RBA's Inflation Fight Costs Home Buyers $290 Billion

The Reserve Bank is expected to lower official interest rates below 4% for the first time in over two years, as borrowers have paid over $250 billion due to the bank's efforts to curb inflation. The monetary policy board will commence its two-day meeting on Monday, with financial markets anticipating a quarter percentage point cut to 3.85%. Reserve Bank governor Michele Bullock is likely to announce this rate cut this week. The last time rates were below 4% was in May 2023, when headline inflation stood at 7% and underlying inflation exceeded 6%. Currently, headline inflation is at 2.4%, while underlying inflation is at 2.9%.

For a $600,000 mortgage, a quarter percentage point reduction would decrease monthly repayments by approximately $100. This follows the February rate cut, which also provided a $100 monthly saving on the same loan size. Gareth Aird, head of Australian economics at Commonwealth Bank, noted that despite the strong jobs market, the RBA appears to have successfully lowered inflation, allowing for an easing of interest rate settings. He stated, "Our view is that the proverbial inflation dragon has been slayed," and that domestic data suggests a 'soft landing' has been achieved, enabling the RBA to normalize the cash rate through 2025 to a more neutral level.

New figures from the Reserve Bank confirm that Australian home buyers paid a record $20 billion in interest on their mortgages in the March quarter. Over the 12 months to March, they paid almost $80 billion in interest, a 159% increase compared to the 12 months before the RBA’s initial rate rise in May 2022. Including interest paid by investors, Australian borrowers have paid nearly $290 billion in interest on home loans since 2022, compared to $157.5 billion in the three years prior.

Even at 3.85%, the Reserve Bank will likely consider monetary policy restrictive, suggesting further rate cuts later in 2025 and into 2026. Recent data showing unemployment steady at 4.1% despite increased job creation in April and wages growth at 3.4% align with the Reserve Bank’s economic forecasts, which are to be updated on Tuesday. EY senior economist Paula Gadsby believes these figures, along with recent inflation data, will give the Reserve Bank confidence to cut rates now and in the second half of 2025. She stated that the Reserve Bank would likely be comfortable with both the labor market and recent wages data as it considers loosening monetary policy at its board meeting.

The global economy has faced turmoil due to Donald Trump’s tariff war. Financial market volatility has decreased recently as the United States and China have reduced their tariff impositions. However, the US’s effective average tariff rate on all imports has risen to an 80-year high, causing concerns about US economic growth and inflation.

Economists at ANZ suggest a quarter percentage point rate cut this week is probable. ANZ had anticipated three cuts this year, starting in May and followed by reductions in July and August. They now expect the next move in August, with a further rate cut early next year. They stated that easing in May is the 'path of least regret' for the RBA, given the uncertain global backdrop and encouraging inflation outcomes. They also noted that while there has been an impact on Australian consumer and business confidence, progress in US-China trade talks has reduced the risk of a more pronounced global shock.

You may also like...

Who Is To Blame For Floods in Nigeria?

From local government budgets to digital tools tracking public spending, explore the root causes of flooding in Nigeria—...

The Nilotes: Africa’s Tallest and Darkest-Skinned People

This deep-dive unpacks their striking physiques, ancient migrations, and enduring cultural traditions. From cattle pasto...

From Skit to Screen: How Instagram Comedians Are Taking Over Nollywood

Instagram comedians like Layi Wasabi, Taooma, and Lasisi Elenu are redefining Nollywood stardom. From short skits to maj...

Beyond the Headlines: Decoding Africa's Self-Determined Evolution

Forget outdated narratives. Africa is forging its own future, driven by youth, tech, and a powerful reclamation of ident...

