Retirement Interview 56

If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview was conducted in January. This interviewee is a personal friend of mine as well as one of the most liked and respected mentors in the Millionaire Money Mentors forums. He has previously completed several interviews here including:

My questions are in bold italics and their responses follow in black.

Let’s get started…

My dear wife and I are both 59 years young.

We have been married for 33+ years after dating for 5 years so I have known my wife for nearly 65% of my life.

I suspect I am way more excited by this fact than she will be when I bring it to her attention.

We have three pretty amazing sons who are the center of our lives. They are currently ages 30, 29, and 22.

The two older sons are completely self-sufficient and have been for several years. The 22-year-old graduated college in May 2024 and is slowly embarking on his next adventure.

Within a year from now, we should truly be empty nesting!

We have lived in Florida for the past 2+ years and I suspect this is where we will stay throughout retirement. However, we spent most of our lives in Northern New Jersey and that is where we raised our three children.

Our Florida home is located in a fairly busy and certainly growing, tourist-centric suburban portion of Florida.

Hmmm… I can’t whistle (not sure why), I really have no fashion sense at all (and hardly care) and when I dance (not often) I do so in a manner that is eerily similar to the gopher from the movie Caddyshack.

RETIREMENT OVERVIEW

In the simplest of terms, I visualize retirement as the transition away from trading your time for money. Most people eventually come to realize that time, not money, power, or status, is a person’s most valuable and yet finite asset.

Some realize this earlier in life (Go Team FIRE) and some realize it on their deathbed (less than ideal) but most everyone eventually arrives at this truth. Retirement is that glorious stage of your life when you cease trading your time freedom, or life force to borrow from Vicki Robin and Joe Dominguez, for money.

I retired in April, 2022. I was fortunate enough to be able to retire early (age 56.5) and on my terms, thus I was able to hand-pick my retirement date.

I chose April 1st which is April Fool’s Day. I chose April 1st for a variety of solid financial reasons however I will add that if you want to playfully screw with your workplace leadership, pick April Fool’s Day to retire.

More than one member of leadership pointedly asked me if my early retirement announcement was an April Fool’s joke. No sorry, the joke was on them.

My dear wife’s greatest starring role has been as the pillar of strength who raised our three sons, kept me out of trouble (no easy task), and provided a loving, supportive household for our family. This is a role with no finish line so in many ways she will never get to retire.

She did, however, also work part-time for 40+ years at a small but incredibly busy family candy store where they made the best-tasting chocolate. She retired from that role about 6 weeks after I had retired primarily because she wanted to support her employer during a particularly busy seasonal time.

I have an engineering background but spent most of my W2 career in roles that were focused on the softer side of engineering (Quality Assurance, New Product Development, Process Engineering).

I was fortunate enough to have a lengthy professional career that was rewarding both personally and financially. My annual earnings peaked in 2020 at $338K but probably more importantly I had 18 significant plateau earning years where I averaged about $210K annually.

Our retirement was completely a planned event. We set a goal, crafted a solid action plan, executed the necessary plan tasks, and completed the plan.

Seriously, it was that simple. We were completely focused on FIREing before age 59, developed a plan to do so and we were relentless in our pursuit of that goal.

PREPARATION FOR RETIREMENT

We ramped up the intensity of our execution about 10 years before we actually retired. That is when we got very serious and we ratcheted up that intensity every single year until we eventually retired.

We were always making solid financial moves up to this point but 10 years out was the beginning of us being absolutely relentless.

Ten years before we retired, we got very serious about capturing our financial data and developing applicable metrics that would allow us to achieve our goal. This started with very detailed annual net worth measurements that not only summed up our net worth but also allowed us to project future contributions and investment growth based on our actual account asset allocation.

Additionally, we focused on key financial metrics that are often overlooked by most people on their financial journey. The most impactful metric that we found was our Savings Rate.

We measured both our Gross Savings Rate and our Net After Tax Savings Rate. We looked to grow these metrics every single chance that we could.

