US Curbs Impact AMD's China Chip Exports; China to Cut Policy Rate

Under both the Biden and Trump administrations, the U.S. has been imposing increasingly strict restrictions on AI chip exports to China. These measures are intended to hinder China's capacity to develop advanced AI models and applications, which the U.S. believes could pose national security risks.

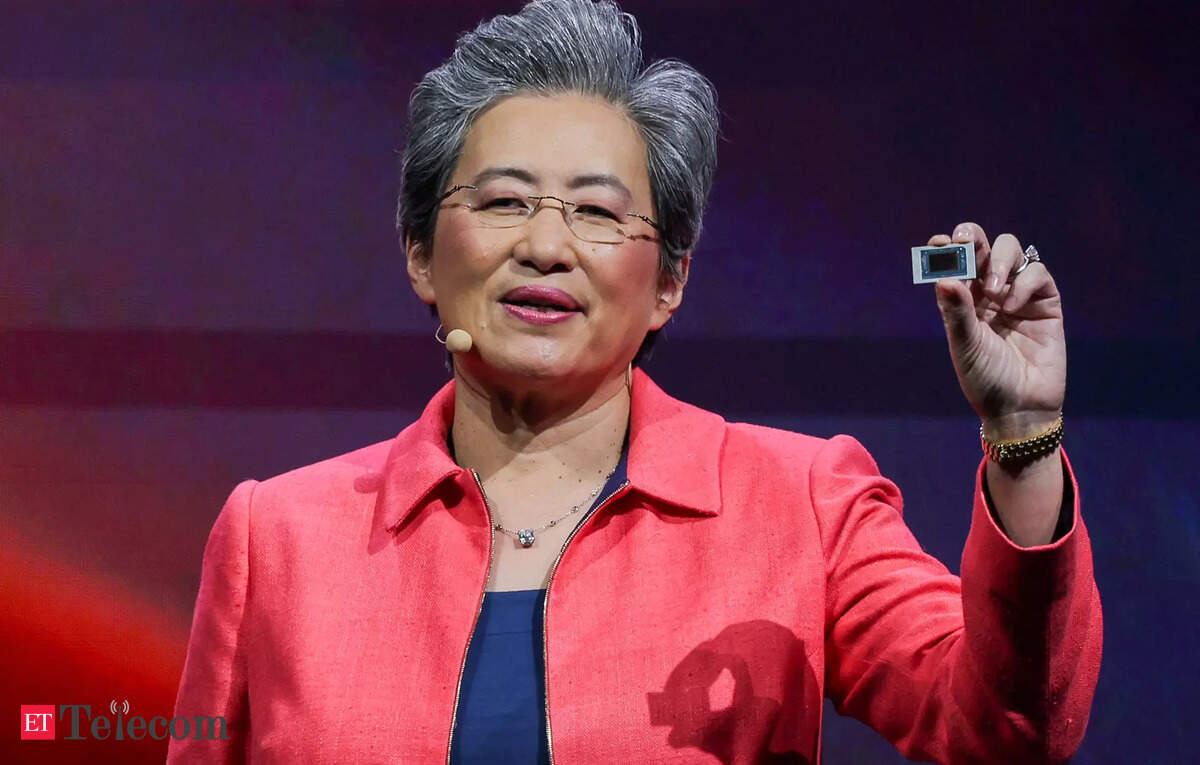

Advanced Micro Devices (AMD) has projected a $1.5 billion revenue loss this year due to these new U.S. chip restrictions, which require the company to obtain a license to ship advanced artificial-intelligence processors to China. AMD CEO Lisa Su stated that the majority of this impact would be felt in the second and third quarters of the year. Despite these controls, she anticipates that AI chip revenue from the company's data center business will still experience "strong double digits" growth this year. AMD had previously announced an $800 million charge related to the new U.S. tariffs on chip exports to China. The company forecasts an adjusted gross margin of 43%, reflecting an 11 percentage-point decrease from the gross margin excluding the charge. Nvidia has also cautioned that it will require an export license to China, potentially facing a $5.5 billion charge.

China accounts for approximately a quarter of AMD's total revenue, and the export controls could reduce Wall Street's revenue forecast by nearly 5%. AMD's finance chief, Jean Hu, clarified that the $1.5 billion revenue hit for 2025 is a direct result of the latest export controls implemented in April. Some analysts suggest that major hyperscalers are expediting purchase orders to avoid potential export-license issues.

Despite these challenges, AMD's forecast remains optimistic, indicating strong demand for its advanced processors, which power complex AI systems for clients like Microsoft and Meta Platforms. These cloud giants have reaffirmed their significant investment plans in AI infrastructure. AMD reported a 57% increase in data center sales, reaching $3.7 billion, surpassing estimates. Total revenue also exceeded expectations, rising by 36% to $7.44 billion. Adjusted profit was 96 cents a share, exceeding estimates by 2 cents a share.

In related news, China's central bank, the People's Bank of China (PBOC), announced a rate cut for the seven-day reverse repos by 0.1 percentage points, effective Thursday. This adjustment will set the rate at 1.4 percent. The PBOC aims to better implement a moderately loose monetary policy and enhance support for the real economy through this measure. Interest rates for the standing lending facility (SLF) will also be reduced by 0.1 percentage points. The PBOC governor, Pan Gongsheng, indicated that further monetary policies, including lowering the policy rate and reserve requirement ratio, would be rolled out to enhance macro regulation. The policy rate reduction is expected to lead to a 0.1 percentage point decrease in the loan prime rate (LPR).