Revolutionizing Fintech: The Impact of Agentic AI and Onchain Finance, ET BFSI

Looking ahead, BCG sees the next wave of growth coming from three segments: B2B(2X), financial infrastructure, and lending.

With over $13 trillion in global banking and insurance revenues still in play, the fintech sector is set to enter its next chapter of growth, according to Boston Consulting Group's latest report, Fintech’s Next Chapter: Scaled Winners and Emerging Disruptors. The report identifies five major trends that are expected to shape the future of financial technology, pointing to agentic AI, onchain finance, B2B(2X) infrastructure, and a resurgence in lending as key growth pillars.

Agentic AI—AI systems that can operate autonomously with minimal human oversight—is expected to be as transformative as the internet or mobile technology, the report suggests. While most fintechs are still scaling GenAI pilots into production, early-stage companies are already leveraging agentic AI to cut delivery time and costs. Its immediate impact will be felt in software development, but its long-term promise lies in revolutionising commerce, SaaS, and personal financial management. However, scaling agentic AI safely within regulated financial environments remains a key challenge.

Onchain finance, built on blockchain infrastructure, is also nearing a critical inflection point. While stablecoins are already streamlining cross-border payments, the real opportunity lies in the tokenization of illiquid assets like real estate, bonds, and private funds. This could solve problems like slow settlement cycles and high intermediary costs. That said, the pathway to scaling onchain finance requires building interoperable, bank-grade infrastructure and achieving regulatory clarity. Major institutions are already piloting such use cases, but broader adoption is still in the early stages.

Challenger banks, which are now firmly embedded in the banking ecosystem, are expected to see better results from diversifying products and targeting more affluent customer segments than from attempting global expansion. Cross-border growth continues to face regulatory and cultural roadblocks that even traditional banks struggle to overcome.

Lending action

Meanwhile, fintech lending is receiving fresh momentum. Though global fintech-originated loans stand at $500 billion—still a fraction of the $18 trillion US household debt—better customer data, refined underwriting models, and growing interest from private credit funds are creating tailwinds. With $1.7 trillion in assets under management, these funds are becoming significant backers of fintech loans, presenting a $280 billion white-space opportunity. Still, the durability of the fintech lending model through a full credit cycle remains untested.

Looking ahead, BCG sees the next wave of growth coming from three segments: B2B(2X), financial infrastructure, and lending. Businesses continue to face friction in areas like accounting, payments, and treasury management, where embedded fintech solutions and AI could unlock significant efficiencies. Financial infrastructure, though slower to scale due to lengthy implementation cycles, will be central to modernising legacy systems in an AI- and blockchain-enabled world. Lending, particularly beyond unsecured consumer loans, remains underpenetrated and is likely to see innovation in business and secured credit.

With scaled winners now firmly established in areas like wallets, acquiring, challenger banks, and BNPL, the fintech landscape is poised for a new phase—one defined by deep technology integration, infrastructure modernisation, and the rise of new disruptors.

You may also like...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

Beyond Fast Fashion: How Africa’s Designers Are Weaving a Sustainable and Culturally Rich Future for

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...

