Required Minimum Distributions: Navigating through your IRA's required withdrawals

After a certain age, holders of retirement accounts such as Individual Retirement Accounts (IRAs) are required to known as Required Minimum Distributions (RMDs).

These withdrawals, imposed by the U.S. tax authorities, and preserve the coherence of your retirement strategy.

on funds held in certain retirement accounts, notably Traditional IRAs.

They are designed to ensure that savings accumulated tax-free over the years are actually subject to tax at retirement.

Since the SECURE 2.0 law came into force, the age at which these withdrawals are required has been raised. People born between 1951 and 1959 must start their RMDs at age 73, while those born in 1960 or later must wait until age 75.

Roth IRAs, on the other hand, are not subject to RMDs as long as the account holder is alive, making them a strategic long-term tool for certain people in retirement planning.

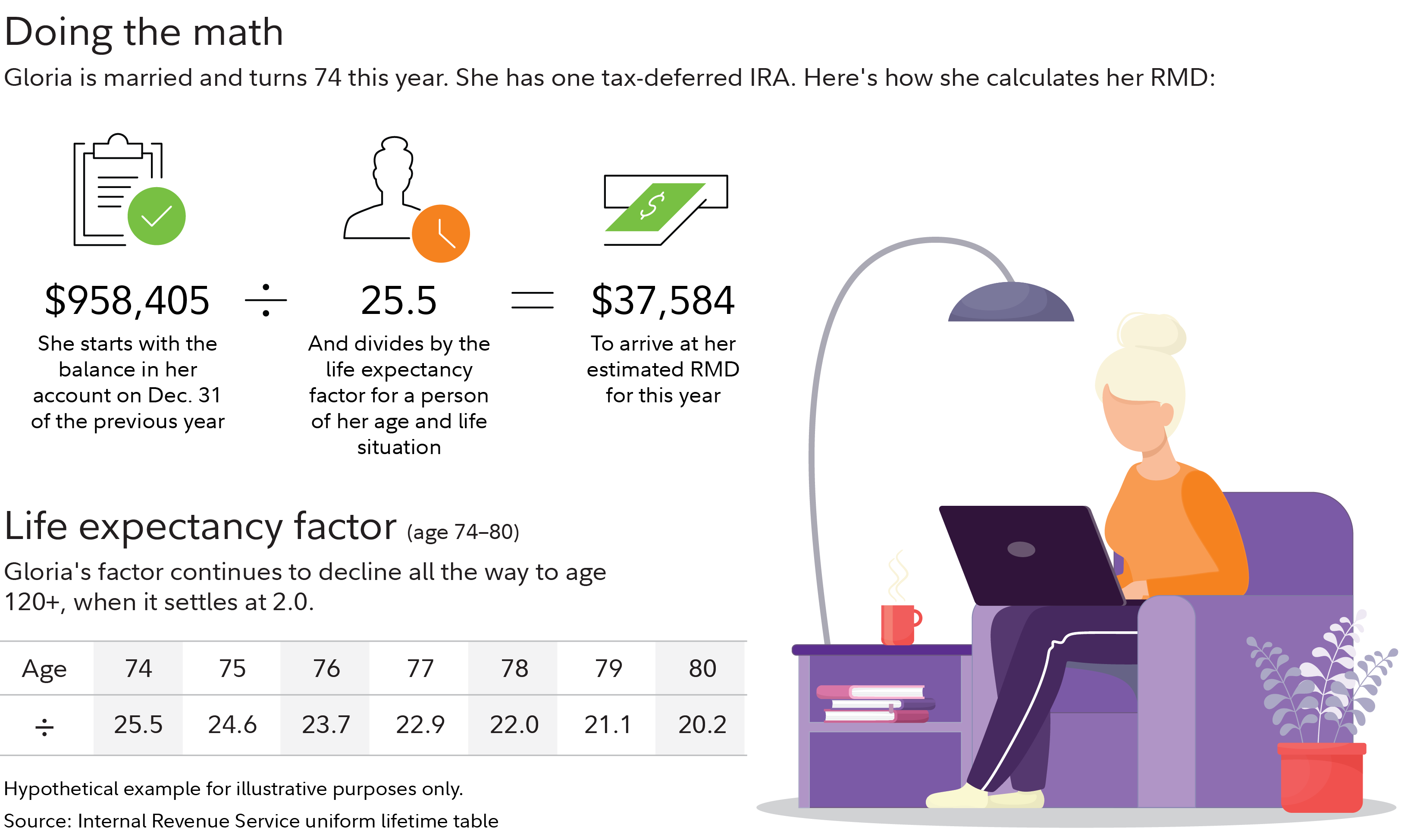

The annual RMD is calculated by dividing the account balance at December 31 of the previous year by a factor determined by the IRS, based on the account holder's life expectancy. This calculation is updated each year.

For example, if the IRA balance is $500,000 and the IRS factor is 25, the minimum amount to withdraw will be $20,000.

This amount is considered taxable income, and its , reduced to 10% if the error is corrected promptly.

other sources of retirement income, notably .

, resulting in increased taxation, including on a portion of social security benefits that would otherwise be partially or totally exempt.

It is therefore essential to integrate RMDs into a global approach to retirement planning, taking into account all available income and its tax impact.

of the year following that in which the holder reaches the required age. For subsequent years, withdrawals must be made by December 31.

It is important to note, however, that postponing the first withdrawal until April 1 implies two withdrawals in the same tax year, which may result in a significant increase in taxable income.

There are several strategies for limiting the tax impact of RMDs and integrating them optimally into a retirement strategy:

When a taxpayer holds several IRA accounts, he or she is allowed to calculate the total amount required for all accounts and make the withdrawal from just one of them.

However, this flexibility does not apply to 401(k) plans, for which each account is treated separately and requires its own RMD.

, but as a central element of end-of-career financial planning.

Integrating them into a coherent retirement planning scheme optimizes overall taxation, preserves the value of remaining assets and coordinates withdrawals with Social Security benefits.

Anticipating these withdrawals well before the legal retirement age can limit their negative impact. The choices made by savers in their 50s and 60s have a decisive effect on the structure of their future income and their ability to cope with unforeseen events.

for holders of certain retirement accounts, but also an and taxation.

By approaching them with rigor and anticipation, retirees can minimize their negative effects and preserve their long-term financial security objectives.

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...

![IGP Yohuno visits Ablekuma North [Photos+Video]](./public/placeholder.png)