Things have been looking up-and-up for over the past month, ever since hitting a low point during a post-Liberation Day slump. The share price has risen over 40% since early April.

Indeed, Snowflake – the cloud-based data platform – is one of the many companies that has benefitted from the relaxation in the trade tensions that had been weighing down global commerce.

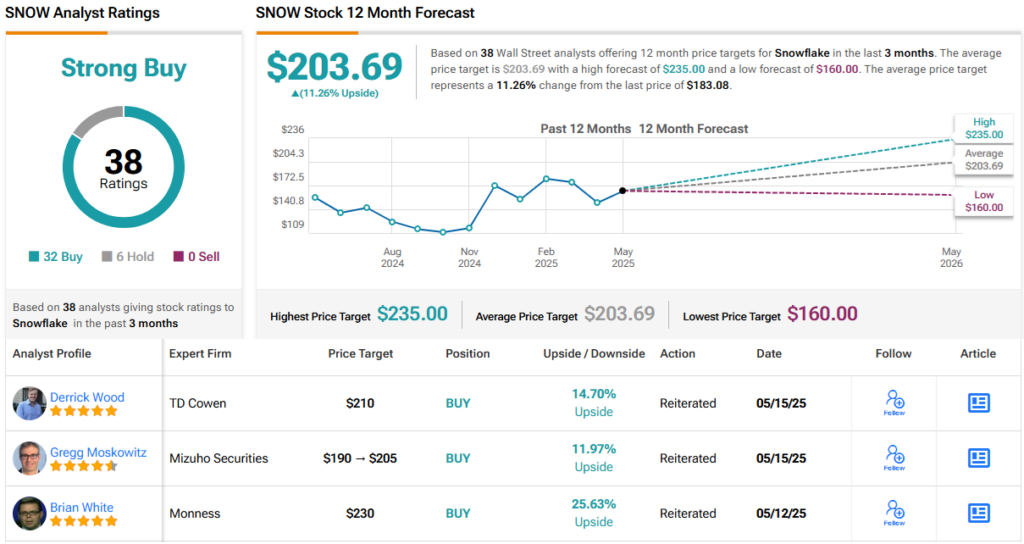

Now, Wall Street is humming with expectations as the company prepares to unveil its Q1 2026 earnings report later this week on Wednesday, May 23. Multiple analysts have reiterated Buy ratings – along with bullish price targets – anticipating that the company will continue on its strong path of growth.

Last quarter, SNOW delivered both top- and bottom-line beats, and analyst projections of $1.01 billion in revenue for the recently concluded quarter would represent a year-over-year increase of some 28%.

However, one top investor known by the pseudonym Noah’s Arc Capital Management is offering a word of caution.

“Despite double-digit growth and AI opportunities, I believe Snowflake’s business execution and competitive pressures make current expectations and valuation unsustainable,” asserts the 5-star investor, who sits among the top 3% of TipRanks’ stock pros.

Noah’s Arc spotlights Snowflake’s decelerating growth, which has fallen off the “hypergrowth” trajectory of years’ past. The investor notes that the company’s net revenue retention is also dropping.

In other words, Noah’s Arc does not buy the market’s assumption that Snowflake will continue to enjoy high growth and margin expansion. This makes SNOW’s “lofty” forward Price-to-Earnings ratio of 155x much too expensive.

“The stock remains priced for near-flawless execution and high growth. I believe these are expectations that the current business fundamentals cannot support,” adds Noah’s Arc.

Another point of contention for the investor is the large amount of stock-based compensation that is diluting shareholders. Last fiscal year, for example, there was $1.48 billion worth of stock-based compensation, which added up to some 41% of total revenues.

Moreover, Noah’s Arc can’t get past Snowflake’s falling net revenue retention, which signifies to the investor that “something is wrong.” The investor further posits that the company’s consumption-based revenue model is becoming less compelling, and warns that future contract renewals could become smaller in nature.

Noah’s Arc floats an additional concern that Snowflake will begin to lose market share to the big players in the tech industry. This does not bode well for Snowflake, either.

“I think intensifying competition means Snowflake is likely to lose key ‘bake-offs’ with competitors. Cloud heavyweights like Microsoft, AWS, and Google are encroaching on Snowflake’s data-platform turf,” concludes Noah’s Arc, who rates SNOW a Strong Sell. (To watch Noah’s Arc Capital Management’s track record, click here)

Wall Street, on the other hand, feels a bit differently. With 32 Buy and 6 Hold ratings, SNOW boasts a Strong Buy consensus rating. Its 12-month price target of $203.69 has an upside in the low double digits. (See )

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.