Nestoil Embroiled in High-Stakes $1 Billion Debt Battle with Court Intervention

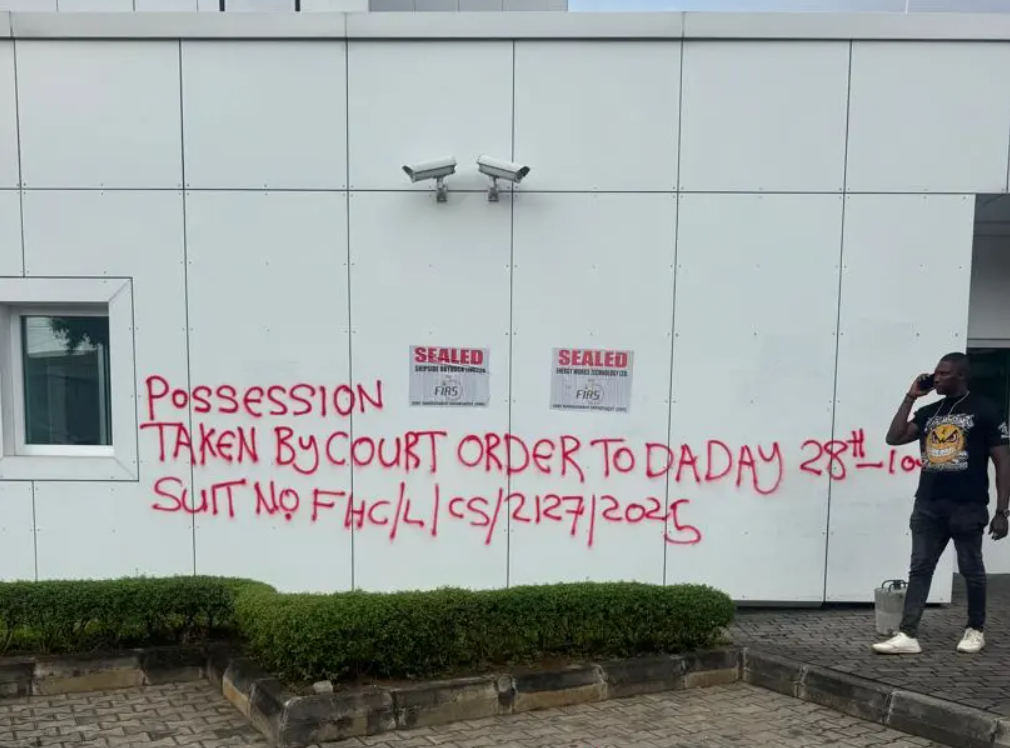

The Federal High Court in Lagos has ordered the takeover of significant assets belonging to Nestoil Limited, its affiliate Neconde Energy Limited, and their promoter, Ernest Azudialu-Obiejesi, amidst allegations of defaulting on debts exceeding $1 billion and ₦430 billion. The judicial action was initiated by First Trustees Limited and its subsidiary, FBNQuest Merchant Bank Limited, leading to armed police officers sealing Nestoil’s headquarters at 41/42 Akin Adesola Street, Victoria Island, Lagos, as part of the enforcement.

Justice D. I. Dipeolu issued a comprehensive Mareva injunction on October 22, 2025, specifically restraining Nestoil, Neconde Energy, and their promoters from transacting with funds or shares held across more than 20 financial institutions. This injunction will remain in effect pending the full hearing of the substantive motion. The outstanding indebtedness, as officially claimed by FBNQuest Merchant Bank and First Trustees, stood at $1,012,608,386.91 and ₦430,014,064,380.77 as of September 30, 2025.

The court order further revealed that Ernest Azudialu-Obiejesi and Nnenna Obiejesi had personally guaranteed substantial portions of these debts owed to various Nigerian banks. Specific guaranteed amounts include NGN366,797,069,094.48 and US$61,213,667.57 to Access Bank Plc, $152,031,856.21 to First Bank Nigeria Limited, and N10,430,376,065.92 and $213,829,487.61 to Zenith Bank Plc as of the same September 30, 2025 date. An additional $62,493,290.19 was guaranteed to Union Bank Plc. The total amount personally guaranteed by the 3rd and 4th defendants was stated as $485,668,638.83 and N389,926,180,446.69.

