Trump-Linked American Bitcoin Miner Surges: Q3 Revenue Doubles Amid Massive Expansion

American Bitcoin (NASDAQ: ABTC), the cryptocurrency mining firm notably backed by Eric Trump and Donald Trump Jr., has reported a remarkably strong third quarter, showcasing significant growth and operational efficiency. The Miami-based company achieved revenue of $64.2 million, representing an impressive 453% year-over-year increase. Furthermore, ABTC's net income soared to $3.47 million, successfully reversing a $576,000 loss recorded in the same period of the previous year.

Since becoming a standalone public entity through a spin-out from Hut 8 and a strategic merger with Gryphon Digital Mining, American Bitcoin has aggressively scaled its operations. During the third quarter, the firm expanded its mining capacity by approximately 2.5 times, reaching 25 exahash per second (EH/s). This expansion was coupled with high efficiency, as its mining fleet achieved an impressive efficiency of 16.3 joules per terahash (J/TH).

The company's strategic, scalable, and “asset-light” mining approach has been instrumental in its financial success, enabling it to generate bitcoin below prevailing market prices. This, combined with disciplined at-market purchases, has contributed to wider profit margins. On the treasury front, American Bitcoin demonstrated a strong focus on accumulation, acquiring over 3,000 BTC during the quarter, concluding Q3 with a total of 3,418 BTC. As of this month, the company's bitcoin holdings have further grown to 4,004 BTC, equivalent to 432 satoshis per share. Eric Trump underscored this dual strategy, emphasizing that the firm prioritizes both production and accumulation to reinforce long-term value creation amidst fluctuating market conditions.

The strategic merger that solidified American Bitcoin’s public presence occurred in September, when American Bitcoin Corp. completed a stock-for-stock merger with Gryphon Digital Mining. This created a Nasdaq-listed Bitcoin accumulation platform that is majority-owned by Hut 8. This combination of mining operations with strategic Bitcoin purchases was designed to establish a structural cost advantage. At the time of the merger, Eric Trump highlighted ABTC as a public vehicle offering investors direct exposure to Bitcoin while simultaneously advancing U.S. leadership in the global crypto economy. The Trump family has consistently emphasized the company's alignment with American values and its leveraging of public markets to scale operations efficiently.

Despite these strong fundamentals and high-profile backing, ABTC shares experienced a decline of more than 13% in pre-market trading on Friday, reflecting a broader crypto market pullback as bitcoin dipped below $95,000. Nevertheless, the company's strategic expansion and prominent support have garnered significant investor attention, positioning American Bitcoin as a noteworthy player within the dynamic digital asset ecosystem. With its combination of growing mining output, efficient operational practices, and a rapidly expanding bitcoin treasury, American Bitcoin is establishing itself as one of the more institutionally oriented and growth-focused bitcoin miners in the market, even amidst ongoing price turbulence.

You may also like...

Premier League Giants Battle for USMNT Star Adams: Man Utd, Chelsea, Liverpool in Transfer Frenzy!

The latest football transfer market updates reveal intense activity among top clubs. Manchester United, Chelsea, and Liv...

Wemby's Relief: NBA Star Victor Wembanyama Speaks Out After Friend's Safe Return

San Antonio Spurs star Victor Wembanyama's longtime friend, Elijah Hoard, was safely located after going missing at Chic...

Iconic Comedy 'Scrubs' Makes Triumphant Comeback After 16 Years With Record-Shattering Ratings

The iconic medical sitcom "Scrubs" has made a triumphant return to ABC, drawing over 11 million viewers and achieving AB...

Streaming Shake-Up: HBO Max Merges With Divisive Rival, Promising Big Changes for Subscribers

The potential merger of Paramount and Warner Bros. Discovery is set to significantly reshape the streaming landscape, pa...

Twisted Sister Shocker: Sebastian Bach Joins for 50th Anniversary as Snider Steps Down!

Twisted Sister's 50th-anniversary shows are set to continue, with Sebastian Bach joining as the lead vocalist for select...

Global Tensions Silence the Decks: Charlotte de Witte Cancels Australia Tour Over Middle East Conflict Fallout

Belgian techno DJ Charlotte de Witte has cancelled her highly anticipated Australian shows, including performances in Sy...

