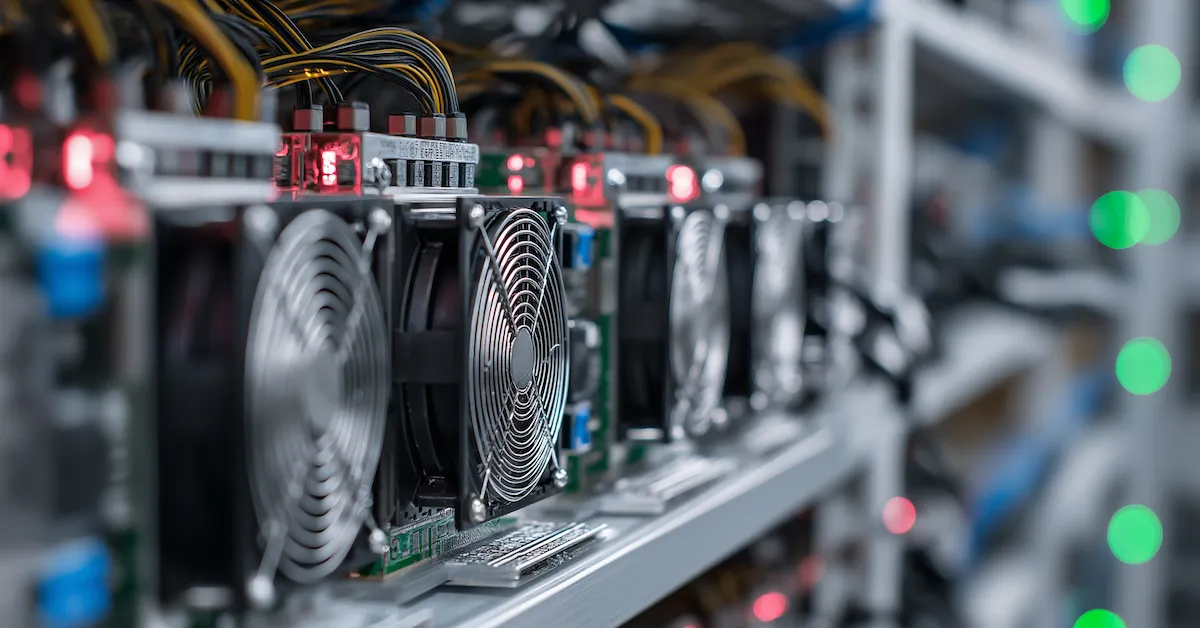

New York's Bold Move: Tax Hike Threatens Bitcoin Mining Industry

Yesterday, two prominent members of the New York State (NYS) Senate, Liz Krueger (D) and Andrew Gounardes (D), introduced Senate Bill 8518 (S8518), a legislative proposal poised to significantly impact digital asset mining operations within the state. The bill specifically targets digital asset mining that utilizes the proof-of-work (PoW) consensus mechanism, aiming to impose excise taxes that could make it considerably more challenging for bitcoin miners to sustain their operations in NYS.

S8518 stipulates a progressive excise tax structure based on the amount of energy consumed by bitcoin and other digital asset miners annually. The proposed rates are clearly defined: zero cents per kilowatt-hour (kWh) for facilities consuming up to 2.25 million kWh per year. Beyond this threshold, the taxes escalate: 2 cents per kWh for consumption between 2.25 million and 5 million kWh annually; 3 cents per kWh for consumption between 5 million and 10 million kWh per year; 4 cents per kWh for energy usage between 10 million and 20 million kWh per year; and a maximum rate of 5 cents per kWh for any consumption exceeding 20 million kWh per year.

However, the bill includes crucial exemptions. The proposed taxes will not apply to mining operations that power their facilities using renewable energy sources, provided these sources are defined as such by Section 66-P of NYS public service law. Additionally, the mining facility must not be operated in conjunction with an electric corporation’s transmission and distribution facilities to qualify for this exemption. A significant provision of S8518 dictates that all revenues generated from these taxes, including any collected interest and penalties, will be exclusively channeled to subsidize energy customers enrolled in NYS energy affordability programs, aiming to assist low-income households with utility costs.

