The Digital Banking Boom: How Mobile Finance Is Transforming Africa’s Economy

From Cash to Code: The Growth of Mobile Money

There's a revolution in the making all over Africa, but it doesn't look like you'd expect. Forget marble bank buildings and endless lines. These days, people are turning to their mobile phones—not just for calls, but for their entire financial lives. It started with Kenya’s M-Pesa, then spread to Nigeria’s Opay, Ghana’s MoMo, and a whole wave of digital banking options. What kicked off as a fix for financial exclusion has exploded into a force that’s changing how the continent does business.

Back in the early 2000s, Africa had a strange problem. Millions owned mobile phones, but hardly anyone could get a bank account, especially if they lived outside the cities or worked in the informal economy. Banks just couldn’t reach them. Mobile network operators saw this gap and ran with it, turning phones into wallets. When Kenya launched M-Pesa in 2007, it upended the script. Now, people could send cash, pay bills, or get their paycheck—all without ever stepping foot in a bank.

And now that idea has gone crazy. In Ghana, MoMo transfers billions every year. Nigeria’s fintech scene is booming, with companies like Flutterwave, Moniepoint, and PalmPay bringing digital payments everywhere. Over in francophone Africa, Orange Money and Wave are changing how people send money home or pay for goods at the market.

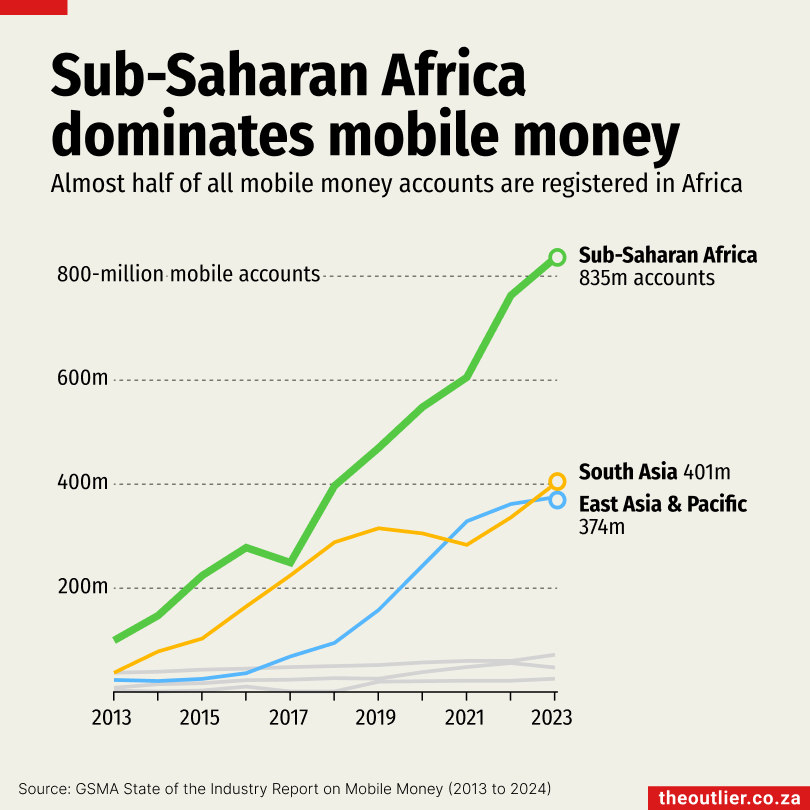

The impact? Honestly, it’s huge. More than 70% of people in sub-Saharan Africa use some kind of mobile money. Farmers get paid instantly. Market sellers accept QR payments on the spot. Even cross-border trade, which used to be a slow, cash-heavy hassle, now happens with a few taps. Africa, so often called “behind” in banking, has skipped ahead.

But it’s not just about making life easier. Mobile banking is opening doors for people who've never had one—women, youth, small business owners. One night, they can borrow money, buy insurance, or start to save for the future. So, yes, Africa's mobile banking story is one of technology, but it is more a story of people finally getting an opportunity.

The Fintech Frontier: Startups, Policy, and Competition

Digital and mobile banking are shaking up Africa’s financial scene. In Nigeria, you’ll find hundreds of fintech startups, each one hungry for a slice of the continent’s massive payments market. Billions of worldwide venture funds get the system whirring, but it's brutal competition—everybody's after the same thing.

Telecom giants MTN, Airtel, and Safaricom are the ones who rule the mobile money territory. They use their enormous networks to bring in millions who had otherwise been excluded. Banks, which once looked a little lost, are catching up fast. Now they’re rolling out digital apps, teaming up with fintechs, and trying out open banking. Governments aren’t sitting back either. Central banks in Kenya, Nigeria, and South Africa have started rolling out digital regulations and sandbox programs to keep an eye on all this innovation without letting things get out of hand.

But of course, there are still real problems. There's always fraud and cybercrime hanging around. A lot of people aren’t comfortable with digital tools yet, and in some places, messy rules and transaction taxes just slow everything down. Nigeria’s push for a cashless economy in 2023 showed how shaky the tech and public trust can be—reminding everyone that progress doesn’t mean much if people can’t actually use it.

Even so, there’s no stopping this fintech wave. Mobile banking isn’t just convenient—it’s changing how people think about money, security, and what’s possible. For more and more folks, a bank isn’t a building anymore. It's sitting right in their pocket.

The rest of the world is looking, as well. Major players like Visa, Mastercard, and PayPal are investing in African fintech startups. The continent's a testing ground for new ideas—peer-to-peer lending, digital microloans, even blockchain remittances. If you want to catch a glimpse of the future of money, it's in Africa.

Everyday Impact: How Digital Banking Is Changing African Lives

Digital banking isn’t some distant idea in Africa—it’s part of daily life now. In Accra, street vendors swipe their phones for MoMo payments. In Kampala, boda-boda riders cash out on Airtel Money before the dust even settles. Freelancers in Lagos get paid from overseas clients through Flutterwave or Payoneer, no more waiting for the check that never comes. The old barriers that kept people out of formal banking? They’re falling fast.

This shift does more than just make things easier. Small businesses use mobile apps to grab quick microloans, so restocking or paying suppliers doesn’t have to be a gamble anymore. Women’s cooperatives in rural areas pool their savings on secure digital platforms, no more hiding cash under mattresses. Even in refugee camps, mobile money puts dignity back in people’s hands—aid arrives directly, no middlemen skimming off the top.

That kind of change ripples out. Digital banking is making governments more transparent, too. Programs like Kenya’s Inua Jamii and Nigeria’s NPower now send money straight to people’s digital wallets, skipping the endless paperwork and shady delays. Even donations—whether it’s church collections or charity—are going mobile. The culture around money is shifting, fast.

But here’s the catch: this whole revolution runs on trust and infrastructure. Reliable internet, cheap smartphones, and knowing how to stay safe online—that’s what will decide how far these changes go. Sure, fintechs are opening doors, but they also need to keep people safe from scams and data leaks. No shortcuts there.

One Nairobi fintech founder nailed it: “We’re not just building apps—we’re building systems of trust.” And you can feel that trust reshaping economies from the ground up.

What’s next? Seamless payments across borders—no hassle, no delays. Picture a trader in Benin paying a supplier in Ghana with a single tap, or a South African student sending cash home to Malawi instantly. That’s the dream, and fintech leaders are pushing hard to make it real—a truly connected Africa, fueled by digital finance.

This surge in digital banking proves something bigger: innovation here isn’t just about shiny new tech. It’s about bringing people in, about resilience, and about creativity. Africa isn’t just trying to catch up—it’s rewriting the future of banking, on its own terms.

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...