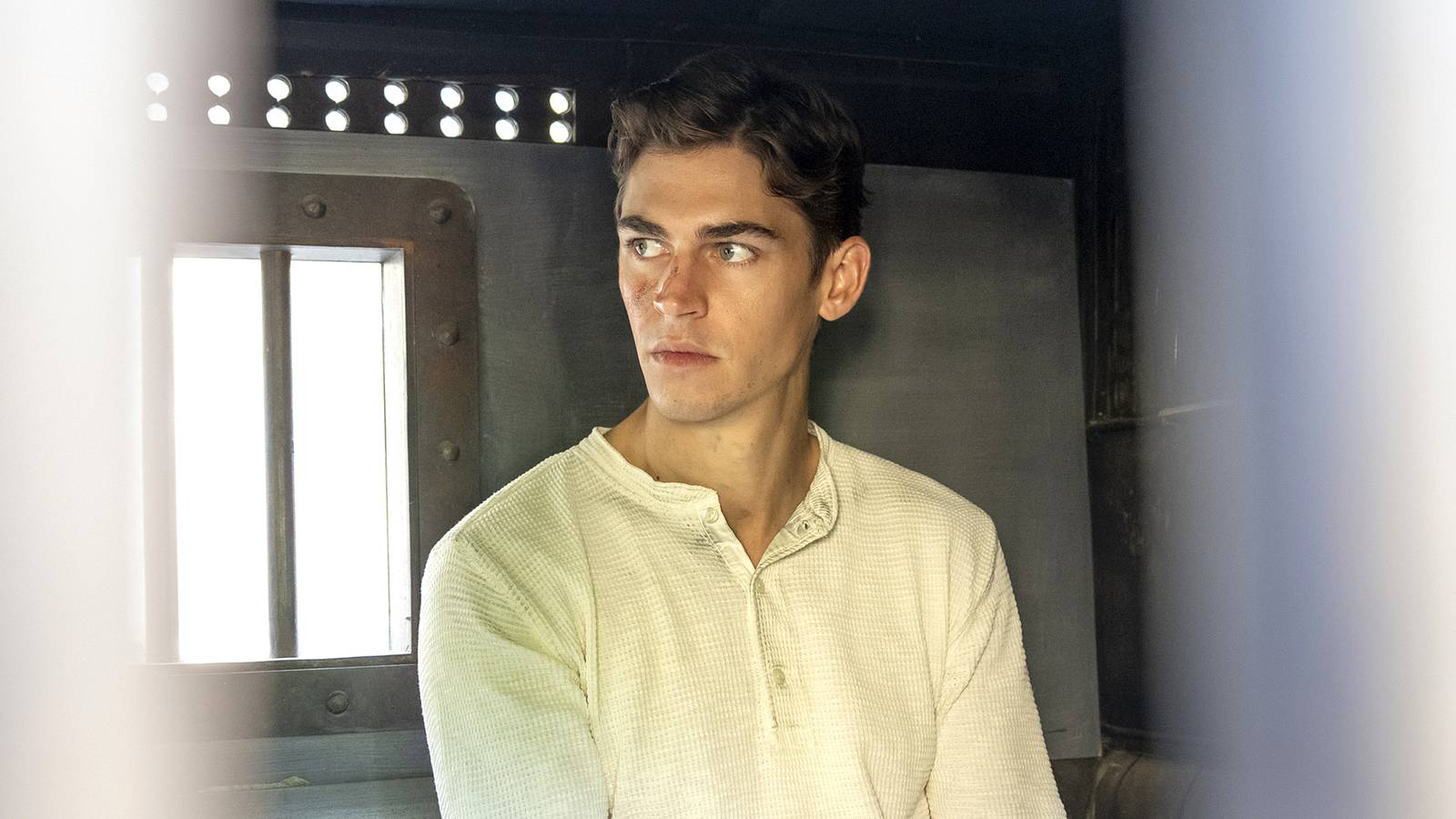

Fiennes Tiffin Teases Epic Sherlock Season 2 Showdown

The Prime Video series 'Young Sherlock' reintroduces a nascent Sherlock Holmes, portrayed by Hero Fiennes Tiffin, embark...

Middle East Tensions Ripple: Namibians Stranded in Dubai, Kenya Airways Launches Repatriation Flights Amid Iran Attacks

Middle East military tensions have prompted Kenya Airways to operate special repatriation flights to Dubai, aiding stran...