Streaming Giants Collide: Netflix and Paramount Battle Over Warner Bros. Discovery

Warner Bros. Discovery (WBD) is currently at the center of a high-stakes bidding war, facing acquisition offers from both streaming behemoth Netflix and the Skydance-owned Paramount. This tug-of-war in Hollywood is anticipated to involve a lengthy and intricate regulatory process for whichever buyer emerges victorious, with implications that could fundamentally reshape the media landscape.

On one side, Warner Bros. Discovery's board has endorsed a $72 billion deal with Netflix, specifically for the sale of its studio and streaming business. Concurrently, Paramount, under Skydance ownership, has put forth a hostile bid of $77.9 billion for a complete takeover of WBD, which would include its extensive network portfolio like CNN. Regardless of the suitor, any merger of this magnitude is expected to trigger a rigorous review by the U.S. Justice Department, potentially leading to lawsuits to block the transaction or requests for significant modifications. Furthermore, regulatory bodies in other countries and entities could also challenge either acquisition, adding layers of complexity to the process.

Political considerations are also projected to play a role, particularly under U.S. President Donald Trump, who has made unprecedented statements regarding his personal involvement in the approval or disapproval of such a deal. The entire process could extend beyond a year, if not longer. However, the eventual new ownership of Warner properties promises to drastically alter the industry, influencing movie production, the competitive streaming platform market, and the wider media ecosystem.

Warner Bros. Discovery, the target of these bids, is a 102-year-old Hollywood titan, recognized as one of the “big five” studios with iconic titles such as “Harry Potter” and “Superman.” Its vast cable operations include prominent networks like CNN and Discovery, alongside its ownership of DC Studios and HBO Max. Paramount, having recently completed its own $8 billion merger with Skydance, is another long-standing Hollywood studio, boasting blockbuster franchises like “Top Gun” and “The Godfather.” Beyond traditional film and TV production, Paramount's portfolio encompasses networks like CBS, MTV, and Nickelodeon, as well as its proprietary Paramount streaming service. Netflix, on the other hand, is primarily driven by its streaming business, holding a 20% share of the U.S. market for on-demand subscriptions, significantly higher than HBO Max (13%) and Paramount (7%). Netflix has also cultivated a robust production arm, responsible for global hits like “Squid Game” and “Stranger Things.” In terms of market capitalization as of mid-December, Netflix leads with approximately $430 billion, followed by Warner Bros. Discovery at around $70 billion, and Paramount Skydance trailing closer to $14 billion.

The path to regulatory approval is fraught with challenges for both Netflix and Paramount. Paramount has voiced concerns over Netflix’s streaming dominance, arguing that combining it with HBO Max would stifle competition and grant Netflix an “overwhelming” market share. Conversely, Netflix asserts that its merger would expand consumer choice by offering a broader array of plans and titles from Warner’s catalog. Antitrust experts anticipate that both companies will endeavor to convince regulators that their competition extends beyond conventional subscription rivals to encompass broader internet video libraries, with YouTube frequently cited as a major player. Netflix is already strategizing to highlight Google's streaming platform's dominance in viewing hours; according to Nielsen, YouTube commanded nearly 13% of viewership last fall compared to Netflix’s 8%. Jim Speta, a professor at Northwestern University’s Pritzker School of Law, suggests both companies will likely contend that a merger is “necessary for them to compete against YouTube,” explaining that “the broader you make the market that we’re thinking about, the less the merger looks anti-competitive.”

However, critics will argue that either merger could be detrimental to consumers. While content libraries might expand, concerns persist about a combined entity's potential to control prices or compel consumers through additional subscription hoops to access specific titles. Scott Wagner, head of antitrust practice at law firm Bilzin Sumberg, highlighted worries that “the range of available content on the streaming services might decrease,” specifically mentioning older movies that could see shorter streaming windows across platforms.

The implications extend to studio production and news operations. A successful takeover by Paramount would merge two of Hollywood's “big five” studios. Although Netflix has committed to honoring Warner’s existing contractual obligations for theatrical releases, skepticism remains due to its core reliance on online streaming. Trade groups have also cautioned about potential job losses, as layoffs linked to restructuring are common post-merger. While such layoffs might not typically trigger antitrust scrutiny, Speta notes that competition concerns could arise if a company becomes so large that it wields excessive “purchasing power,” potentially influencing wages more broadly.

For Paramount, a specific area of regulatory focus will be the news and broader cable landscape. Attorneys like Wagner expect the prospect of combining Warner-owned CNN with Paramount’s CBS under a single umbrella to be raised during the review. However, he believes this issue will carry less weight than questions pertaining to streaming and content libraries, and is unlikely to be the decisive factor leading to the merger’s collapse. Similar to arguments for broadening the definition of the streaming market, proponents of the Paramount merger will likely emphasize the wider spectrum of media offerings beyond traditional TV news, including information shared on social media platforms. There are also notable political implications surrounding a potential CBS-CNN combination. Under its new Skydance ownership, Paramount has already initiated steps to appeal to a more conservative viewership in its news operations, notably by appointing Free Press founder Bari Weiss as editor-in-chief of CBS News. Should Paramount’s bid for Warner be successful, many anticipate similar ideological shifts at CNN, a network that has frequently been a target of criticism from Donald Trump.

