Netflix Revises $83B Deal to Acquire Warner Bros., Going All-Cash Amid Rival Bid

Netflix has formally amended its agreement to acquire Warner Bros. Discovery (WBD), shifting to an all-cash offer of $27.75 per share, maintaining an enterprise value of $82.7 billion. The move addresses vulnerabilities in the original deal, which was roughly 84% cash, leaving WBD shareholders exposed to fluctuations in Netflix’s stock. The revised offer also counters a rival Paramount Skydance takeover campaign, which has proposed a $30-per-share all-cash bid.

The all-cash structure provides WBD shareholders with certainty, removing market volatility and simplifying the transaction. Shareholder voting is expected by April 2026, following the filing of a preliminary proxy statement with the SEC. Netflix has also agreed to reduce Discovery Global’s net debt—its cable TV networks entity scheduled for spin-off before the merger—by $260 million, setting the target at $17 billion by June 30, 2026, decreasing to $16.1 billion by year-end. Netflix’s debt financing for the acquisition has risen from $34 billion to $42.2 billion.

Both Netflix and WBD boards have unanimously approved the amended deal. Closing remains subject to U.S. and European regulatory approvals and WBD shareholder consent, with an estimated timeline of 12–18 months post-signing. Discovery Global, which includes CNN, TNT, TBS, HGTV, Food Network, TNT Sports, and Discovery+, is expected to spin off within six to nine months. Netflix will acquire Warner Bros. studios, HBO, HBO Max, and WBD’s games division.

Paramount Skydance, led by David Ellison and supported by Larry Ellison, RedBird Capital, and sovereign wealth funds from Saudi Arabia, Qatar, and Abu Dhabi, continues to pursue its hostile bid. Paramount argues its proposal faces fewer regulatory hurdles and has filed lawsuits demanding greater transparency on Netflix’s deal, including Discovery Global’s valuation. Paramount has indicated plans for a proxy fight to nominate WBD board candidates.

WBD’s January 20 proxy filing estimated Discovery Global’s equity value at $2.41–$3.77 per share via sum-of-the-parts analysis and $4.63–$6.86 per share under potential acquisition scenarios. Paramount, however, claimed its analysis values the division at zero, with a theoretical M&A value of $0.50 per share. Both Netflix and WBD have submitted Hart-Scott-Rodino filings and are engaging with U.S. and European antitrust regulators. Netflix’s financing structure is not subject to CFIUS review, a point also highlighted by Paramount regarding foreign investor rights.

Industry stakeholders have expressed concern over potential job losses, theater closures, and consolidation of media power. In response, Netflix co-CEO Ted Sarandos has pledged a 45-day theatrical window for Warner Bros. films, aiming to preserve traditional release patterns. Netflix has experimented with theatrical releases, including Stranger Things’ finale, which grossed over $25 million, and limited two-week runs for Train Dreams and A House of Dynamite. Upcoming releases such as the Peaky Blinders spin-off The Immortal Man are also slated for similar theatrical debuts.

WBD CEO David Zaslav described the amended agreement as bringing together “two of the greatest storytelling companies.” Sarandos emphasized the financial certainty, expedited timeline, and potential benefits for U.S. production, job creation, and long-term industry growth. Co-CEO Greg Peters added that the merger would drive Netflix’s growth and investment while remaining pro-consumer, pro-innovation, pro-creator, and pro-growth. Breakup fees remain unchanged: WBD would pay $2.8 billion if it withdraws, while Netflix would pay $5.8 billion if regulators block the deal.

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

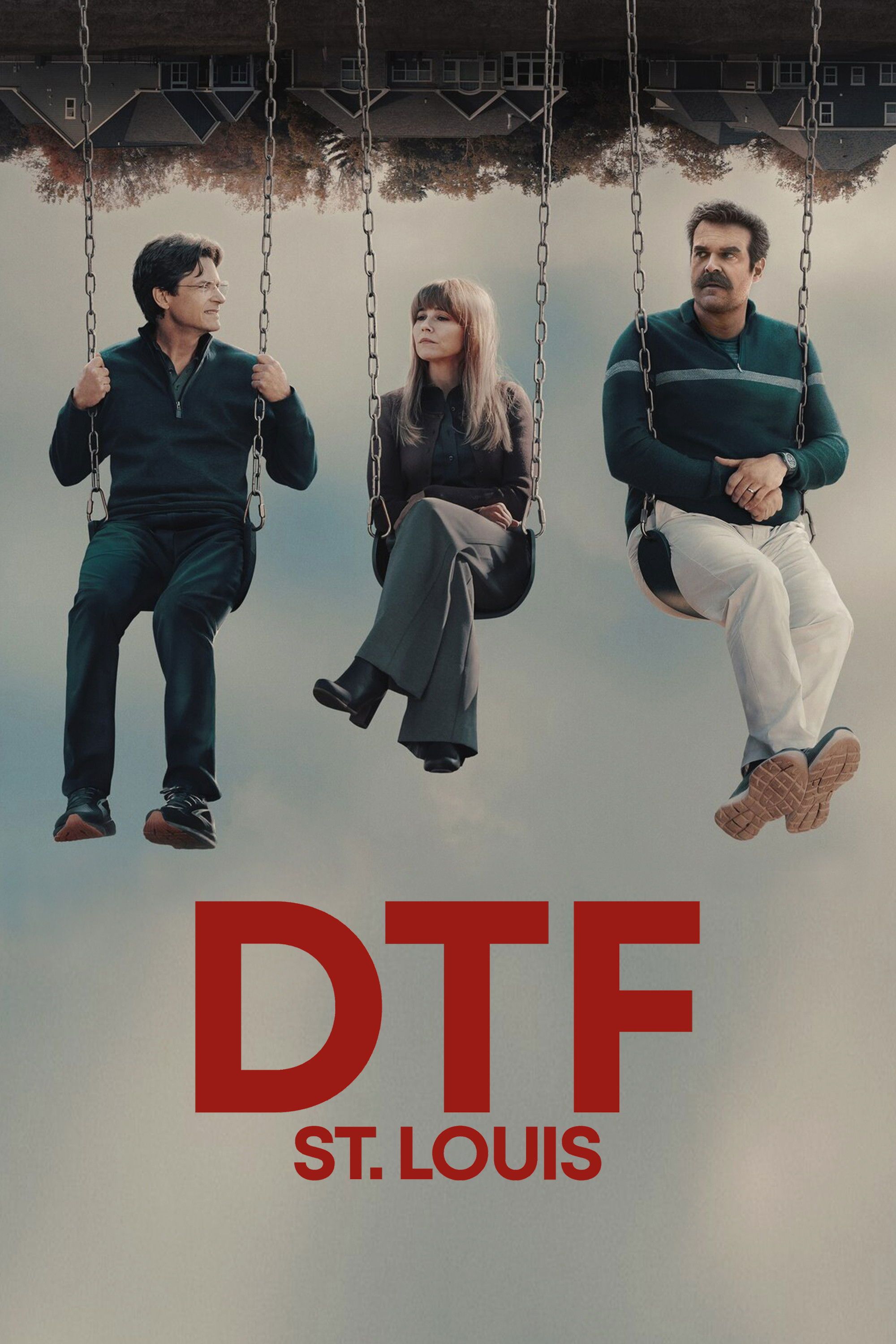

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...