Nigeria Hits Record High: FAAC Pays Out Staggering N1.8tn Revenue

The Federation Account Allocation Committee (FAAC)has reported the highest monthly revenue allocation for 2025, distributing a total of N1.818 trillion among the federal, state, and local governments in June 2025. This significant amount was confirmed in a communiqué issued after the FAAC meeting held in Abuja in July 2025, according to Mr. Bawa Mokwa, Director of Press and Public Relations at the Office of the Accountant General of the Federation (OAGF). This latest distribution represents a notable increase compared to the preceding five months of the year. For context, the FAAC shared N1.659 trillion in May, N1.681 trillion in April, N1.578 trillion in March, N1.678 trillion in February, and N1.703 trillion in January.

The N1.818 trillion distributable revenue for June 2025 was derived from various revenue streams. These included N1.018 trillion from statutory revenue, N631.507 billion from Value Added Tax (VAT), N29.165 billion from the Electronic Money Transfer Levy (EMTL), N38.849 billion from exchange difference revenue, and an additional N100 billion sourced from non-mineral revenue through augmentation.

According to the communiqué, the total gross revenue available in June 2025 stood at N4.232 trillion. From this gross amount, deductions for the cost of collection amounted to N162.786 billion, while a substantial N2.251 trillion was earmarked for transfers, interventions, refunds, and savings. A detailed breakdown of the gross revenue components highlighted that statutory revenue for June reached N3.485 trillion, marking a substantial increase of N1.390 trillion compared to the N2.094 trillion received in May. Conversely, gross VAT revenue experienced a decline, dropping from N742.820 billion in May to N678.165 billion in June, a decrease of N64.655 billion.

Photo Credit: Pinterest

The distribution of the N1.818 trillion distributable revenue saw the Federal Government receive N645.383 billion. State governments were allocated N607.417 billion, and local government councils received N444.853 billion. Additionally, N120.759 billion was distributed to oil-producing states as 13 percent derivation revenue from mineral sources.

Further detailed distribution by revenue component showed specific allocations. From the N1.018 trillion statutory revenue, the Federal Government received N474.455 billion, state governments were allocated N240.650 billion, and local government councils received N185.531 billion. Oil-producing states received N118.256 billion as part of their 13 percent derivation from this segment. For the N631.507 billion generated from VAT in June, the Federal Government took N94.726 billion, state governments received N315.754 billion, and local governments received N221.027 billion. Out of the N29.165 billion from the EMTL, the Federal Government was allocated N4.375 billion, states received N14.582 billion, and local government councils got N10.208 billion.

Photo Credit: The Nations Newspaper

Revenue from the exchange difference, amounting to N38.849 billion, was distributed with the Federal Government receiving N19.147 billion, states allocated N9.712 billion, and local governments N7.487 billion. An additional N2.503 billion from exchange difference was distributed to states entitled to derivation revenue. Lastly, the N100 billion augmentation from non-mineral sources was shared, with the Federal Government receiving N52.680 billion, state governments N26.720 billion, and local governments N20.600 billion.

FAAC also reported changes in revenue inflows for June: Companies Income Tax (CIT), Petroleum Profit Tax (PPT), and Electronic Money Transfer Levy significantly increased. However, receipts from Oil and Gas Royalty, VAT, Import Duty, Excise Duty, and Common External Tariff (CET) Levies experienced noticeable declines. This substantial revenue boost in June is anticipated to provide crucial fiscal breathing space for all levels of government, assisting them in managing funding obligations and development programs amidst ongoing economic adjustments.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

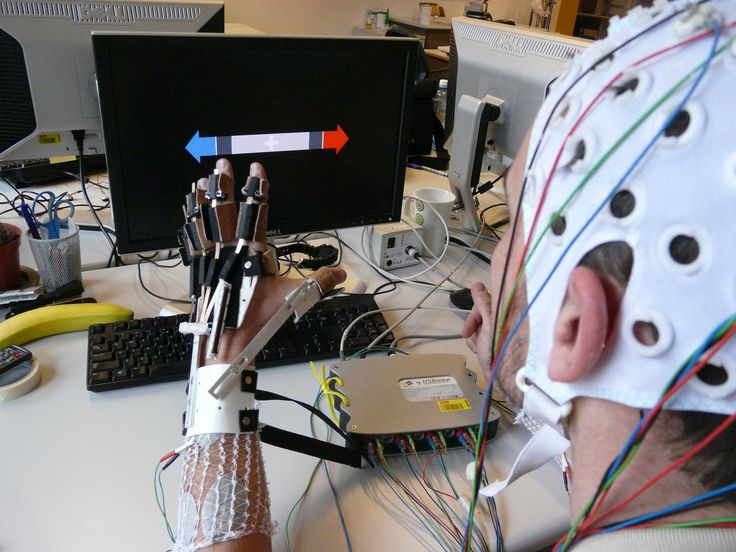

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...