These peaked two years before retirement at 46% and 62% respectively. Your journey really starts to accelerate at these savings rate levels.

We also leaned into utilizing 8 to 10 retirement calculators annually to provide guidance on our progress. We actually still re-run these calculators annually as a check on our journey’s likelihood of continued financial success.

Why 8 to 10 calculators? Even the better retirement calculators are inherently flawed but if 8 to 10 of them agree that your financial plan is sound, it is very likely that you will be just fine.

Lastly, 3+ years before retiring we starting building cash flow projections for our retirement years. This is very important to address prior to retiring.

It is easy to say that you are projecting to spend $XXX dollars a year in retirement (adjusted annually for inflation) but it is way more challenging to specifically state every year where these dollars are being withdrawn to be spent. These details are hugely important as you need to build your personal paycheck from your assets.

We retired with zero debt so we have no financial liabilities. I realize that holding a modest mortgage in retirement may technically be a solid financial move (vs spending down assets to pay off your mortgage).

However, I find a real joy in being debt-free at this point in our journey so frankly I did not care what the spreadsheet says.

Our net worth on our retirement date was $3.1M. This included approximately $2.8M of investable assets as well as our mortgage-free retirement home in Florida.

At retirement, our investable assets were still heavily invested in US equities. However, we knew that within a few months we would be selling our mortgage-free home in New Jersey and moving to our vacation home in Florida.

Therefore, we quickly went from a position of having little cash to adding $450K of cash to our portfolio. This not only provided a large cash buffer but also allowed us to add a bit to our brokerage account equities at a time when the US market was in a short-lived bear market. Winner winner, chicken dinner.

Our tax diversification at retirement was and still is less than ideal. Shortly after adding the funds from the sale of our house, our tax diversification stood at 28% taxable accounts / 70% tax-deferred accounts / 2% tax-free accounts.

Not ideal but our sizable taxable accounts are allowing us to bridge our spending until we reach ages of >59.5.

Pre-retirement we had collected several years of annual spending data which we used as a guide for retirement planning. Our initial plan was to spend similarly initially in retirement.

This proved to be an erroneous approach as we had really ratcheted down our spending leading up to retirement. Our time freedom initially in retirement greatly increased our ability to spend and we wanted to do so.

Luckily, we had built-in buffers to allow for increased spending.

We had never used a strict budgetary approach to spending during our accumulation phase and so far we have not done so in retirement. We simply attempt to spend mindfully but freely on things that we value.

This has resulted in us spending between 4.0% and 5.0% of our net worth annually. This may concern some 4% Rule purists but it does not worry us at all given the significant Social Security which we will begin collecting in 6 to 11 years.

Once our Social Security starts rolling our annual spending will likely drop to 2% to 3%.

We made a few key financial moves leading up to and into our retirement…

I became eligible for the 401K at my last employer in the fall of 2021 and I retired on April 1st of 2022. In that short 5-month window, I placed 100% of my salary into the 401K maximizing our 401K contributions for both what remained of 2021 and the 1st 3 months of 2022.

It was nice to bang these retirement accounts two last times before retiring. My wife’s face when I told her that we would not get a paycheck for 5 months was priceless but it all worked out just fine.

A few months after retirement, we sold our mortgage-free NJ home for $500K and moved to Florida. Doing so instantly provided us a cash cushion in our portfolio that previously was at least 95% invested in US equities.

With the help of a dear friend who is a long-time employee of a regional bank, we opened a $100K HELOC using our Florida vacation home as collateral. Typically, banks are hesitant to open HELOCs on rental properties, so we called in a favor.

This money serves as our “just in case I screw this up” money.

For good or bad I can honestly say that this plan was completely the brain tulip of my wife and I with me being the chief warped architect.

Along my journey, I have consumed and continue to consume a tremendous amount of information from FIRE and personal finance knowledge via blogs, podcasts, and YouTube. My personal finance resources have evolved over time as my personal finance interests have changed.

