Midwest Crypto Revolution: Indiana Lawmakers Push Bill to Become Bitcoin Leader!

Indiana lawmakers are taking a significant step towards integrating digital assets into the state's financial framework with a new proposal, House Bill 1042. This measure aims to allow the state to invest in digital assets like Bitcoin through regulated funds while simultaneously preventing local governments from imposing restrictions on cryptocurrency companies within their jurisdictions. This move underscores a growing political and financial interest in the crypto space, which has transitioned from a perceived fringe asset to one garnering support from prominent U.S. leaders and major financial institutions. The bill's early hearing, amidst a busy legislative session, signals its high priority for Republican lawmakers.

Authored by Representative Kyle Pierce, R-Anderson, HB 1042 seeks to provide Hoosiers with more investment choices while establishing necessary guardrails and exploring how blockchain and digital asset technology can benefit communities across Indiana. Pierce emphasized the increasing role of digital assets in everyday finances and the state's readiness to engage responsibly.

The proposed legislation adopts a cautious approach to Bitcoin and other digital asset investments. It strictly prohibits direct crypto purchases by public investment funds, instead authorizing investments solely through cryptocurrency exchange-traded funds (ETFs). These ETFs, which track crypto prices, operate under federal oversight, offering a more stable, albeit still risky, investment vehicle compared to direct token holdings. Concerns about market safeguards, fraud, and manipulation in crypto markets, as highlighted by the SEC, were echoed in testimony from Tony Green, deputy executive director of the Indiana Public Retirement System (INPRS). While INPRS remained neutral on the bill, it stressed the importance of clear disclaimers regarding volatility and noted a limited interest in crypto options among its members.

Under the provisions of HB 1042, several key state programs would be mandated to offer at least one crypto ETF. This includes the 529 education savings plan, the Hoosier START plan, and retirement systems for teachers, public employees, and lawmakers. Additionally, other state funds would gain the authority to invest in crypto ETFs, and the state treasurer could also place assets in stablecoin ETFs.

Beyond investment mechanisms, the bill also establishes critical guardrails concerning digital asset regulation. It seeks to standardize how Indiana state agencies and local governments can regulate digital assets, preventing local rules that specifically target crypto use, mining operations, or self-custody. A significant provision also protects private keys as privileged information. Furthermore, HB 1042 proposes the creation of a Blockchain and Digital Assets Task Force. This task force would be charged with studying potential government and consumer applications of the technology and recommending pilot projects across the state.

Indiana's initiative reflects a broader national trend where states are increasingly exploring the integration of cryptocurrency into pension funds and public accounts. Bitcoin, in particular, is gaining traction as a potential store of value for governmental entities, with some federal proposals even suggesting the use of Bitcoin reserves to mitigate national debt. A recent landmark example comes from Texas, which became the first U.S. state to purchase Bitcoin through a spot ETF. Last week, Texas acquired $5 million worth of Bitcoin via BlackRock’s iShares Bitcoin Trust (IBIT). This acquisition is the inaugural step under Texas’s new Strategic Bitcoin Reserve, established by legislation passed in June. While Texas ultimately plans to self-custody its BTC, IBIT was utilized for the initial allocation as the procurement process continues. This highlights a rising institutional interest in Bitcoin as a reserve asset, evidenced also by Harvard University tripling its IBIT holdings to $442.8 million, and similar boosts in exposure by Emory University and Abu Dhabi’s Al Warda Investments. Prior to this, Texas had also explored a Bitcoin reserve proposal involving cold storage, resident donations, and annual audits. Meanwhile, New Hampshire has approved a pioneering $100 million Bitcoin-backed municipal bond, the first globally, which requires borrowers to over-collateralize with BTC. At the time of writing, the price of Bitcoin was observed flirting with the $90,000 mark.

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

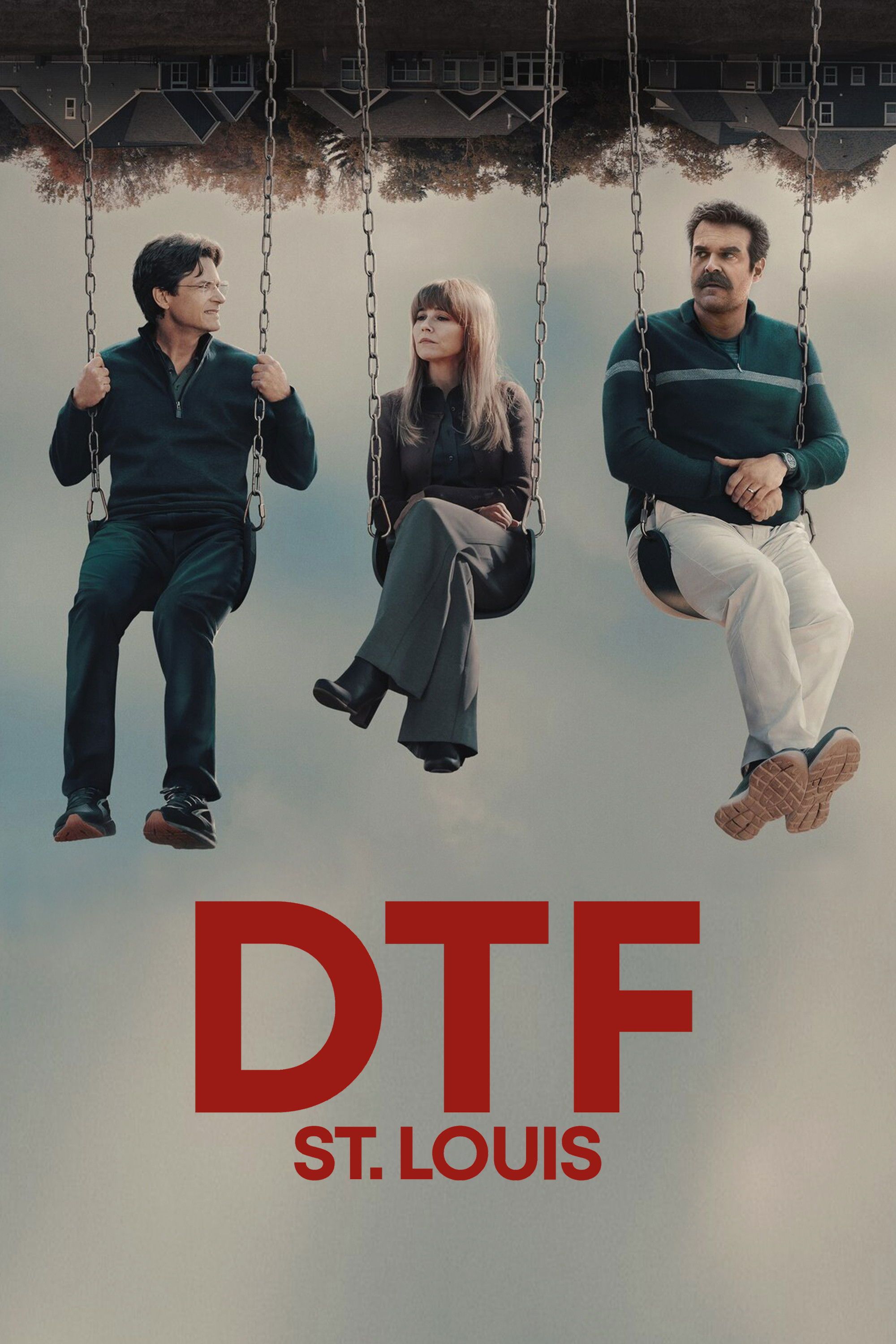

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...