Netflix Bombshell Bid: Streaming Giant Eyes Warner Bros. Amid Heated Skydance Battle

Netflix is reportedly preparing a revised, all-cash offer to acquire Warner Bros. Discovery’s streaming and studios businesses, according to sources cited by the Wall Street Journal. This new proposal follows earlier reports from Bloomberg News suggesting Netflix was considering such a move. Previously, Netflix’s initial agreement stipulated that each Warner Bros. Discovery shareholder would receive $23.25 in cash and $4.50 worth of Netflix common stock (or 0.0460 Netflix shares if the stock price fell below a certain collar) for each share of WBD common stock. This original deal had an enterprise value estimated at $82.7 billion.

The shift to an all-cash offer comes amid an aggressive push from David Ellison’s Paramount Skydance, which has been vigorously advocating for its own $30 per share all-cash hostile bid for the entire Warner Bros. Discovery entity.

Paramount Skydance has taken concrete steps to press its case, including filing a lawsuit on Monday. This lawsuit seeks to compel WBD to disclose crucial financial details of the Netflix deal, particularly how WBD is valuing the proposed Discovery Global cable TV networks spin-off, which Paramount Skydance alleges would be worthless based on its analysis comparing it to Comcast’s recent Versant spin-off.

Furthermore, Paramount has officially declared its intention to launch a proxy fight. This move involves nominating its own WBD board candidates for election at Warner Bros. Discovery’s annual shareholder meeting, with these candidates expected to back the Paramount bid.

The competition for WBD has intensified as Netflix’s stock performance has affected its initial offer’s perceived value. Shares of Netflix have dropped more than 12% since the Warner Bros. deal was announced on December 5, falling below the $97.91 per share ‘collar’ outlined in the WBD agreement. This decline would reduce the total value of the acquisition for WBD shareholders; Paramount’s analysis from January 8 estimated the total value of the Netflix transaction to WBD shareholders at $27.42 per share, given the drop in Netflix’s share price. Netflix’s stock closed at $90.32 per share on Tuesday, up 1% for the day.

Under Netflix’s original deal with WBD, the streaming giant aimed to acquire specific assets including the Warner Bros. film and television studios, HBO and HBO Max, and its games division. This initial bid was backed by $59 billion in debt financing from Wells Fargo, BNP, and HSBC. In contrast, Paramount Skydance’s offer is to buy Warner Bros. Discovery in its entirety, with significant financial backing from David Ellison’s father, Oracle co-founder Larry Ellison, as well as other partners such as RedBird Capital Partners and the sovereign wealth funds of Saudi Arabia, Qatar, and Abu Dhabi.

These complex developments are being closely watched in the media industry. For instance, the “Daily Variety” podcast recently featured Variety’s Todd Spangler explaining the latest intricacies of Paramount Skydance’s pursuit of Warner Bros. Discovery, specifically detailing the lawsuit filed in Delaware.

Separately, on the same podcast, Joe Otterson took the pulse of WWE viewership and fandom, a year after the wrestling franchise transitioned its streaming home to Netflix, highlighting Netflix's broader strategy in content acquisition and distribution.

You may also like...

Binge-Worthy 8-Episode Thriller Masterpiece Lands on Netflix!

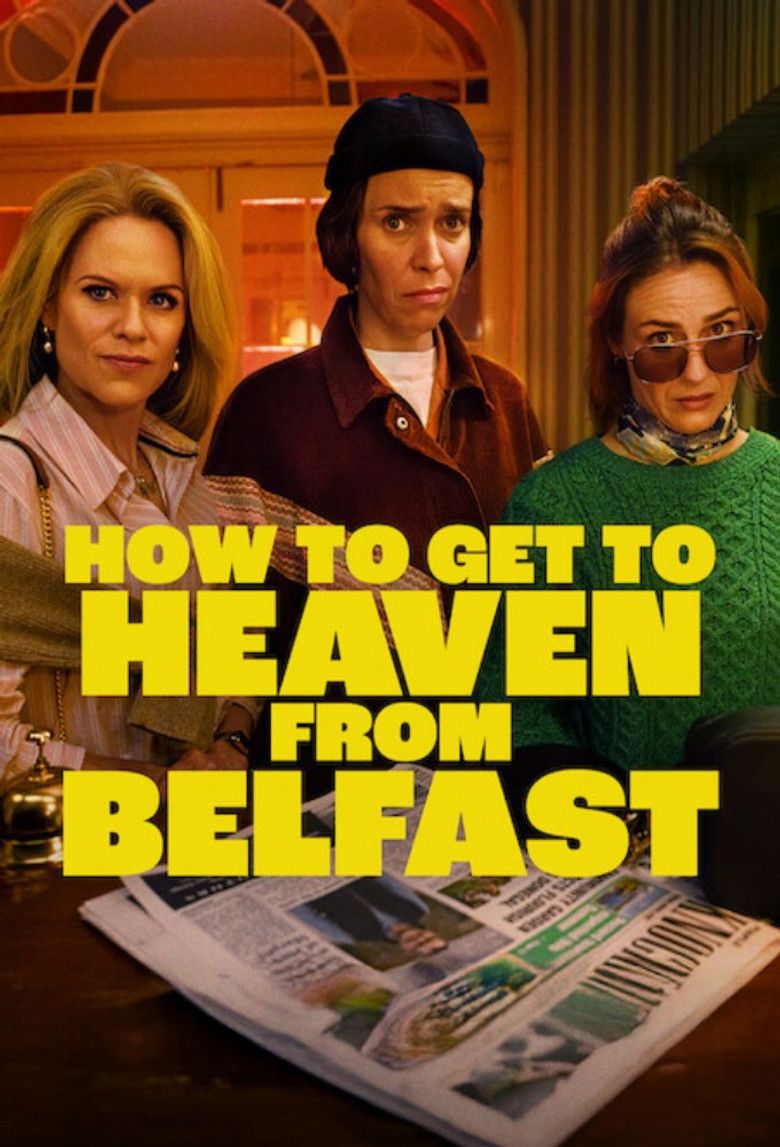

Lisa McGee, creator of "Derry Girls," brings "How To Get To Heaven From Belfast" to Netflix, a gripping comedy thriller....

Blockbuster Oscar Nominee Hits Netflix After Raking In Millions!

<i>Jurassic World Rebirth</i> redefines the beloved franchise by exploring scientific overreach and humanity's evolving ...

Little Mix's Leigh-Anne Reveals Dream Collaboration with Manon and Normani!

Leigh-Anne Pinnock expressed her desire to collaborate with Manon Bannerman and Normani, a wish that carries significant...

Music Star Thomas Rhett & Lauren Akins Announce Arrival of First Son!

Country music star Thomas Rhett and his wife, Lauren Akins, have welcomed their fifth child and first son, Brave Elijah ...

Bridgerton Stars Unveil Game-Changing Season 4 Death

An interview with the stars of Bridgerton Season 4 Part 2 delves into the tragic death of John Stirling and its aftermat...

Shocking Recruitment Scandal: Kenyan Faces Charges for Sending Youths to Ukraine War

A Kenyan man has been arraigned in court over alleged human trafficking, accused of recruiting 22 youths for the Russia-...

Angola Under Fire: Billion-Dollar Contracts Awarded Without Public Tender

A comprehensive review of Angolan presidential decrees has uncovered that at least US$61.5 billion in public spending wa...

Pentagon Declares AI Heavyweight Anthropic a Supply Chain Risk

The Trump administration has ordered federal agencies to cease using Anthropic products following a dispute over the com...