My list of recommendations is 25+ long so contact me if you want some resources and I can direct you best based upon where you are on your personal journey. I also have found great value being a member of two very unique personal finance tribes:

We do not have a financial planner however some 40% of our investable assets are managed by a professional money manager with 25+ years of investing experience. He is very happy to answer specific personal finance questions and adds value to our lives in many ways.

I created a detailed Excel spreadsheet in which I logged about 60 tasks to be completed prior to our actual retirement dates. These “to do” tasks focused on healthcare, financial, professional, and personal needs.

I found that having this document allowed me to organize my thoughts at a granular level.

I really was pretty confident in our ability to execute our plans (perhaps overconfident?). I honestly did not have many pre-retirement concerns other than the pressure to get our long-time house sold as mortgage rates rose quickly in 2022.

In the end, like so many worries, this proved a non-issue, and our home sold quickly for slightly more than we were asking.

We are utilizing a high-deductible healthcare plan through the ACA. This is our 3rd year doing so.

Overall, we have been pleased with the value presented by these healthcare plans. The ACA is an imperfect program for sure but it is far better IMO than what the world looked like prior to having this program in place.

The protections for people with pre-existing conditions alone make it a winner (FYI – we do not have any but I can recognize the need for these humane protections).

We briefly considered a healthshare option and we may do so again in the future but the fact that it is not contractual healthcare concerns us even though we have some friends who are very pleased with their healthshare program.

I realize that healthcare for an early retiree can seem daunting and it is certainly often presented that way by the media but it is simply just another solvable challenge. My advice would be to not let a fear of healthcare coverage challenges in early retirement keep you from living your dream life.

Tell them? I never shut up about our plans to FIRE for 10+ years.

I told everyone who would listen to me and I told those who did not care anyway. It was a surprise to nobody but my last employer that we were on a timeline to retire early.

I do think many friends were surprised that we were able to execute our plan. There was quite a bit of – Holy Crap they actually are going to retire early.

Absolutely. I had heard all of the common wisdom about retirement transitions.

The resource that really helped me frame my retirement was a book by Ernie Zelinski called How to Retire Happy, Wild and Free. This is a very atypical finance/retirement book that drives home the point that you need to craft your Get-A-Life Tree before you retire and just as importantly you need to continue to nurture and grow this tree throughout your retirement.

I literally had an entire wall in our den covered in color-coded Post It notes showing my Get-A-Life tree. I spent many hours on this and it paid dividends.

My wife crafted her own tree as well but honestly not with the same zeal as I did. I think this may be a small part of the reason why the actual retirement transition was much easier for me than it was for her.

THE ACT OF RETIRING

Several months before my actual retirement, I selected April 1st as my target retirement date. The choice was perfect.

It allowed me to max out my 401K one last year. It was a Friday so the end of the work week.

It was the 1st day of a new month so it allowed me to have company-sponsored healthcare for an additional month. And, of course, it was April Fool’s Day which seemed like a great FU to Corporate America!

The few months leading up to my retirement announcement through my actual retirement went very smoothly. As I neared retirement, I was searching for a person within the organization that I could secretly partner with to tie out on some details of my plan.

This is tricky and it is very hard to find an individual, in a leadership role, that you can fully trust. Ultimately, I decided to trust the HR Director who reported to my boss as well so my choice could have easily gone poorly.

My judgment of the HR Director’s character turned out to be accurate and we well worked together to make my transition a victory lap vs a hot mess.

There was very little that did not go well. I was fortunate to work with some absolutely amazing people throughout my career and this was true of my co-workers at my final employer which was a smaller startup company.

I was actually the very 1st retiree from the company and they gave me a loving, heartfelt sendoff which I still cherish.

I think the biggest surprise to me regarding my final weeks of employment was how very invisible I became to leadership from the very day that I announced my pending retirement. I had purposely given 4+ weeks’ notice since I knew my broad role would be hard to fill and I wanted to help with the transition as much as I could.

