Rhode Island Pushes Tax Relief: Bitcoin Exemption Bill Returns

Rhode Island lawmakers have once again introduced a legislative measure aimed at temporarily exempting small-scale Bitcoin transactions from state income taxes. This proposal, Senate Bill S2021, marks the second consecutive year such a measure has been put forth, intended as a pilot program to alleviate tax complexities associated with everyday Bitcoin usage. Introduced on January 9 by Senator Peter A. Appollonio, the bill has been referred to the Senate Finance Committee for consideration.

Under the provisions of Senate Bill S2021, Bitcoin sales or exchanges would be granted an exemption from state income and capital gains taxes. This exemption would be limited to $5,000 per month and would be capped at $20,000 annually. The legislation specifically amends Rhode Island’s personal income tax code by incorporating a new section dedicated to Bitcoin. It defines Bitcoin as a “digital, decentralized currency based on blockchain technology,” and extends the proposed exemption to both individuals residing in Rhode Island and businesses primarily based and operating within the state.

If enacted, qualifying Bitcoin transactions falling below these specified thresholds would not be included in taxable income for state purposes. The bill allows taxpayers to self-certify their eligibility on their annual state tax returns, eliminating the need to report individual transactions, provided they maintain reasonable records demonstrating compliance with the annual limit. These records would only be required for production if requested by the state during an audit. Furthermore, the legislation mandates Rhode Island’s Department of Business Regulation to issue clear, plain-language guidance detailing acceptable recordkeeping practices and valuation methods, utilizing publicly available Bitcoin price indices to determine market value at the time of each transaction.

It is crucial to note that this proposal is explicitly temporary. The exemption is slated to take effect on January 1, 2027, and would sunset on January 1, 2028, unless it is extended or amended by the General Assembly following a review of its fiscal and economic impact. Lawmakers characterize this measure as a practical initiative designed to treat digital currency more akin to traditional money for routine, small transactions, rather than solely as speculative investments.

Rhode Island is not alone in exploring pro-Bitcoin initiatives, though most other U.S. states have adopted less comprehensive approaches. Ohio, for instance, is considering a narrow “de minimis” exemption that would remove state capital gains taxes on small crypto purchases below a low dollar threshold. New Hampshire has taken a different path, becoming the first U.S. state in May 2025 to authorize its treasury to invest in Bitcoin and other large-cap digital assets. Under House Bill 302, up to 5% of certain public funds can be allocated to crypto, with Bitcoin currently meeting the market-cap criteria.

You may also like...

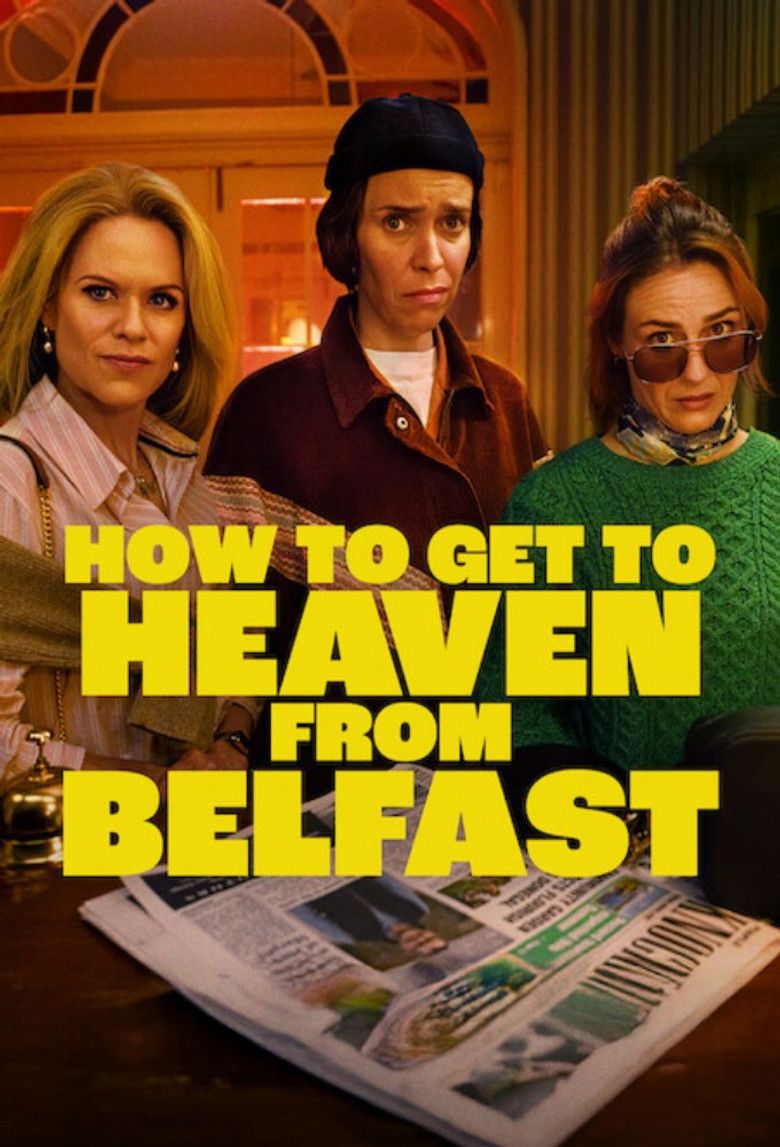

Binge-Worthy 8-Episode Thriller Masterpiece Lands on Netflix!

Lisa McGee, creator of "Derry Girls," brings "How To Get To Heaven From Belfast" to Netflix, a gripping comedy thriller....

Blockbuster Oscar Nominee Hits Netflix After Raking In Millions!

<i>Jurassic World Rebirth</i> redefines the beloved franchise by exploring scientific overreach and humanity's evolving ...

Little Mix's Leigh-Anne Reveals Dream Collaboration with Manon and Normani!

Leigh-Anne Pinnock expressed her desire to collaborate with Manon Bannerman and Normani, a wish that carries significant...

Music Star Thomas Rhett & Lauren Akins Announce Arrival of First Son!

Country music star Thomas Rhett and his wife, Lauren Akins, have welcomed their fifth child and first son, Brave Elijah ...

Bridgerton Stars Unveil Game-Changing Season 4 Death

An interview with the stars of Bridgerton Season 4 Part 2 delves into the tragic death of John Stirling and its aftermat...

Shocking Recruitment Scandal: Kenyan Faces Charges for Sending Youths to Ukraine War

A Kenyan man has been arraigned in court over alleged human trafficking, accused of recruiting 22 youths for the Russia-...

Angola Under Fire: Billion-Dollar Contracts Awarded Without Public Tender

A comprehensive review of Angolan presidential decrees has uncovered that at least US$61.5 billion in public spending wa...

Pentagon Declares AI Heavyweight Anthropic a Supply Chain Risk

The Trump administration has ordered federal agencies to cease using Anthropic products following a dispute over the com...