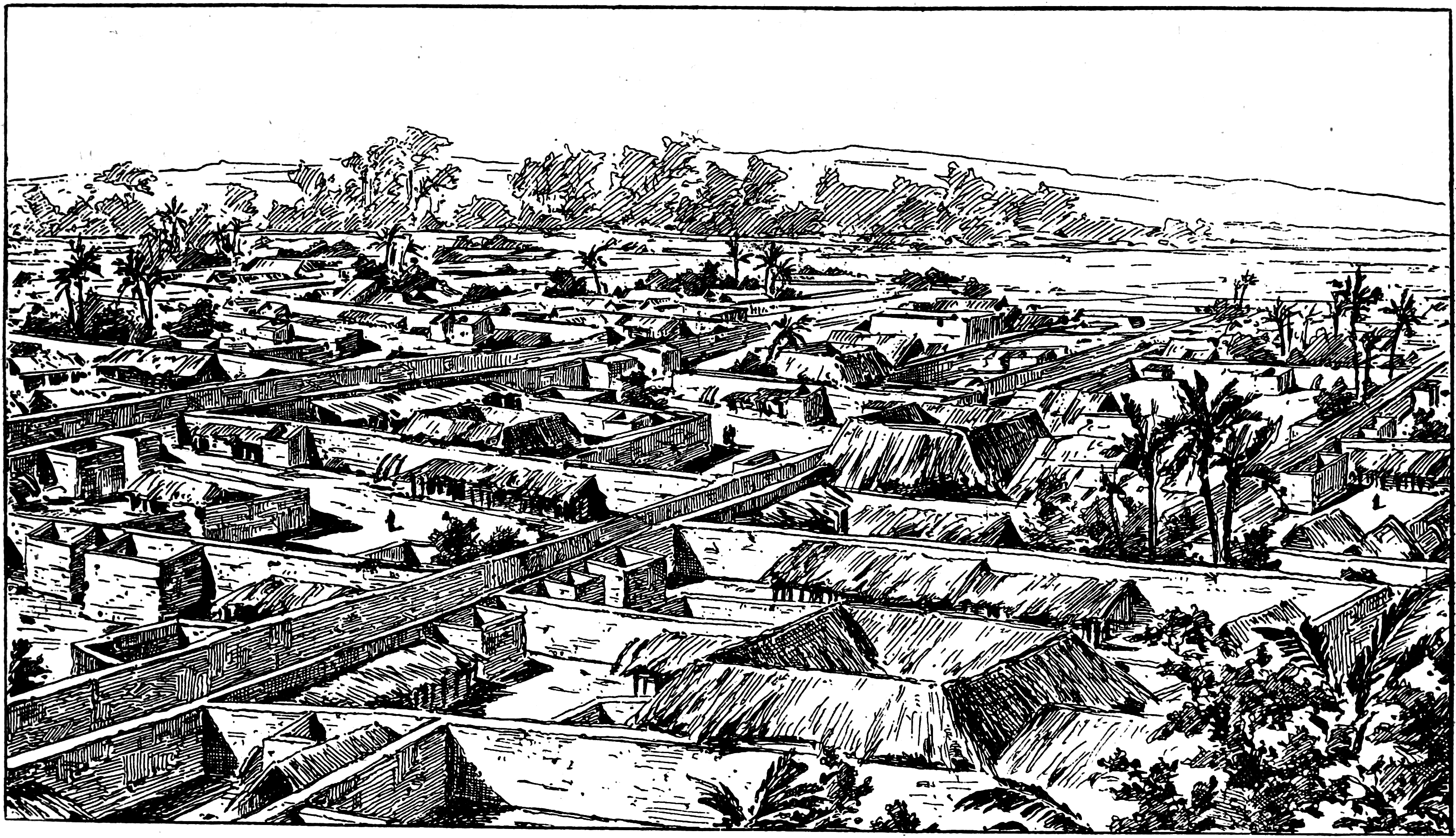

The Bini Empire Had Streetlights Before London: What We Were Before We Were Colonized

Before colonization, the Benin Empire was a thriving civilization with urban planning, advanced politics, and even stree...

Who Sold Nigeria? A Journey into the Royal Niger Company and the Auctioning of a Nation

The Royal Niger Company "sold" Nigeria to the British government for £865,000 in 1899. This transaction marked the trans...

How Africa Is Winning With Digital Payments

(9).jpeg)

Africa’s fintech revolution is redefining digital finance. From M-Pesa to blockchain innovations, discover how mobile mo...

Africa’s Food Crisis: How Climate Shocks and Global Politics Threaten the Continent’s Plate

(7).jpeg)

Africa’s food crisis is deepening as climate change, soaring prices, and global politics threaten millions. Discover how...