Donald Trump’s potential role in these mergers has been conspicuously vocal. He has explicitly stated his intention to “be involved in that decision,” a suggestion that Speta deems alarming and “completely unprecedented” for a president. While shifts in administration have historically influenced the scope of antitrust enforcement, direct presidential intervention in specific merger outcomes is uncharted territory. Earlier in the month, Trump expressed that Netflix’s deal “could be a problem” due to the combined market share it would command. Furthermore, Trump maintains a close relationship with Larry Ellison, the billionaire Oracle founder whose family trust is a significant backer of Paramount CEO David Ellison’s company bid to acquire Warner. An investment firm managed by Jared Kushner, Trump’s son-in-law, was also an initial contributor to Paramount’s bid before withdrawing. Netflix also has its own political connections; Trump previously lauded Ted Sarandos, co-CEO of the streaming giant, as a “fantastic man” following a meeting in the Oval Office prior to the proposed Warner merger announcement. Conversely, Trump has continued to publicly criticize Paramount over editorial decisions made by CBS’s “60 Minutes.”

Even without direct presidential intervention, the protracted process itself could harm the companies involved. Paul Nary, an assistant professor of management at the University of Pennsylvania’s Wharton School of Business, points out that Warner Bros. Discovery has generally underperformed for shareholders since its inception just three years ago. He warns that the company could be “potentially being left in even worse shape” if its management is distracted by a long, drawn-out deal. Nary encapsulates this risk, stating, “There’s a potential for the winner’s curse here.” He observes that “media and entertainment is one of those spaces where you see all of these mega mergers — high stakes (and) big egos competing over the glamorous assets. And so many of those deals end up failing.”

You may also like...

Future Unclear: Is Pep Guardiola Set to Depart Man City?

Intense speculation surrounds Pep Guardiola's future at Manchester City, with rumors suggesting he might leave earlier t...

Saudi League Slams Ronaldo: 'You Are Not Bigger Than The League' Amid Al-Nassr Strike

)

Cristiano Ronaldo protested the Saudi Pro League's transfer dealings, citing perceived financial bias against Al-Nassr, ...

Set Secrets Unveiled: Rebecca Ferguson Details On-Set Abuse, Keeps 'Idiot' Actor Anonymous

Rebecca Ferguson opened up about a past incident where a co-star screamed at her on set, emphasizing that her story high...

Hollywood Shockwave: Timothy Busfield Indicted on Child Sex Abuse Charges

Timothy Busfield, director of "The Cleaning Lady," has been indicted on four counts of child sexual abuse in New Mexico,...

Must-Read: Yejide Kilanko's 'In Our Own Ways' Offers Exclusive Sneak Peek

Fadaka's spiritual quest, guided by Aunty Kike, leads her through a deceptive journey to a secluded ministry for a 'spec...

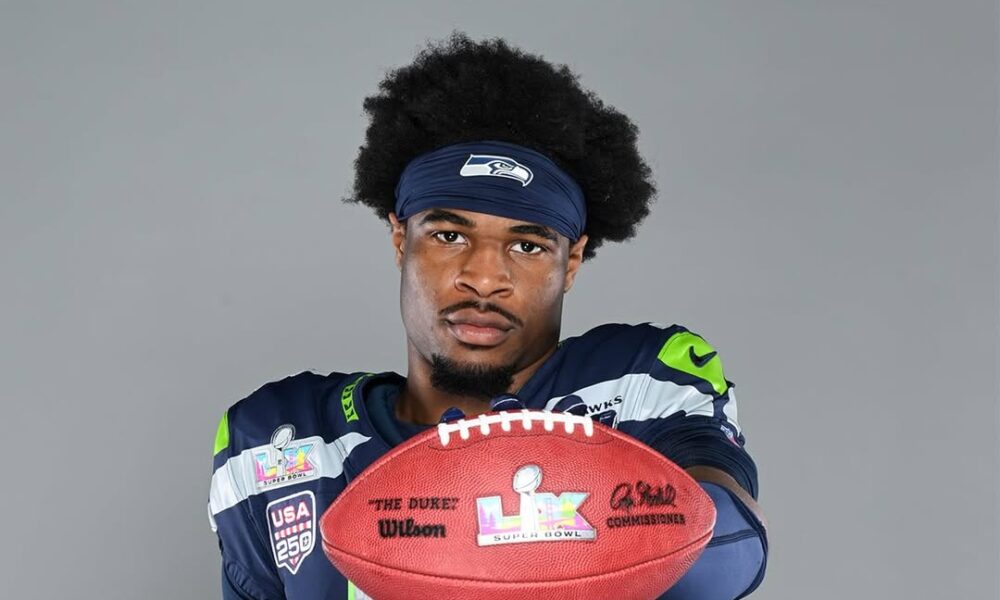

Super Bowl LX 2026: Anticipation Builds for Halftime Spectacle

Super Bowl LX is set to electrify Levi’s Stadium on February 8, 2026, featuring a star-studded halftime show by Bad Bunn...

Probiotic Powerhouse: Yogurt's Reign Challenged by 7 Surprising Dairy Rivals!

:max_bytes(150000):strip_icc()/Health-GettyImages-DairyWithMoreProbioticsThanYogurt-61aceb114e8542caae52b4e4a6067ac6.jpg)

While yogurt is a popular source of probiotics, many other fermented foods surprisingly offer significantly higher conce...

Miracle Spice? Turmeric's 10 Shocking Health Benefits Uncovered

:max_bytes(150000):strip_icc()/Health-GettyImages-ConditionsTurmericCanHelpWith-73e93e547c534162b3a55d2dc5b121d6.jpg)

Discover the extensive health benefits of turmeric and its active compound, curcumin, a potent anti-inflammatory and ant...