It turns out, they did not want my help. I went from the go-to guy on every significant manufacturing, distribution, and quality assurance question to an invisible, non-participant.

Very odd but I suspect this might be more common in the corporate world than I had realized.

I could have easily been bitter about being made invisible but since I now had a great deal of free time while still getting paid, I decided to use that time for the greater good.

What did I do? I first went around and helped as many people as I could people set up their 401K plans and get started investing in their future.

Since I was not a part of HR, I could be very specific in terms of financial recommendations. I was just a friend helping friends.

Second, I held one-on-one meetings with anyone who wanted to learn about FIRE and how I retired early. I showed them everything including all of my financial data. It was a very rewarding final 4 weeks of my career.

In complete honesty, I never actually suffered from one more year (OMY) syndrome. I very much enjoyed my work career and I feel very fortunate to have had such a rewarding career.

I especially cherish all the friends who I made over my many years. However, I was very happy to pivot to my encore career as an early retiree.

Life is very much different now but both portions of my journey have been wonderful.

RETIREMENT LIFE

I definitely experienced a short decompression period but it really took very little for me to embrace my new time freedom.

Easy – I do not dislike one damn thing about my retirement life! Honestly, my life could not be better.

Of course, being retired does not remove every challenge from your life. Real life can be messy and that does not change just because you are financially independent or you retire.

However, attacking challenges in retirement is much more enjoyable than when you are dealing with work life stresses.

We adore our time freedom. We tend to keep very busy but we enjoy a fast pace and many stimulating activities.

It is wonderful to wake up the vast majority of your days and tackle whatever YOU feel is important at that moment. That is true freedom.

A typical day in our retirement life looks something like this:

Despite being retired, I do find that I still feel the need to accomplish both physical and mental activities every day. Even if I have a productive day but I do not get both mental and physical activity, I do not feel positive about the day.

Maybe that is just how a lifelong Type A person behaves in retirement (or maybe I am just an odd duck).

For many years we have been semi-focused on physical fitness but early retirement really has allowed us to make this a key daily activity. We spend anywhere from 1.5 to 2+ hours a day, at least 5 days a week exercising with a purpose.

We like to travel and be active so planned travel is a big part of our schedule. Since retiring we have taken at least half a dozen cruises, some of these for longer than a week.

Additionally, we travel throughout Florida and everywhere else as the fancy strikes us. We just returned from a short 4-night trip to Las Vegas.

We also love a good road trip so we often get in the car and take long road trips up to NJ to visit family and long-time friends. This is travel-based but much more about socialization than seeing new places.

We live 10 minutes away from Walt Disney World so we spend many, many, many days enjoying all the Walt Disney World attractions and hotels. We often head out to various local spots for some live music, food and drink.

We are looking to try some slow travel in the future in which we would travel but live somewhat like locals vs spending every day as tourists. We are targeting 2025 for our 1st attempt with a 2-month trip to the New York Adirondack region.

Our social life has always been pretty robust. We are “peoply” by nature.

Retirement itself did not hinder our social life one bit. I have always stayed in touch and met socially with many people who I worked with over my career. It is a big part of who I am so retirement did not hinder that at all.

Our physical move away from our very rich social network in NJ to Florida has most definitely hindered our social network on a day-to-day basis. However, since we now in a very tourist-centric area that is fun to visit, we find that we get many, many visitors who stay with us often.

It is like we opened our own bed and breakfast in retirement! We are also slowly making new Florida friends.

This is definitely a slower process when you are older and it takes some effort.

There is really not much that I would change. I will share a few words of caution regarding change.

Most people dislike or are fearful of change. For some people it is a combination of both.

My wife really dislikes change. Change has never been a hurdle for me but I can recognize that I am in the minority on this topic.

Our plan as executed included a great many changes in a short time. I retired. My wife retired.

We started living off assets (vs paychecks). We sold our long-time home. We moved 1,000 miles aways from lifelong friends.

