More crypto milestones expected in 2025 after new BTC high

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Just 11 days into the year’s second half and we’ve already seen bitcoin hit several new all-time highs — most recently eclipsing $118,000.

With a new bitcoin ATH marked on the 2025 second-half crypto bingo card, what more could we see over the next six months?

Before moving on from BTC price, the surge comes as corporate bitcoin buying has swelled and segment observers expect more institutional platforms to allow access to the asset.

Remember how Ledn CIO John Glover tries to predict bitcoin moves? Well, he’s still eyeing the $136,000 mark, but now thinks it will come quicker than originally thought (this year).

Source: TradingView

Source: TradingView

From there, Glover said he expects a subsequent correction to between $91,000 and $109,000 over time before ultimately moving higher again.

Benchmark’s Mark Palmer sees the most significant upcoming catalyst for the broader crypto ecosystem as the CLARITY Act — a framework to determine whether crypto tokens are commodities or securities — becoming law. Casey told us about “Crypto Week” approaching.

“With the possibility of a huge regulatory rug-pull removed, institutional investors would have a green light to invest in the space in earnest,” Palmer told me.

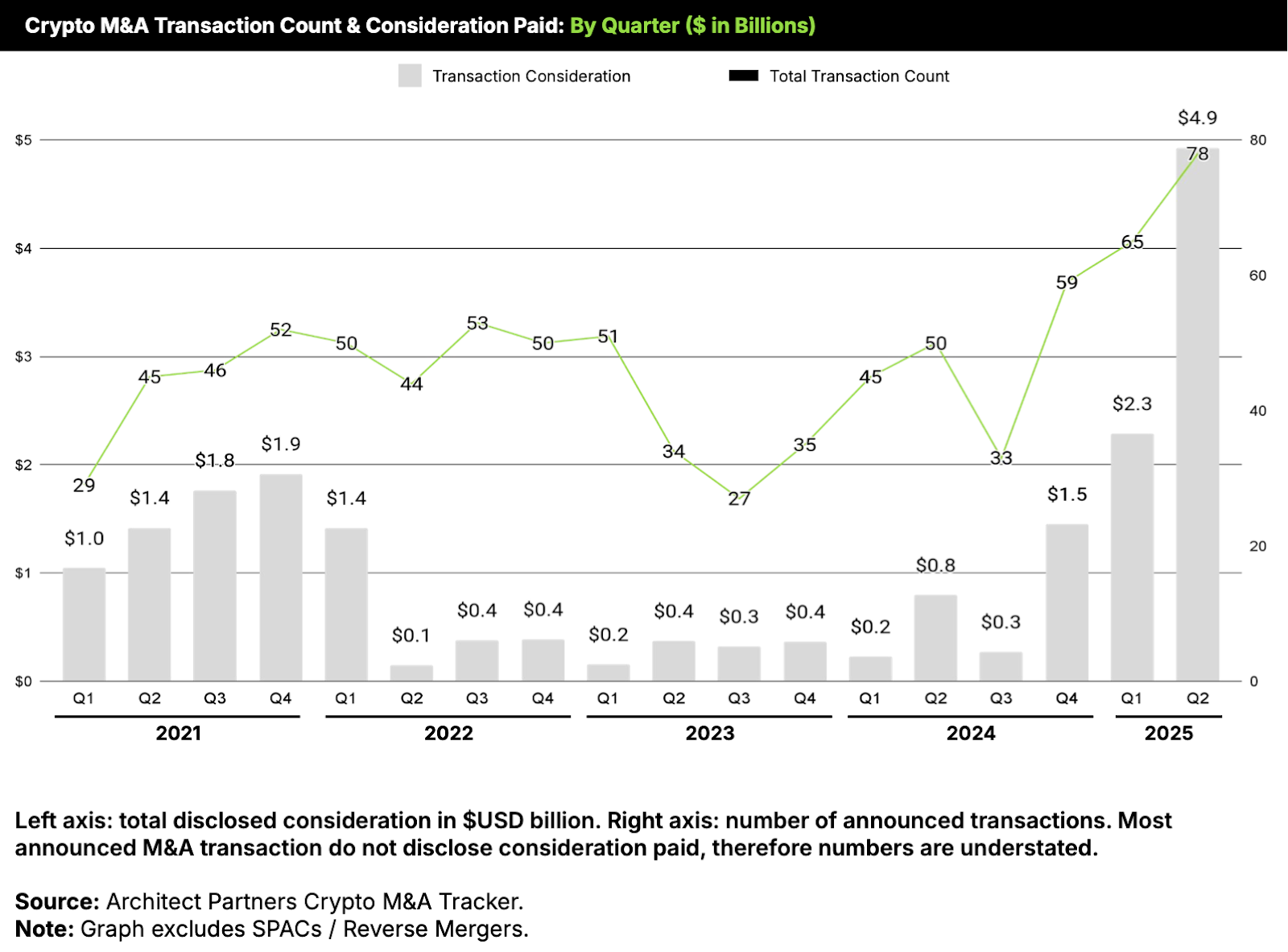

When it comes to M&A in the space, an Architect Partners report highlights that the 78 crypto M&A transactions in Q2 was by far a record. You might recall us writing about Ripple’s buy of Hidden Road being one of a growing number of crypto-TradFi intersections. A big crypto-crypto deal was Coinbase acquiring derivatives giant Deribit.

Source: Architect Partners

Source: Architect Partners

Architect Partners founder Eric Risley believes we’re at the beginning of a long-term uptrend in crypto M&A as the value prop for crypto/blockchain has gained broader acceptance.

“Certainly quarter to quarter will fluctuate, but the fundamental strategic drivers of M&A are now quite clear,” he told me. “Participants will include existing crypto businesses and more importantly, traditional financial services organizations of all stripes — banks, traditional broker-dealers and payment businesses.”