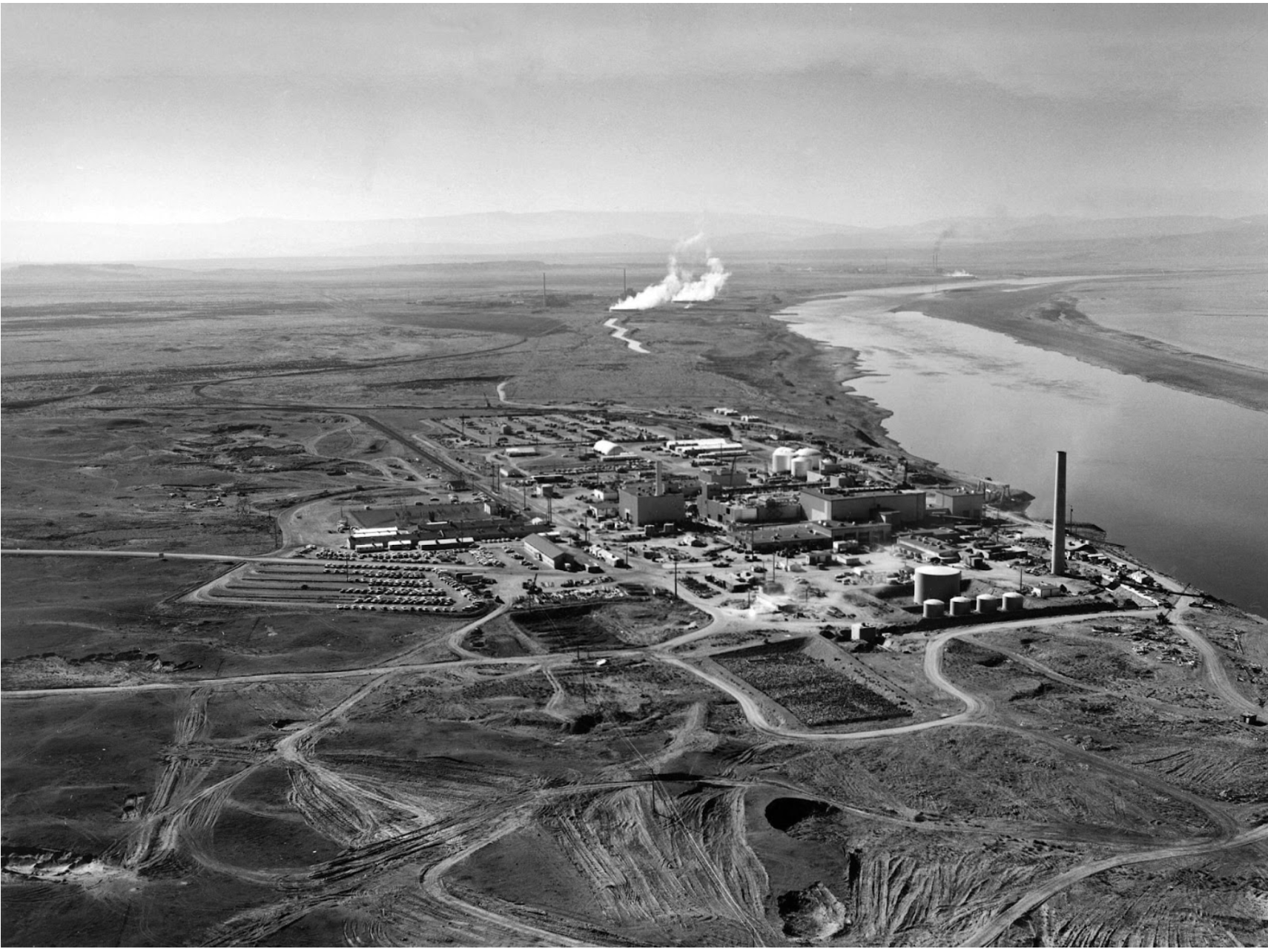

The Secret Congolese Mine That Shaped The Atomic Bomb

The Secret Congolese Mine That Shaped The Atomic Bomb.

TOURISM IS EXPLORING, NOT CELEBRATING, LOCAL CULTURE.

Tourism sells cultural connection, but too often delivers erasure, exploitation, and staged authenticity. From safari pa...

Crypto or Nothing: How African Youth Are Betting on Digital Coins to Escape Broken Systems

Amid inflation and broken systems, African youth are turning to crypto as survival, protest, and empowerment. Is it the ...

We Want Privacy, Yet We Overshare: The Social Media Dilemma

We claim to value privacy, yet we constantly overshare on social media for likes and validation. Learn about the contrad...

Is It Still Village People or Just Poor Planning?

In many African societies, failure is often blamed on “village people” and spiritual forces — but could poor planning, w...

The Digital Financial Panopticon: How Fintech's Convenience Is Hiding a Data Privacy Reckoning

Fintech promised convenience. But are we trading our financial privacy for it? Uncover how algorithms are watching and p...