All of this happened in 7 months or less. In hindsight perhaps I should have allowed for a longer window for these changes to take place.

There was some and honestly that surprised me. I had excitedly anticipated this day for so long (15+ years) and planned most every detail.

When the day arrived, I was very surprised how emotionally draining it was to close this chapter of my life. I knew it would be more emotional for my wife given how long she had worked for the same family but I was surprised that I was a bit of a trainwreck emotionally myself.

I have been surprised how much money remains a topic in my head. I have slowly begun to relax as we near 3 years in retirement but I am surprised how conscious I remain about our financial plan.

I remain an optimizer although I am working on toning down my efforts. I would not use the term worry but it has definitely taken a while for some of the angst to diminish even though by all measures our plan is very sound and most future decisions will hardly move the needle much.

Talking about this angst with others who are on their own FIRE journey has been very therapeutic. My advice: find a few mentors or peers that you can trust and share openly.

I am surprised how joyful it is to be unimportant. When I was in the peak years of my career, I held leadership roles in which I was important to day-to-day operations.

I was in many ways, very important. I absolutely enjoyed being important. It was a rush.

Now I am happily retired and I am in many ways completely unimportant. I no longer make critical daily decisions.

I no longer develop strategic plans. I no longer lead a team of professionals. I no longer, hire, fire or promote people.

I am by many measures now unimportant. I thought becoming unimportant might bother me quite a bit.

Surprise – it has not bothered me at all. There is real peacefulness in being unimportant.

My plan is simply to stay healthy both physically and mentally as long as I possibly can so that I can spend as many active years with my amazing wife and family. I think being active and engaged is a key to a long and happy life.

I also do very much enjoy most personal finance topics and I would like to continue to help as many family members, friends, and even casual acquaintances get over the retirement wall as early as they would like to do so. There is plenty of room on this side of the wall for great people to join us.

RETIREMENT FINANCES

We retired into the beginning of the 2022 US stock/bond bear market. Granted it was a fairly rapid bear market and the market recovered quickly however nobody would want to retire into the start of a bear market.

Fortunately, we had taken precautions in case of such an event and had a large cash cushion as well as other margins of safety in place so we did not have to see equities at lower prices. Since the end of 2022 Mr. Market has been very generous and we have been rewarded for keeping to our planned high US equity asset allocation.

Therefore, despite 2.5+ years of solid spending, our network has grown significantly. As of year-end 2024 our Net Worth has increased from $3.1M at retirement to $4.1M.

One footnote: there are approximately $300K of additional monies added to our net worth after retirement through a lump sum pension payout and a small inheritance. Even with these additions removed, our net worth has grown by $700K (+23%) over 2.5+ years which is far greater than I would have ever imagined.

We have spent between $135K and $156K annually each of the past three years. This is significantly more than we were spending leading up to retirement ($85K the year before retirement).

Peter Drucker, renown business author/educator, is credited with saying: “Tell me what you value and I might believe you, but show me your calendar and your bank statement, and I’ll show you what you really value”. I think there is great truth in this statement.

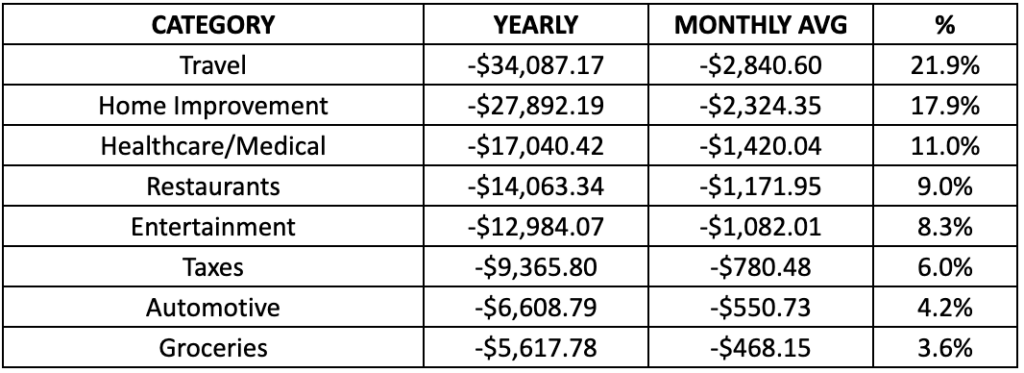

Here are the largest spending categories for our household in 2024:

