisive Rival, Promising Big Changes for Subscribers

The potential merger of Paramount and Warner Bros. Discovery is set to significantly reshape the streaming landscape, pa...

Twisted Sister Shocker: Sebastian Bach Joins for 50th Anniversary as Snider Steps Down!

Twisted Sister's 50th-anniversary shows are set to continue, with Sebastian Bach joining as the lead vocalist for select...

Global Tensions Silence the Decks: Charlotte de Witte Cancels Australia Tour Over Middle East Conflict Fallout

Belgian techno DJ Charlotte de Witte has cancelled her highly anticipated Australian shows, including performances in Sy...

Fiennes Tiffin Teases Epic Sherlock Season 2 Showdown

The Prime Video series 'Young Sherlock' reintroduces a nascent Sherlock Holmes, portrayed by Hero Fiennes Tiffin, embark...

Middle East Tensions Ripple: Namibians Stranded in Dubai, Kenya Airways Launches Repatriation Flights Amid Iran Attacks

Middle East military tensions have prompted Kenya Airways to operate special repatriation flights to Dubai, aiding stran...