Mutuum Finance (MUTM) Emerges as DeFi Leader

June 2025 has witnessed a significant surge in crypto Exchange Traded Fund (ETF) inflows, primarily driven by Bitcoin ETFs. This influx of institutional capital into the broader crypto sector is generating massive capital movements across the market. Among the notable beneficiaries of this substantial capital shift is Mutuum Finance (MUTM), which is progressively gaining prominence. This trend has fueled speculation that MUTM could emerge as one of the top performers in 2025, with analysts projecting substantial gains.

Mutuum Finance (MUTM) is currently in the fifth phase of its presale, demonstrating strong investor confidence by having successfully raised over $10.95 million from approximately 12,350 investors. During this current phase, MUTM tokens are available at $0.03, representing a remarkable 200% increase from their initial phase 1 price of $0.01. Looking ahead, the price for the upcoming sixth phase of the presale is set to increase by 16.67% to $0.035. Analysts are forecasting an impressive 3,450% gain for MUTM after its presale concludes. Based on this projection, a $1,400 investment made during the presale could potentially escalate to $48,300. A key advantage for current presale participants is that tokens are being sold at a 50% discount compared to the anticipated listing price of $0.06, offering early investors double the potential returns compared to those who wait for the public listing.

Mutuum Finance (MUTM) distinguishes itself through its real utility, rather than solely relying on market hype. Its foundation is a decentralized non-custodial protocol designed to facilitate participation for both lenders and borrowers. Lenders can deposit their assets into liquidity pools to earn interest, with the interest rate dynamically adjusted based on the pool’s utilization rate. This rate is determined by the proportion of actively borrowed assets relative to the total assets within the pool. As the utilization rate increases, so does the interest rate, which incentivizes borrowers to repay their loans and encourages lenders to deposit more assets to capitalize on the higher returns. This mechanism fosters increased liquidity within the pools, thereby enhancing overall protocol health and ensuring optimal market efficiency through demand and supply-driven actions.

To safeguard lenders' liquidity, Mutuum Finance (MUTM) mandates that all loans must be overcollateralized. This means borrowers are required to deposit assets with a value greater than the loan they receive. The specific level of collateralization is determined by the intrinsic characteristics of the asset, with assets exhibiting high on-chain trading volume and low volatility typically receiving more favorable terms than those with high volatility and low liquidity. Recognizing the dynamic nature of the crypto market, Mutuum Finance (MUTM) is committed to actively adjusting these parameters. For instance, if an asset gains prominence, experiences increased on-chain volume, and its volatility decreases, its parameters can be modified to encourage its use as collateral within the protocol.

Furthermore, Mutuum Finance (MUTM) implements a liquidity rewards program, where MUTM tokens are distributed to encourage lenders to contribute more assets to the pools. This strategy effectively lowers the utilization rate and subsequently the interest rate within a pool, making the protocol more appealing to users—a critical factor for its long-term success. The protocol also plans to utilize its revenue to purchase MUTM tokens from the open market. These buybacks will exert positive price pressure on the tokens, enhancing their online profile and potentially generating significant media buzz, which could attract a surge of new users. With Mutuum Finance (MUTM) already listed on CoinMarketCap, a platform boasting over 350 million monthly visitors, improved price performance could significantly boost its visibility and serve as a crucial driver for project growth.

In summary, Mutuum Finance (MUTM) is a CertiK audited project that has recently garnered considerable attention within the crypto market. On-chain whale activity indicates growing institutional interest. Capital is anticipated to continue flowing into its presale, with this momentum expected to persist after the tokens’ public listing. Given projected listings on major public exchanges, MUTM tokens could experience parabolic growth. At its current price of $0.03, MUTM tokens present a compelling opportunity for substantial returns in 2025.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

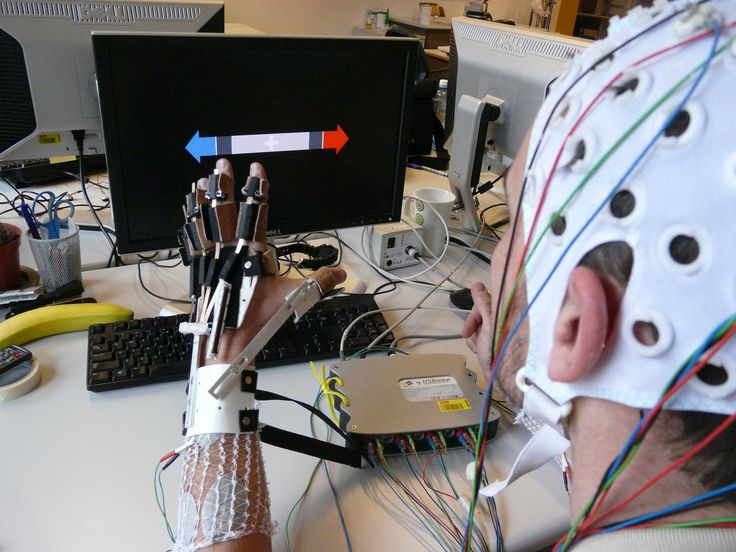

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...