When reviewing spending habits, it naturally helpful to focus on the larger spending categories and assure that this spending is in line with your personal goals. Additionally, much can be learned by looking at what you spend very little money to acquire.

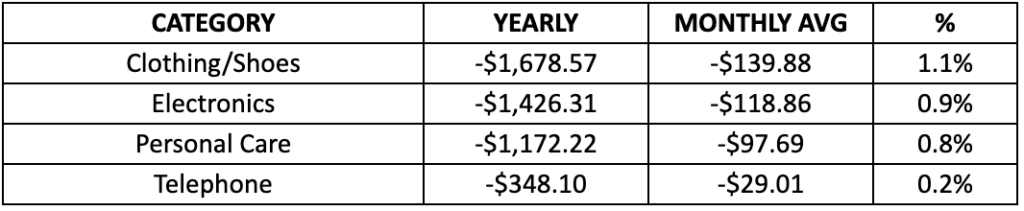

Here are some notably modest spending categories for us in 2024:

There is nothing wrong with spending significantly on these categories if they bring you joy however, we clearly did not value them much in 2024.

We generate almost all of our income from spending down assets. At the moment, given our age, all of the spending comes from our taxable brokerage and online savings accounts.

The current plan is to slowly start tapping out traditional IRAs in 2027. This will accelerate after we enroll in Medicare at age 65 and ACA income limits are lifted.

This is absolutely one of the more significant financial challenges that we are grinding through mentally. Additionally, we have ACA subsidies and necessary capital gain harvesting challenges.

These are all interrelated. This puzzle is really one that cannot be easily optimized given the unknowns involved.

I find that a reasonable approach when you encounter these types of complex challenges is to strike a balance. Thus, we are doing annual Roth conversions up to the 12% federal tax bracket limit which results in us retaining some but not all of our possible ACA subsidies.

Additionally, by staying in the 12% federal tax bracket, our long-term capital gains that we are harvesting are taxed at 0%.

All of these annual moves mean that only a portion of our traditional IRAs will get converted before RMDs begin at age 75. However, we also plan to spend fairly significantly from our traditional IRAs beginning at age 62 so this will help keep our traditional IRA balances from growing exponentially.

I have a keen eye on this situation but at this time I am not terribly afraid of RMDs. We saved this money to spend it in the future, so let’s spend it.

We have not returned to paid work in any way. We are not opposed to doing so in some modest, low-stress role but frankly our time freedom has been so amazing that we cannot imagine. compromising it for a few more dollars that we will never spend.

We have enough and knowing that we do is golden.

Surprisingly not one damn bit. That is actually a bit of a shock since we had always been somewhat frugal and we really had ratcheted down our spending greatly the last 5 years of our working years.

We retired in our Go-Go Years and we are Go-Going. I realize this is somewhat unusual for those who FIRE, even late FIRE but honestly, this has been no problem for us.

We are nearing three years as retirees and we are honestly still discovering new quirks about this amazing lifestyle. I think one of the hardest lessons that I am learning very slowly is to relax regarding our finances.

Once you have won the game (retiring at age 56 is a win to me), it is fine to keep playing the game. However, you do not need to optimize every financial decision any longer.

Get things directionally correct and chill a little bit (man I suck at chilling out).

My middle son shared this with me in a cherished retirement congratulations card. I am overjoyed to share this with all of you now.

The sooner one learns this profound life lesson, the sooner one can really start living fully.