Nigeria Shifts Economic Strategy: Government Aims for Less Debt, More Investment

Nigeria’s Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has reaffirmed the Federal Government’s commitment to reducing reliance on borrowing while aggressively attracting investment into the economy. Speaking to Bloomberg TV on the sidelines of the World Economic Forum in Davos, Edun said the Tinubu administration is prioritizing fiscal discipline and investment-led growth under its Renewed Hope Agenda.

He explained that although the 2026 budget reflects a wider deficit on paper, the government is firmly focused on fiscal consolidation following key reforms that have removed structural distortions and improved macroeconomic stability. According to Edun, the administration’s central objective is to consolidate recent gains, lower dependence on debt, and stimulate investment—particularly domestic investment—as the engine of sustainable growth.

Edun said Nigeria’s presence at Davos was aimed at projecting the country’s renewed investment appeal. “We’re here in Davos to tell the Nigerian story and to show how investible Nigeria is now that we have a stable macroeconomic environment,” he noted. While Nigeria has the capacity to issue another Eurobond, he stressed that any return to international debt markets would depend strictly on favorable conditions and adherence to borrowing limits.

Rather than external borrowing, the government’s immediate focus is boosting revenue and mobilizing domestic resources to reduce the debt burden. Nigeria’s debt-to-GDP ratio stood at 39.4 percent in Q1 2025 following GDP rebasing, with the IMF projecting a decline to 35 percent by 2026. To achieve this, Edun said the government is implementing four new tax reform laws aimed at raising the tax-to-GDP ratio from about 13 percent to 18 percent, alongside deploying technology to improve revenue collection and eliminate leakages.

He added that with the private sector accounting for about 90 percent of GDP, the administration is strengthening incentives to encourage higher consumption, savings, and investment by Nigerians, the diaspora, and foreign investors. The government is also exploring investment inflows from cash-rich regions such as the Middle East as part of its broader investment drive.

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

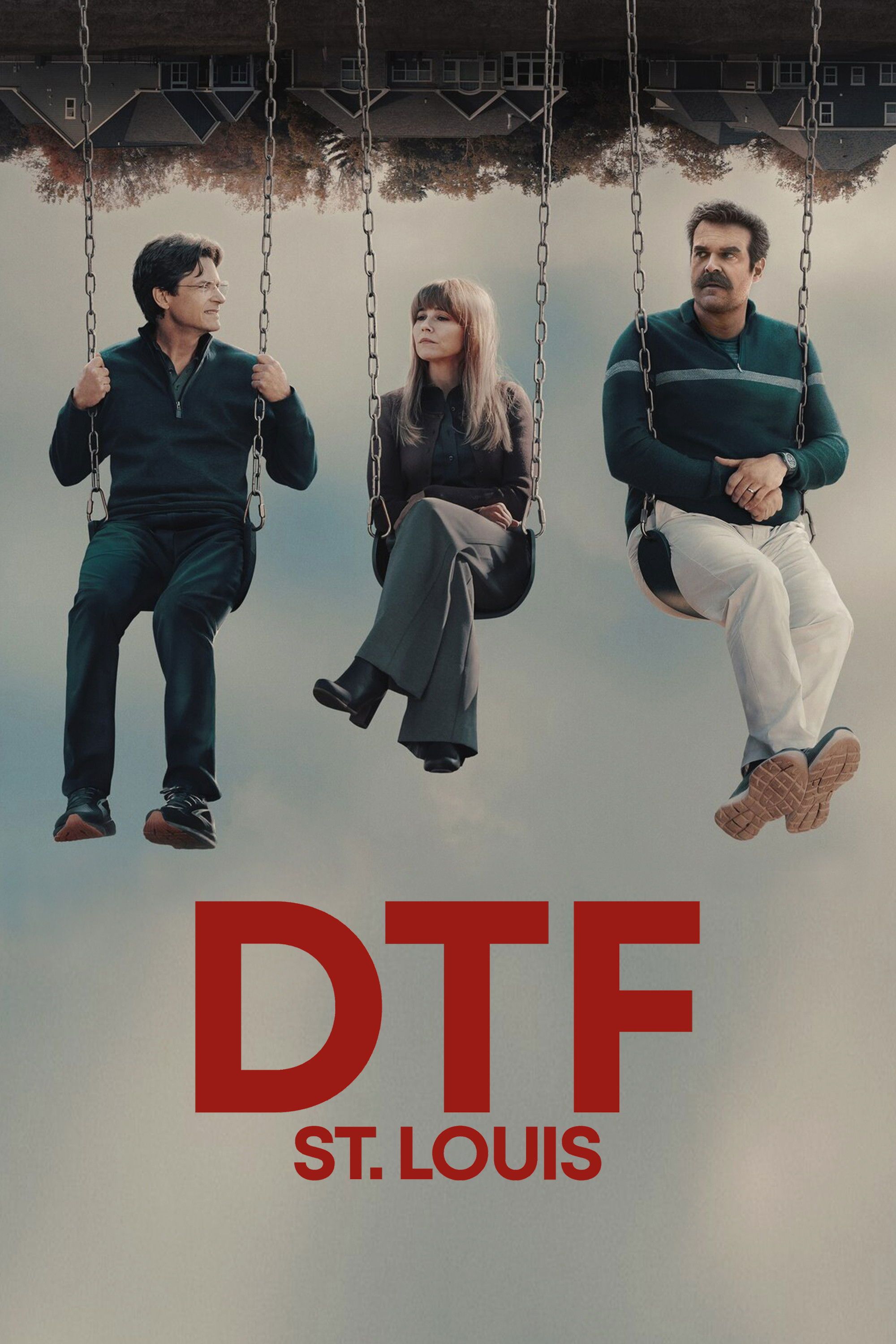

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...