A major open question, Risely added, is what the next generation of dapps look like — beyond those focused on price speculation and payments.

As we chew on that one, the assets under management in crypto investment products hit an all-time peak of $188 billion at the rough halfway point, CoinShares data shows.

And that was before this week. It’s been 18 months (to the day) since spot bitcoin ETFs made their US debut; net inflows stand at $51 billion (after yesterday’s near-record daily mark of ~$1.2 billion). US ether ETFs also saw their second-best daily inflow total yesterday, at $383 million.

More crypto ETFs (single-asset and index) are expected to come this year, but timelines remain up in the air. On that, Grayscale shared some feelings with the SEC.

Investors preferring crypto exposure via equities will be watching for more public listings after Circle’s IPO. We’ll keep an eye on companies like Gemini and Kraken.

And continuing the tokenization conversation, Bitwise and VanEck execs had predicted the tokenized securities market to hit $50 billion in 2025. It’s about halfway there.

Recommended Articles

Ripplecoin Mining Cloud Mining Application is Changing the Way Ripple XRP Bitcoin BTC Solana Holders Make Money | User | malvern-online.com

Ripplecoin Mining Cloud Mining Application is Changing the Way Ripple XRP Bitcoin BTC Solana Holders Make Money

Bitcoin Dominance Continues Historic Climb - Altcoins Struggle To Gain Ground

Bitcoin has officially entered a new chapter in its bull market, surging to fresh all-time highs near $118,800 after wee...

DDC Enterprise Signs $100M Bitcoin Deal With Animoca Brands

DDC Enterprise partners with Animoca Brands in a $100M Bitcoin deal, boosting its BTC reserves and reshaping corporate t...

Best Crypto to Buy in This Bull Run as Bitcoin Smashes $118K

Let’s take a closer look at BTC’s performance and five cryptocurrencies that stand to benefit the most from the market-w...

What Happened in Crypto Today?

Find out what happened in the crypto market in the past 24 hours; here are major headlines, news updates and market move...

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...