The wide-ranging freezing orders encompass accounts and shares in numerous financial institutions, including Citibank Nigeria, Fidelity Bank, Guaranty Trust Bank, Stanbic IBTC, Polaris Bank, Opay, Standard Chartered, Sterling Bank, Titan Trust, Wema Bank, Unity Bank, Globus Bank, Keystone Bank, and Providus Bank. The injunction also extends to investments and assets within several associated companies. Abubakar Sulu-Gambari (SAN) has been appointed as the receiver-manager, authorised to take possession of Nestoil’s corporate offices and all other assets of Nestoil and Neconde Energy wherever found. This crucially includes Neconde Energy’s interest in Oil Mining Lease (OML) 42, which it operates jointly with the Nigerian National Petroleum Company Limited (NNPCL).

To ensure the enforcement of these orders, Justice Dipeolu directed various security agencies, including the Nigeria Police Force, the Nigerian Navy, and the State Security Service, to provide protection and assistance to the receiver-manager and court bailiffs. Furthermore, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and NNPCL were mandated to grant the receiver access to OML 42, cooperate in its exploitation, production, and sale of hydrocarbons, and assist in managing its revenues. Financial institutions and companies holding assets or shares on behalf of the defendants were also compelled to disclose these holdings under oath within seven days of being served with the court order.

In response to the developments, Nestoil Group issued a statement through its Corporate Communications Department, confirming the existence of an ongoing commercial dispute before the courts. The company assured stakeholders that the situation is being handled through appropriate legal and regulatory channels, with constructive discussions underway with relevant authorities and financial institutions to reach a fair and lasting resolution. Nestoil stressed that its operations across the oil, gas, power, and infrastructure sectors remain unaffected, with proactive measures implemented to ensure business continuity and protect its workforce and clients. The Group reaffirmed its long-standing commitment to integrity and transparency, asserting its financial strength, operational stability, and strategic focus despite the ongoing proceedings.

The matter has been adjourned to November 7, 2025, for the hearing of the substantive motion on notice, with Nestoil urging the public to rely on verified information directly from the Group.

You may also like...

The Art and Legacy of Joke Silva: A Trailblazer in African Film and Performing Arts

Joke Silva, award-winning Nigerian actress and mentor, has shaped African theatre and Nollywood cinema with her talent, ...

How Superhero Movies Evolved from Niche Adaptations to Box Office Giants

Superhero films began as early comic book adaptations, with icons like Superman and Batman appearing on screen in simple...

Your Body Is Not a Classroom: When Student Training Crosses the Line

When student training in healthcare lacks proper supervision and consent, patients can pay the price. Where should we dr...

Your Brain Deletes Memories on Purpose. Here’s Why Forgetting Is Necessary

Your brain deliberately deletes memories to improve focus, learning, and emotional survival. Forgetting is not weakness,...

MVP Race in Jeopardy: Top Stars Shai Gilgeous-Alexander and Nikola Jokic Face Eligibility Crisis

The NBA MVP race is under threat as Shai Gilgeous-Alexander and Nikola Jokic near disqualification under the league’s 65...

Post-All-Star Battle: NBA Power Rankings Shake Up the League

Post-All-Star NBA power rankings highlight the Thunder, Spurs, and Pistons atop the standings, while injuries and em...

Netflix Chief Ted Sarandos Heads to White House for Crucial Warner Bros. Deal Talks

Netflix co-CEO Ted Sarandos is navigating complex negotiations for Warner Discovery amidst political pressure from Donal...

Paramount Skydance Faces Q4 Losses, Eyes Bold Warner Acquisition Bid

Paramount Skydance reported a widened Q4 loss driven by declines in TV advertising and distribution, even as streaming a...