MultiChoice's French Future: African Media Powerhouse Faces Foreign Control

Africa's burgeoning tech ecosystem is preparing for Moonshot 2025, a significant gathering set for October 15 & 16 in Lagos, bringing together over 5,000 changemakers, investors, and innovators. Under the theme “Building Momentum,” the event aims to foster deeper conversations and expand the scope of industry dialogues, shaping the future of technology across the continent. This comes amidst a period of dynamic shifts in African business, policy, and fintech landscapes.

A major development in the media sector sees French media group Canal+ completing its takeover of South African pay-TV company MultiChoice. Having acquired 94.4% of MultiChoice's shares, Canal+ announced plans to delist the company from the Johannesburg Stock Exchange (JSE). This acquisition concludes MultiChoice’s six-year run as a separately listed entity, transforming it into a wholly owned Canal+ subsidiary pending approval from the South African Reserve Bank (SARB). Canal+ also intends to list its own shares on the JSE, offering South African retail investors an opportunity to engage with the newly combined enterprise. This deal creates a formidable pay-TV giant with over 40 million subscribers across Africa, Europe, and Asia, marking a significant expansion for Canal+ and intensifying competition in the African media market against local streaming services.

Concurrently, South Africa is on the verge of implementing crucial ICT policy changes that could open its doors to foreign tech companies like Starlink. Communications Minister Solly Malatsi revealed that new rules for the Equity Equivalent Investment Programme (EEIP) are weeks away from finalization. This revised policy would allow foreign tech companies to meet entry targets by investing in local community development initiatives rather than divesting 30% of their shares to local investors. Starlink has already expressed readiness to comply, pledging R2.5 billion ($144,000) towards rural investments. While Minister Malatsi advocates for a flexible system that encourages local participation while being favourable to foreign companies unwilling to cede equity, his proposal faces scrutiny from policymakers concerned about potential favouritism towards certain entities like Starlink. The debate also raises questions for companies that previously adhered to the antecedent equity requirements.

In the fintech domain, MTN’s MoMo has demonstrated substantial growth, processing $2.1 billion in international remittances across 14 African markets in the first half of 2025. With a vision to address Africa's payment fragmentation, MoMo aims to build a borderless fintech ecosystem where payments flow freely without the usual friction and high fees, which average over 8% per transaction across the continent. Serving 283 million users and processing over $1.1 trillion in yearly transactions, MoMo disbursed $1.3 billion in microloans and boasts a merchant network of over 2 million people. It is also expanding its reach by opening its rails to other startups through MoMo OpenAPI. Despite challenges such as fragmented systems and competition from players like OPay, Wave, and M-PESA, MoMo is re-engineering itself as a digital-first platform, betting on scale and simplicity to achieve financial inclusion for the over 350 million unbanked Africans.

Other significant developments include Paga's expansion into the United States, offering digital banking services tailored for Africa’s diaspora, enabling eligible users to manage funds in US Dollars and Naira. Additionally, Nigerian fintech Kredete has secured $22 million in Series A funding to scale its AI-powered platform, which provides digital lending services to African immigrants and cross-border users by analyzing alternative real-time data to build credit profiles without traditional banking requirements. Kredete, serving over 700,000 monthly users, is also venturing into merchant payments, credit-linked savings, rent reporting, and stablecoin-backed cards to enhance financial inclusivity. PalmPay is also making strides in Nigeria, offering a super-app with instant and free transfers, savings, loans, and rewards, claiming that 1 in 4 of its 35 million+ users opened their first banking account through the platform.

Looking ahead, the Growth Africa Summit 2025 (GAS 2.0) is slated to challenge outdated business strategies under its theme “Redefining the Growth Playbook,” aiming to introduce radical and resilient growth models for African businesses. Furthermore, Data Science Nigeria (DSN) will host the AI Bootcamp 2025 from October 20–25 at the University of Lagos, offering an all-expense-paid AI and Data Science learning experience to learners from 36 states and 13 African countries, themed “AI for All: Democratizing Intelligence and Driving Impact.” The broader tech landscape also notes Michelin's re-entry into Nigeria's tyre market, GTCO's substantial 450.97% increase in tech spending in H1 2025, and ongoing global discussions surrounding AI, including competition between the U.S. and China for talent, and Microsoft AI's announcement of its first in-house image generator.

You may also like...

Wolves Fandom Erupts: 'Sell the Club!' Chants Rock Stadium Amidst Frustration!

Wolves fans' frustration reached a boiling point at Molineux, with chants against the club's ownership and manager Vitor...

Haaland's Agony: Disallowed Goal and Injury Plague Man City's Disappointing Outing!

Manchester City's nine-match unbeaten run came to an end at Villa Park as Aston Villa secured a victory, highlighted by ...

Andrew Garfield Teases Spider-Man Return, But Fans Should Brace for a 'Catch'

Andrew Garfield has expressed a keen interest in joining Sony's animated *Spider-Verse* franchise, hinting at a potentia...

Mel Gibson's 'Passion of the Christ' Sequel Faces Blasphemy Outcry Over Jesus Recasting

Mel Gibson's highly anticipated sequel, "The Resurrection of the Christ," is moving forward two decades after the origin...

Snoop Dogg Drops Bombshell at Verzuz Relaunch in Vegas, Igniting No Limit-Cash Money Battle

Snoop Dogg made a surprise appearance at ComplexCon in Las Vegas, joining his former label, No Limit Records, in a star-...

Daft Punk Legend Thomas Bangalter Stuns Paris with Surprise DJ Set Alongside Fred again..

Daft Punk's Thomas Bangalter made a rare surprise appearance with Fred again.. for a DJ set at Paris' Centre Pompidou. T...

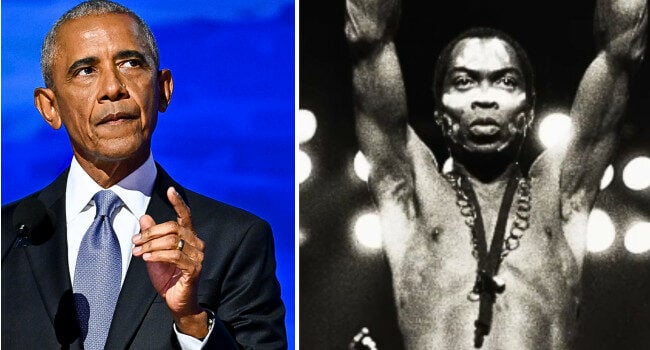

Obama Dives Deep: New Podcast Honors Revolutionary Fela Kuti

Former U.S. President Barack Obama has curated a new 12-episode podcast series, "Fela Kuti: Fear No Man," celebrating th...

Waje & KCee Ignite Romance with New Track 'Luvey Luvey'

Waje has released a new single, “Luvey Luvey,” featuring KCee, a warm and feel-good song celebrating love. Blending Afro...

(9).jpeg)