The introduction of this bill is particularly noteworthy as it comes approximately one year after the expiration of NYS’s digital asset mining moratorium, which had previously banned any digital asset mining reliant on fossil fuels. While the moratorium's expiration theoretically opened the door for bitcoin mining companies to resume or establish operations in the state, the proposed increased taxes under S8518 are likely to serve as a substantial disincentive. This could compel these companies to seek more favorable regulatory and economic environments elsewhere in the U.S., potentially stifling the growth of the industry within New York.

Critics view S8518 as another in a series of adverse regulatory proposals from Democratic lawmakers and bureaucrats in NYS that actively discourage Bitcoin and crypto companies from establishing a presence in the state. Instead of recognizing the potential for job creation and economic revitalization that the bitcoin mining industry could bring to economically struggling upstate New York regions, the bill is perceived by some as an antagonistic measure against digital asset miners.

You may also like...

Bournemouth's Summer Nightmare: £200M Player Exodus Sparks Fan Fear

Bournemouth's decision to retain Antoine Semenyo has been a masterstroke, as the Ghana winger's exceptional performances...

WNBA Finals Game 1 Shocker: Dana Evans, Aces Crush Mercury

The Las Vegas Aces secured an 89-86 victory over the Phoenix Mercury in Game 1 of the 2025 WNBA Finals, driven by their ...

Shocking Ax: Fox Pulls the Plug on Beloved Animated Series 'Great North'

Fox has officially canceled the animated comedy <i>The Great North</i> after five seasons, concluding its run in Septemb...

Unveiling the Horrors: Inside Netflix's Ed Gein Story & Star's Chilling Connection

The Netflix series "Monster: The Ed Gein Story" delves into the life and crimes of the notorious serial killer, explorin...

Backstreet Boys Unleash AI, Brazilian Love, and Millennium Legacy on Tour

Celebrating over three decades in music, Nick Carter and Howie Dorough of the Backstreet Boys reflect on their enduring ...

Ozzy Osbourne's Harrowing Final Confessions Before His Death in Poignant New Documentary

A new documentary, 'Ozzy Osbourne: No Escape From Now,' posthumously showcases the rock legend's final reflections on hi...

Noel Gallagher Unleashes Brutal Critique on Taylor Swift Amid Her 12th Album Launch

Noel Gallagher offers his characteristically blunt, mixed opinions on Taylor Swift's success and modern pop strategies, ...

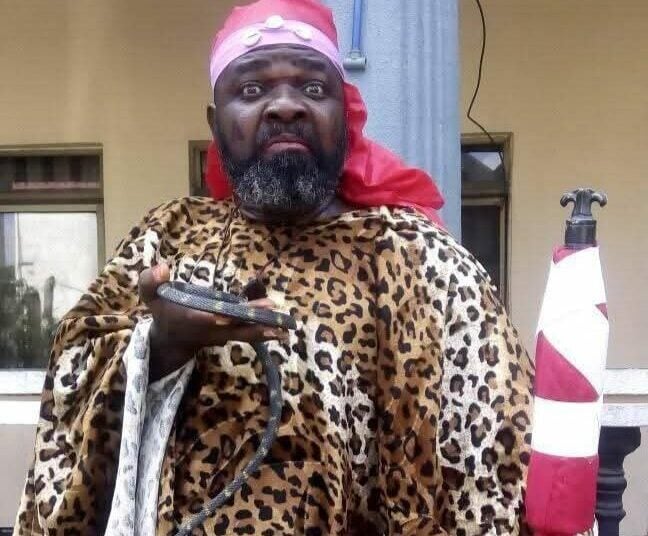

Tragedy Strikes Nollywood: Veteran Actor Duro Michael Passes Away At 67

Nollywood mourns the passing of veteran actor Duro Michael at 67, following a battle with a terminal illness. Producer S...