MicroStrategy Dominates Bitcoin Buys: Report Reveals Shocking 97.5% Corporate Share!

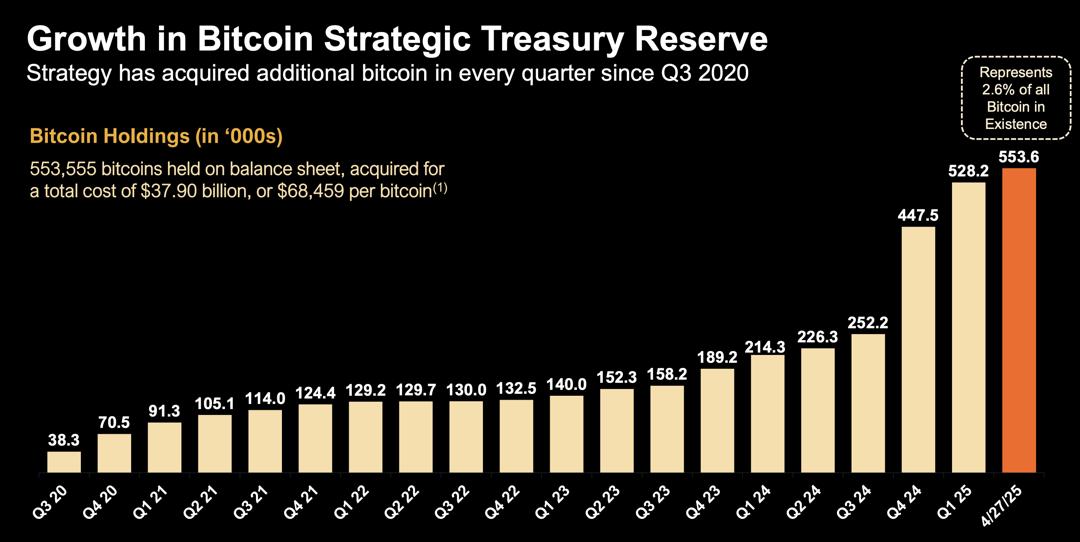

Strategy has emerged as the dominant force in corporate Bitcoin adoption, according to the January 2026 Corporate Adoption Report by BitcoinTreasuries.net.

In January alone, the company acquired 40,150 BTC, bringing its total holdings to 712,647 BTC — roughly two-thirds of all Bitcoin held by public companies.

This accounted for 93% of gross purchases and up to 97.5% of net additions for the month.

Public companies now collectively hold approximately 1.13 million BTC, with Strategy’s massive accumulation driving corporate Bitcoin holdings back to levels last seen in late summer 2025.

Strategy ties its Bitcoin accumulation to a long-term treasury plan, detailing in its Q4 2025 disclosure a seven-year roadmap projecting a 2.5× growth in Bitcoin per share by 2032 under an aggressive yield scenario.

The company also announced an additional 1,142 BTC purchase in the week prior, continuing its rapid acquisition pace.

Beyond purchases, a digital credit segment has emerged within the corporate Bitcoin market, encompassing preferred shares and hybrid instruments blending debt and equity exposure.

Strategy’s products — STRC, STRD, STRF, and STRK — dominate this space, alongside offerings from peers such as Strive (SATA) and Metaplanet (MERCURY), delivering yields ranging from 4.9% to low-teens.

While Strategy’s influence is unmistakable, the broader corporate Bitcoin market continues to diversify.

Among the 194 public companies holding Bitcoin, roughly one-third add at least 1 BTC per day, and around 20 firms accumulate 10 BTC or more per day.

Overall, treasury-focused companies have added an average of 357 BTC per day over five years, surpassing newer entrants like Twenty One Capital.

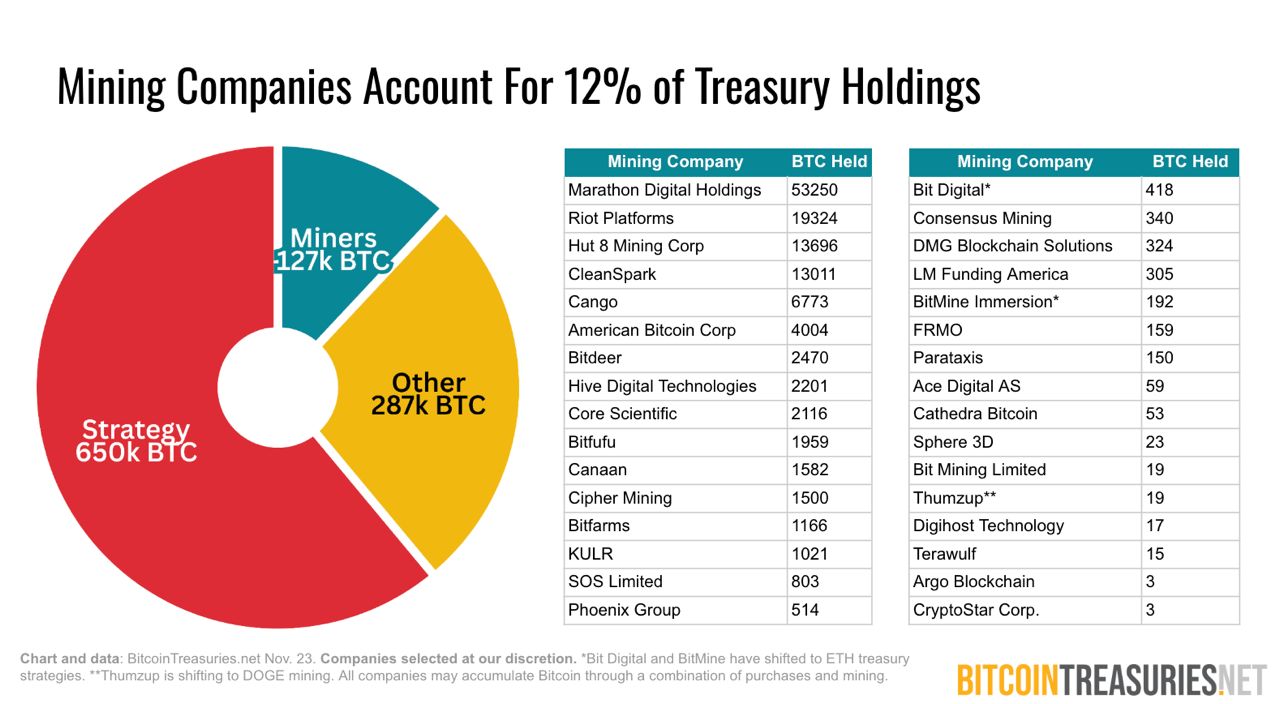

Mining companies also contribute significantly, holding about 124,833 BTC (11% of total public-company BTC), led by MARA, Riot, Hut 8, and CleanSpark.

However, miners were net sellers in January, with Riot and Bitdeer reducing their balances, resulting in a net loss of 290.9 BTC for the sector.

Despite market volatility, including a BTC dip below $65,000 in early February, corporate adoption continues globally.

Since October 2025, 21 new treasuries have been added from regions including South Korea, the U.S., China, Japan, and Canada, collectively contributing around 880 BTC (3% of non-Strategy purchases), highlighting growing institutional interest.

Even as more companies hold smaller amounts of Bitcoin, ownership is increasingly concentrated among the largest balance-sheet buyers, particularly Strategy.

Across corporate, ETF, government, and institutional holdings, total Bitcoin now exceeds 4.08 million BTC, with public-company treasuries expanding from roughly 620,000 BTC to 1.15 million BTC since early 2025.

Strategy’s dominance underscores the continuing trend of large-scale, treasury-focused corporate Bitcoin accumulation, signaling that public-company adoption is increasingly led by major institutional buyers rather than smaller entrants.

Recommended Articles

There are no posts under this category.You may also like...

Explosive Racism Claims Rock Football: Ex-Napoli Chief Slams Osimhen's Allegations

Former Napoli sporting director Mauro Meluso has vehemently denied racism accusations made by Victor Osimhen, who claime...

Chelsea Forges Groundbreaking AI Partnership: IFS Becomes Shirt Sponsor!

Chelsea Football Club has secured Artificial Intelligence firm IFS as its new front-of-shirt sponsor for the remainder o...

Oscar Shockwave: Underseen Documentary Stuns With 'Baffling' Nomination!

This year's Academy Awards saw an unexpected turn with the documentary <i>Viva Verdi!</i> receiving a nomination for Bes...

The Batman Sequel Awakens: Robert Pattinson's Long-Awaited Return is On!

Robert Pattinson's take on Batman continues to captivate audiences, building on a rich history of portrayals. After the ...

From Asphalt to Anthems: Atlus's Unlikely Journey to Music Stardom, Inspiring Millions

Singer-songwriter Atlus has swiftly risen from driving semi-trucks to becoming a signed artist with a Platinum single. H...

Heartbreak & Healing: Lil Jon's Emotional Farewell to Son Nathan Shakes the Music World

Crunk music icon Lil Jon is grieving the profound loss of his 27-year-old son, Nathan Smith, known professionally as DJ ...

Directors Vow Bolder, Bigger 'KPop Demon Hunters' Netflix Sequel

Directors Maggie Kang and Chris Appelhans discuss the phenomenal success of Netflix's "KPop Demon Hunters," including it...

From Addiction to Astonishing Health: Couple Sheds 40 Stone After Extreme Diet Change!

South African couple Dawid and Rose-Mari Lombard have achieved a remarkable combined weight loss of 40 stone, transformi...